The US dollar failed to get the necessary support on Friday, as the release of a number of versatile fundamental statistics, which largely coincided with economists' forecasts, did not lead to significant changes in the market.

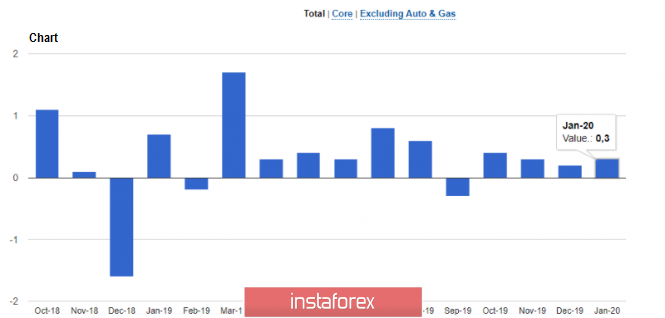

Although the report on US spending in January seems to be good news, the growth coincided with analysts' expectations, so it did not allow the bulls to increase their long positions in the US dollar. This indicator is a key driver of economic growth, so the data is very often subject to high volatility. According to a report from the US Department of Commerce, retail sales in January of this year increased by 0.3% compared to the previous month, which was what economists had expected. Moreover, compared with the same period the previous year, spending in January increased by 4.4%, indicating the strength of the indicator.

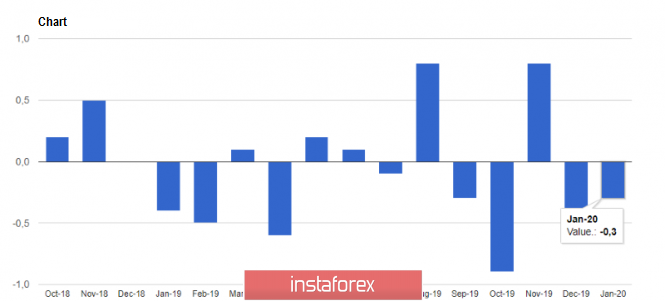

Meanwhile, data indicating a decline in the US industrial production in January did not lead to a sharp closing of short positions in the US dollar. On the contrary, it gradually pushed the EUR/USD pair to an annual low. Most likely, this is due to the lack of buyers of risky assets, as there is a sharp deterioration in the state of the Eurozone economy. According to the report of the US Federal Reserve, industrial production in January decreased by 0.3% compared to the previous month, fully coinciding with the forecasts of economists. Meanwhile, manufacturing production declined by only 0.1%, due to a slowdown in civil aircraft production.

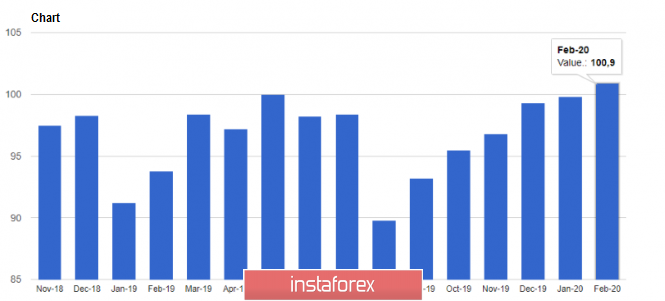

The preliminary report from the University of Michigan reflected well on the US dollar. According to the data, many Americans viewed the economic outlook more positively at the beginning of February this year. The calculated consumer sentiment index was 100.9 points compared to 99.8 points at the end of January, while economists had forecasted the index to decline to 99.5 points. Moreover, the respondents' personal finances and the state of the national economy were generally positive. The effects of the coronavirus did not significantly affect the estimates.

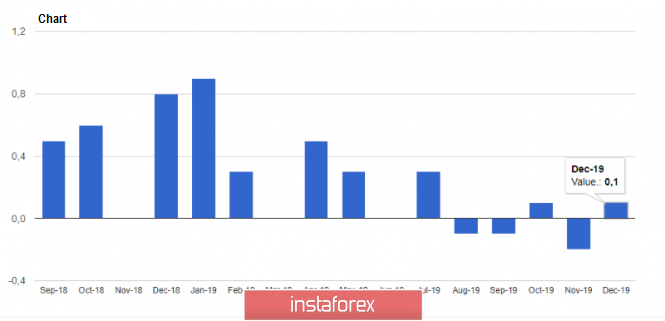

Meanwhile, data on US inventory was ignored by the market. According to a report from the US Department of Commerce, inventories rose by 0.1% in December, and amounted to $ 2.04 billion. This coincided with the forecast of economists.

At the same time, the report on prices for foreign-made goods, which remained unchanged in January 2020, did not also arouse interest among investors. According to the data from the US Department of Labor, import prices in US remained unchanged in January as compared to December, while economists had expected a 0.2% drop in prices. On the other hand, comparing it to January 2019, import prices increased by 0.3%.

As for the technical picture of the EUR/USD pair, we need to buy the euro with great caution, as there are no signals yet regarding the ending of the downward trend. Of course, we can talk about the prospects of an upward correction, however, it is likely to be short. Only the return of the bulls in 1.0860 will lead to the recovery of risky assets in the area of 1.0900, and quite possibly, to the update of 1.0930. If the pressure on the euro continues at the beginning of this week, the next lows will be found in the area of 1.0800, or even lower, near the level of 1.0770. A break in these ranges will open a direct path to the psychological level of 1.0500.

The material has been provided by InstaForex Company - www.instaforex.com