To open long positions on EURUSD, you need:

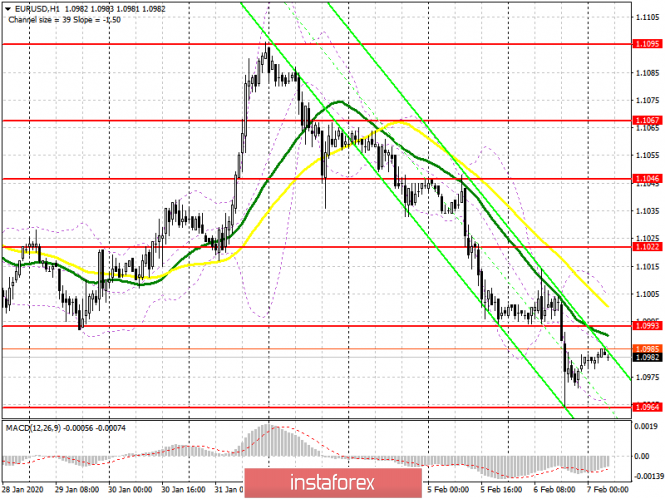

Yesterday, the bulls failed to hold the support at 1.0993, but a larger surge in volume was noted at the level of 1.0964, to which I repeatedly paid attention in my reviews and recommended opening long positions. Today, we publish an important report on the US labor market along with the unemployment rate, so it is unlikely that volatility will be very high in the first half of the day. Perhaps only data on the volume of industrial production in Germany will be able to somehow shake the market. The bulls will try to regain the resistance of 1.0993, on which a lot depends, and if yesterday the market was on their side, now it is completely under the control of the bears. A breakout and consolidation above 1.0993 will lead to a larger upward correction to the resistance area of 1.1022 and possibly to the maximum test of 1.1046, where I recommend taking the profits. If the euro declines further, it is best to return to purchases only at the false breakdown of the minimum of 1.0964 or to open new long positions in the area of the lows of 1.09453 and 1.0905.

To open short positions on EURUSD, you need:

The bears continue to play out their scenario and yesterday reached the low of 1.0964, from which you could observe profit-taking. For today, the focus will be placed on a weak report on the volume of German industrial production, which will allow you to form a false break in the resistance area of 1.0993 and continue the downward trend. However, a more important task for sellers will be to lower the EUR/USD to the support area of 1.0964, the breakout of which will necessarily lead to an update of the new lows in the area of 1.0943 and 1.0905. In the scenario of buyers returning to the area of 1.0993 in the first half of the day, the focus will shift to the US labor market report, which is expected to be quite strong. If the data disappoints, you can open short positions on a rebound from the maximum of 1.1022 and even higher, in the area of 1.1046.

Signals of indicators:

Moving averages

Trading is conducted below the 30 and 50 moving averages, which indicates the predominance of sellers in the market.

Bollinger Bands

In case of growth in the first half of the day, the upper limit of the indicator of 1.1000 will act as a resistance. Support will be provided by the lower border that coincides with the level of 1.0964.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20