Forecast for February 19 :

Analytical review of currency pairs on the scale of H1:

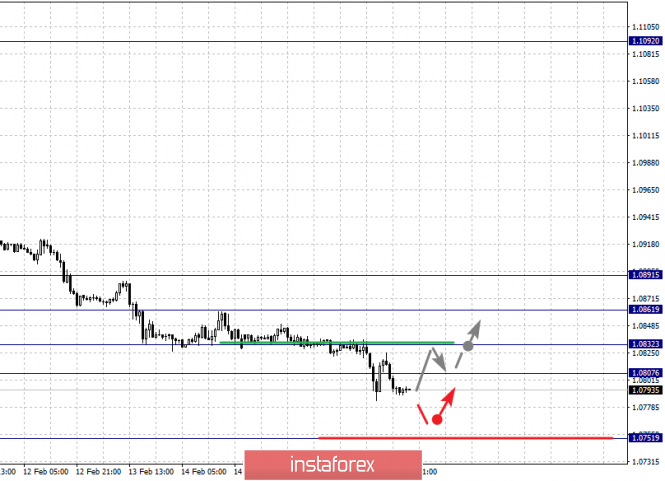

For the euro / dollar pair, the key levels on the H1 scale are: 1.0891, 1.0861, 1.0832, 1.0807 and 1.0751. Here, mainly, we expect a movement in correction from a downward trend. Short-term upward movement is expected after the breakdown of the level of 1.0807. Here, the target is 1.0832. The breakdown of which will lead to in-depth movement. In this case, the target is 1.0861. This level is a key resistance for the subsequent development of the ascending structure. For the potential value for the top, we consider the level of 1.0891. We await the design of expressed initial conditions before this value.

A potential value for the downward movement is the level of 1.0751, however, we consider the movement to this level as unstable.

The main trend is a downward structure from January 31, we expect a correction

Trading recommendations:

Buy: 1.0807 Take profit: 1.0830

Buy: 1.0834 Take profit: 1.0860

Sell: Take profit:

Sell: Take profit:

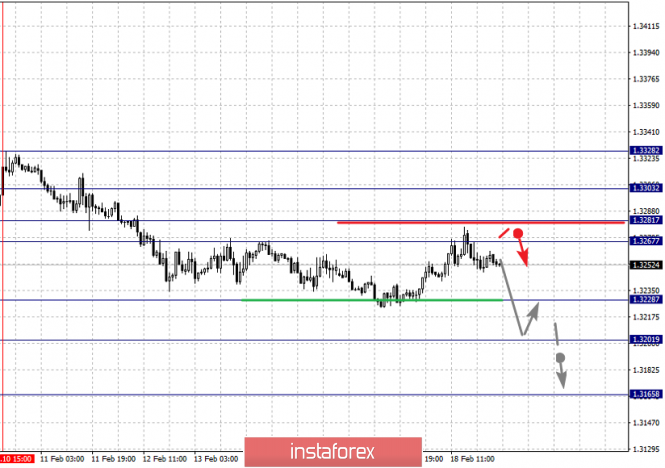

For the pound / dollar pair, the key levels on the H1 scale are: 1.3182, 1.3157, 1.3114, 1.3082, 1.3045, 1.2990, 1.2961 and 1.2928. Here, we are following the development of the ascending structure of February 10. The continuation of the movement to the top is expected after the breakdown of the level of 1.3045. In this case, the target is 1.3082. Short-term upward movement, as well as consolidation is in the range of 1.3082 - 1.3114. The breakdown of the level of 1.3114 will lead to a pronounced movement. In this case, the potential target is 1.3157. Upon reaching which, we expect a consolidated movement in the range 1.3157 - 1.3182, as well as a correction.

Short-term downward movement is possibly in the range of 1.2990 - 1.2961. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2928. This level is a key support for the upward structure.

The main trend is the ascending structure of February 10.

