4-hour timeframe

Amplitude of the last 5 days (high-low): 22p - 52p - 26p - 43p - 80p.

Average volatility over the past 5 days: 45p (average).

The EUR/USD currency pair begins a new and interesting week. This week is only interesting because we have to find out if the upward correction will continue? Recall that for almost three full weeks, the European currency fell daily against the US dollar, with little or no correction. The long-awaited correction began last Friday. However, at the moment, the quotes of the pair only managed to work out the lower boundary of the Ichimoku cloud. Thus, even inside the cloud, traders have not been able to gain a foothold. It is this moment that leaves the bears hope for the resumption of the downward trend. An important factor next week will be the macroeconomic background. That is macroeconomic reports. The fundamental background for the euro/dollar pair has not changed a long time ago. So we should figure out what to expect from the coming week. This article will examine all publications related to the European Union, and the article on GBP/USD - regarding the United States and Great Britain.

And immediately I want to note that there will not be any publications on the state of the EU economy in the coming week. More precisely - not a single important one. For example, an indicator of the assessment of the current situation, an index of economic expectations and an index of business optimism from IFO will be published on Monday in Germany. These reports are nothing more than polls from the heads of 7,000 enterprises. It is unlikely that these data can greatly affect the movement of the currency pair.

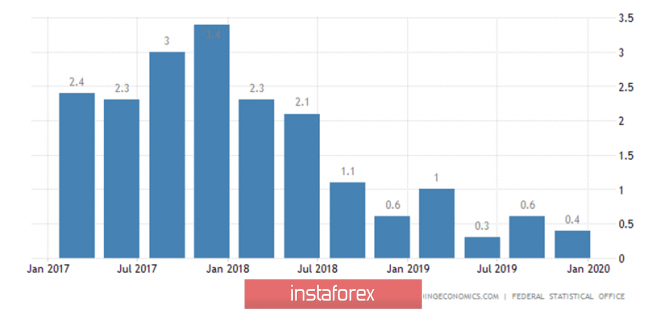

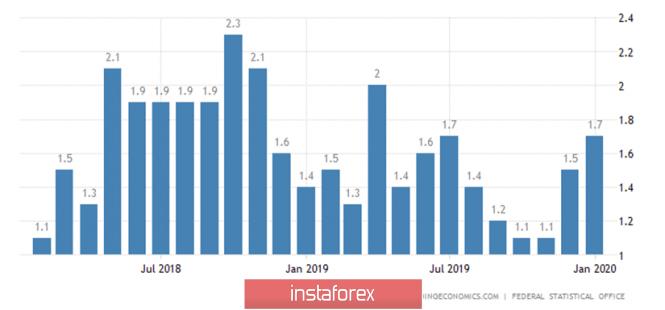

The more important GDP for the fourth quarter will be published in Germany on Tuesday, which experts predict will be 0.4% y/y. Zero GDP growth is expected in quarterly terms. Needless to say, these are very low numbers that have not changed since the publication of the third quarter GDP report? That is, for the better, such an important and significant indicator of the state of the German economy does not change. Of course, if the forecast value is exceeded, then the euro can receive additional support from traders.

The EU will not publish a single macroeconomic report on Wednesday. And on Thursday, dozens of secondary data will be available right away: inflation in Spain, consumer lending in the EU, an index of sentiment in the EU economy, an index of sentiment in the services sector, a level of consumer confidence, an indicator of the business climate and an index of business optimism in industry. Do traders remember when the last time one of these reports had an impact on the movement of the euro?

On Friday, some of the less important reports will be published again. More precisely, these reports will be quite important for Germany. But Germany is just one country in the EU, despite the unofficial status of being the "locomotive" of the EU economy. Therefore, reports on unemployment, changes in the number of unemployed in February and the import price index can be safely ignored. Only the consumer price index for February remains, which is expected to slow down to 1.6% y/y. Neither in the European Union nor in Germany are we talking about stable two percent inflation. Recall that the ECB policy regarding interest rates depends on inflation. As long as inflation is weak, the ECB will not think of any tightening of monetary policy. Thus, two more or less important reports are expected from the eurozone this week - on inflation in Germany and on GDP. No improvement are expected from both indicators. And now it is becoming clear that help for the euro should be expected either from technical factors or from across the ocean.

As we have said, US data will be considered in the article on the pound. As for the technical factors, they are just now quite strong for the euro. The total loss of the euro reached nearly 300 points over the past three weeks. Thus, even if the correction takes the standard 50%, you can count on the strengthening of the euro to the level of 1.0935. Furthermore, everything will again depend on macroeconomic information and the mood of traders. It should be understood that such a strong and recoilless, as in the last three weeks, the movement occurs once or twice a year. Thus, now the euro/dollar is likely to return to a more familiar style, with frequent corrections and pullbacks, without a pronounced trend. Thus, short positions have so far lost their relevance.

Trading recommendations:

The EUR/USD pair started a correction movement. Thus, now we can formally consider long positions with targets at the level of volatility of 1.0891 and Senkou Span B line, but with extremely small lots. It will be possible to consider selling the euro/dollar pair with the goal of the support level of 1.0742, if traders manage to gain a foothold back below the critical line.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com