On Friday, the dollar bulls weakened their grip, after which the EUR / USD pair was able to develop a correction to the middle of the eighth figure. However, the pair's upside impulse turned out to be short-term and today a price pullback followed, which signals the pair's bulls' inability to develop large-scale upward movement. It is likely that in the medium term the pair will get stuck in a flat at this price area. After all, when the price drops to the middle of the seventh figure, the pair begins to attract buyers, while with the development of a more or less large-scale correction, the pair begins to sell. Therefore, it will be quite difficult for both bears and bulls to break out of this price range - this requires a powerful informational occasion. While the economic calendar of the current trading week is not eventful with minor statistics and rare speeches by the Fed representatives. This means that over the next few days the price dynamics will be determined primarily by the external fundamental background. Growth or decline in anti-risk sentiment will push the pair either down or, respectively, up. Macroeconomic reports will serve only as a background, and in some cases, a catalyst.

Nevertheless, the most significant statistics should be highlighted. For example, today the European currency will respond to reports from the IFO. Let me remind you that last week reports from ZEW and PMI were published, which showed multidirectional dynamics. Therefore, the opinion of specialists from the Munich Institute for Economic Research is of particular interest in this context. According to preliminary forecasts, the indicator of the business environment in Germany will decrease minimally (from 95.9 to 95.0 points), but the indicator of economic expectations will remain at its former positions. If the real numbers coincide with the forecast, the euro will receive minimal support. If the indicators sag significantly, the EUR / USD bears will get another reason to test the seventh figure.

On Tuesday, February 25, the Conference Board consumer confidence index will be published. Since November of last year, it has been gradually growing - in December and January, it reached quite high values (128.2 and 131.6 respectively), supporting the American currency. According to experts' general forecasts, the February index will reach 132.6 points - this is the best result since last August. The dollar will negatively react to this release only if it comes out much worse than forecasted values, reflecting the uncertainty of American consumers. Also to happen on the same day, the head of the Dallas Fed, Robert Kaplan, will make a speech. Recall that in early February, he announced that he expected strong economic growth in the United States this year amid a ceasefire in a trade war between the United States and China.

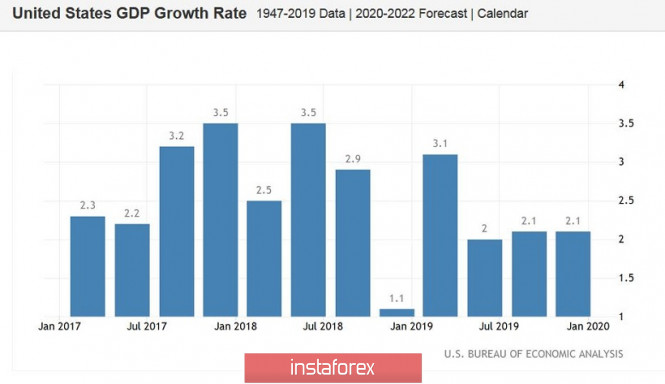

By the way, US economic growth will be in the spotlight on Thursday. On this day, we will find out the second estimate of US GDP growth for the 4th quarter. According to forecasts, this indicator will be revised upward from 2.1% to 2.2%. And although this review will be minimal, the very fact of such dynamics will improve the position of the greenback. The price index should remain at the same level, reflecting a slowdown - if in the second quarter of 2019 it reached 2.4%, then in the fourth quarter, it fell to 1.4%.

Also, the publication of the data on the volume of orders for durable goods in the United States is expected on Thursday. In December, the indicator showed positive dynamics, having got out of the negative area (similarly, without taking into account transport). In January, experts predict contradictory dynamics which is that the overall indicator should slow down to -1.4% (from the previous value of 2.4%), and without taking into account transport, it should grow to a minimum of 0.2%. If both indicators collapse into the negative area, the dollar may be under pressure. Meanwhile, the publication of the data in the real estate market of the United States is expected today. We are talking about the volume of outstanding transactions for the sale of housing. This indicator is an early indicator of housing market activity. In December, the indicator crashed into the negative area, but in January it should show growth. However, this release affects the EUR / USD pair only when there are significant fluctuations.

But on Friday, the pair will respond to the main index of personal consumption spending, which measures the core level of spending and indirectly affects inflation in the United States. It is believed that this indicator is monitored by the members of the regulator "with particular bias". According to forecasts, the index will show contradictory dynamics as in monthly terms, it will grow to 0.2%, while in annual terms, it will decrease to 1.5%. This release may have a significant impact on the position of dollar bulls.

As you can see, the economic calendar for EUR / USD this week is not completely empty. On the other hand, all the above reports will have a short-term impact on the couple - they will neither be able to reverse the trend, nor lower the price below the support level of 1.0750 (the lower line of the Bollinger Bands indicator on the monthly chart) with subsequent consolidation. These statistics can only strengthen or weaken the influence of the external fundamental background.

The news flow regarding the spread of coronavirus will be in the spotlight this week, determining the level of anti-risk sentiment. Further panic growth will allow the EUR / USD bears to keep the pair in the 100-point range of 1.0750-1.0850. I note that over the past weekend alone, the number of patients with coronavirus in Italy jumped from three to 159 people, with three deaths. Now, this European country ranks third in the world in terms of the infection spread, and as a result, all mass events were canceled there and even before the deadline they completed the legendary Venice Carnival. If further events develop in the same way, the euro will be under additional pressure, while the dollar will retain the status of a protective instrument.

The material has been provided by InstaForex Company - www.instaforex.com