To open long positions on EURUSD you need:

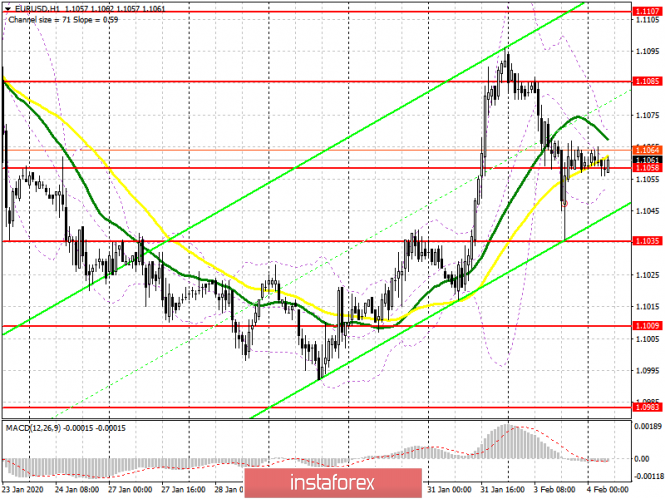

Euro buyers have everything under control so far, despite the fact that yesterday they missed the level of 1.1058, around which the main trade is now conducted. The growth of manufacturing activity in the eurozone and the US did not lead to market changes, since a slight improvement in the situation can only be a temporary phenomenon amid the spread of coronavirus. Today, the bulls require protection at the level of 1.1058, from which they will try to return the pair to resistance at 1.1085. Consolidating above this range will testify in favor of the euro's continued growth to the highs of 1.1107 and 1.1131, where I recommend taking profits. In the event of a weak report on producer prices in the eurozone and consumer prices in Italy, the data for which will be released in the morning, pressure on the euro may return, which will lead to a second test of important support at 1.1035, from which it is best to open long positions if a false breakout is formed there. But I recommend buying EUR/USD immediately for a rebound at the low of 1.1009, the test of which will mean a reversal of the current upward trend.

To open short positions on EURUSD you need:

Bears will wait for the release of the above reports, and bad data can lead to a breakout of support at 1.1058, the protection of which remains a priority for buyers of the euro today. If sellers manage to gain a foothold even below this level in the morning, then you can count on an instant return of EUR/USD to the support area of 1.1035, where I recommend taking profits. No less important will be the resistance defense of 1.1085, to which the bulls will try to return the pair today. The formation of a false breakout there will be a signal to open short positions, otherwise I recommend selling immediately for a rebound from a high of 1.1107, or even higher, in the resistance area of 1.1131. A break of support of 1.1035 will indicate the formation of a new downward trend in the EUR/USD pair.

Signals of indicators:

Moving averages

Trade is carried out in the region of 30 and 50 moving average, which indicates the formation of short-term lateral movement.

Bollinger bands

A break of the lower boundary of the indicator in the region of 1.1050 will be an additional signal to open short positions in the euro. Growth will be limited by the upper level in the area of 1.1071, a breakthrough of which will lead to new purchases of the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20