Trading recommendations:

Buy: 1.3045 Take profit: 1.3080

Buy: 1.3083 Take profit: 1.3112

Sell: 1.2990 Take profit: 1.2962

Sell: 1.2959 Take profit: 1.2930

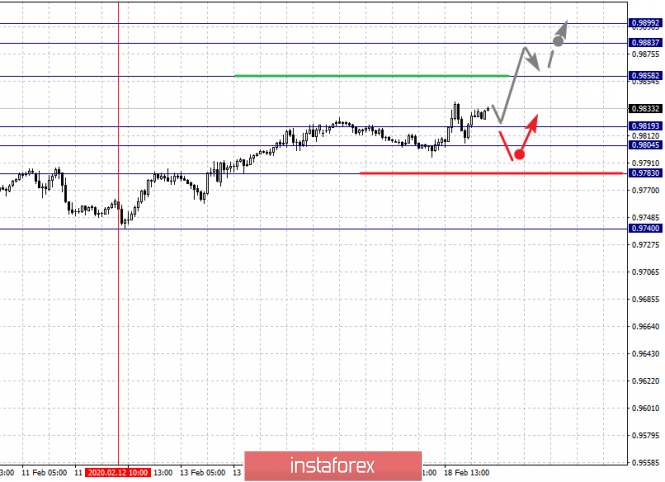

For the dollar / franc pair, the key levels on the H1 scale are: 0.9899, 0.9883, 0.9858, 0.9819, 0.9804 and 0.9783. Here, we are following the local ascendant structure of February 12. The continuation of movement to the top is expected after the breakdown of the level of 0.9858. In this case, the target is 0.9883. We consider the level of 0.9899 to be a potential value for the ascending structure. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9787 - 0.9771. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9783. This level is a key support for the top.

The main trend is the local potential for the top of February 12

Trading recommendations:

Buy : 0.9858 Take profit: 0.9880

Buy : 0.9883 Take profit: 0.9899

Sell: 0.9819 Take profit: 0.9805

Sell: 0.9803 Take profit: 0.9784

For the dollar / yen pair, the key levels on the scale are : 110.80, 110.47, 109.99, 109.62, 109.41 and 109.07. Here, we are following the development of the ascending structure of January 31. The continuation of the movement to the top is expected after the breakdown of the level of 110.00. In this case, the target is 110.47. Price consolidation is near this level. For the potential value for the top, we consider the level 110.80. Upon reaching which, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 109.62 - 109.41. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 109.07. This level is a key support for the top.

Main trend: upward structure of January 31

Trading recommendations:

Buy: 110.00 Take profit: 110.45

Buy : 110.49 Take profit: 110.80

Sell: 109.60 Take profit: 109.42

Sell: 109.38 Take profit: 109.10

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3303, 1.3281, 1.3267, 1.3228, 1.3201 and 1.3165. Here, the descending structure of February 10 is considered medium-term. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3228. In this case, the target is 1.3201. Price consolidation is near this level. The breakdown of the level of 1.3200 will lead to the development of pronounced movement to the bottom. Here, the potential target is 1.3165. We expect a pullback to the top from this level.

Short-term upward movement is possibly in the range of 1.3267 - 1.3281. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3303. This level is a key support for the downward structure.

The main trend is the formation of medium-term initial conditions for the downward movement of February 10

Trading recommendations:

Buy: 1.3267 Take profit: 1.3281

Buy : 1.3283 Take profit: 1.3303

Sell: 1.3226 Take profit: 1.3203

Sell: 1.3199 Take profit: 1.3167

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6733, 0.6718, 0.6701, 0.6668, 0.6645, 0.6614 and 0.6594. Here, we determined the subsequent targets on the H1 scale from the descending structure on February 12. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6668. In this case, the target is 0.6645. Price consolidation is near this level. The breakdown of the level of 0.6645 should be accompanied by a pronounced movement to the level of 0.6614. For the potential value for the bottom, we consider the level of 0.6594. Upon reaching which, we expect consolidation, as well as a rollback to the top.

A correction is expected after the breakdown of the level of 0.6701. In this case, the target is 0.6718. There is a short-term upward movement in the range 0.6718-0.6733. The breakdown of the level of 0.6733 will lead to the formation of initial conditions for the top. Here, the target is 0.6761.

The main trend is the descending structure of February 12

Trading recommendations:

Buy: 0.6701 Take profit: 0.6716

Buy: 0.6718 Take profit: 0.6732

Sell : 0.6668 Take profit : 0.6647

Sell: 0.6643 Take profit: 0.6616

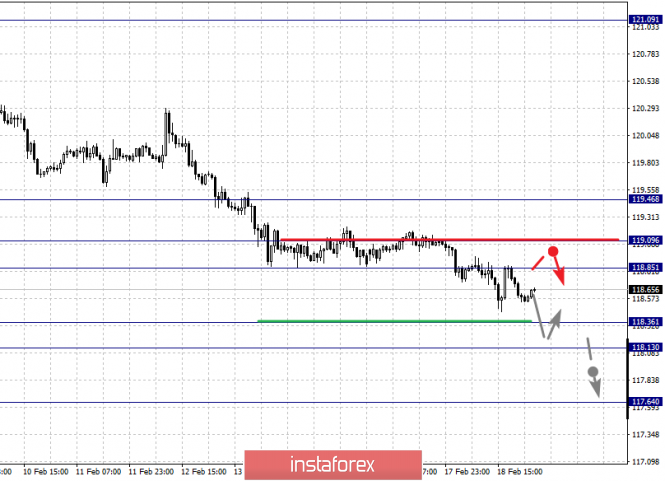

For the euro / yen pair, the key levels on the H1 scale are: 119.46, 119.09, 118.85, 118.36, 118.13 and 117.64. Here, we are following the descending structure of February 5. Short-term downward movement is expected in the range of 118.36 - 118.13. The breakdown of the last value will lead to the movement to the potential target - 117.64, when this level is reached, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 118.85 - 119.09. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.46. This level is a key support for the downward structure.

The main trend is the descending structure of February 5

Trading recommendations:

Buy: 118.85 Take profit: 119.07

Buy: 119.12 Take profit: 119.44

Sell: 118.36 Take profit: 118.14

Sell: 118.11 Take profit: 117.66

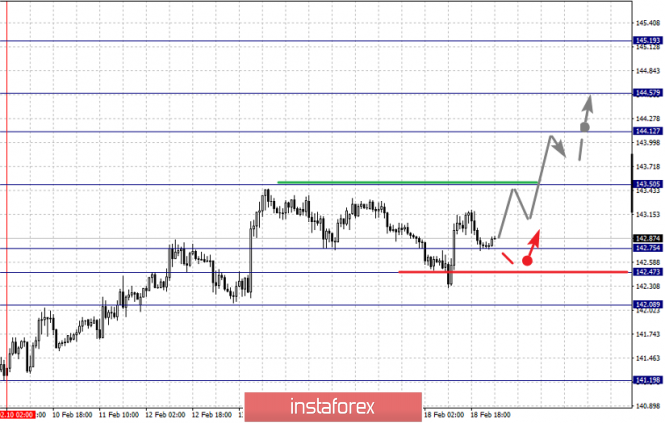

For the pound / yen pair, the key levels on the H1 scale are : 145.19, 144.57, 144.12, 143.50, 142.75, 142.47 and 142.08. Here, we are following the ascending structure of February 10. The continuation of movement to the top is expected after the breakdown of the level of 143.50. In this case, the goal is 144.12. The breakdown of this value will lead to short-term upward movement in the range 144.12 - 144.57. Hence, there is also a high probability of a reversal to correction. For the potential value for the top, we consider the level of 145.19. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement, as well as consolidation, are possible in the range of 142.75 - 142.47; hence, the likelihood of a reversal to the top. The breakdown of the level of 142.47 will lead to an in-depth correction. Here, the goal is 142.08. This level is a key support for the top.

The main trend is the rising structure of February 10

Trading recommendations:

Buy: 143.50 Take profit: 144.12

Buy: 144.15 Take profit: 144.50

Sell: 142.75 Take profit: 142.50

Sell: 142.44 Take profit: 142.10

The material has been provided by InstaForex Company - www.instaforex.com