To open long positions on GBP/USD you need:

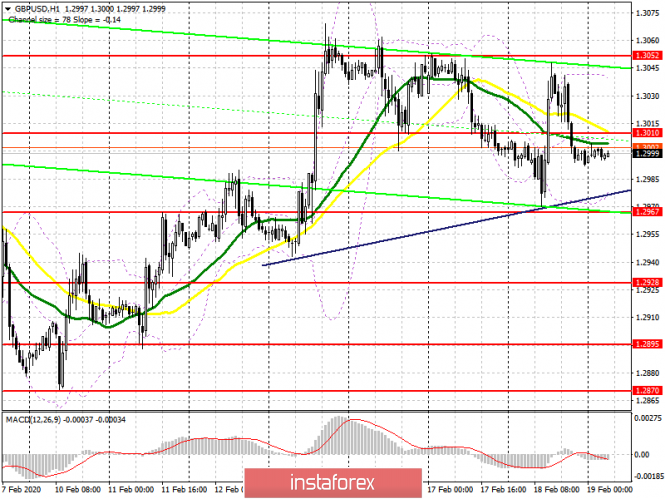

Yesterday, the UK labor market data helped the pound get to the upper boundary of the side channel of 1.3052, however, it was not possible to go beyond its limits, as a result, the bulls even managed to miss the 1.3010 area, below which trade is now conducted. Of the COT reports (Commitment of Traders) for February 11, there was an increase in long non-profit positions from 59,650 to 65,000, while short non-profit positions continued to decline and amounted to 43,922 against the level of 46,672 a week earlier. As a result of this, the non-profit net position almost doubled to the level of 21,084 from 12,000, which indicates bullish market sentiment in the medium term. Today's release of an important inflation report can determine the direction of the pound. A return and consolidation at the level of 1.3010 will be the first signal to open long positions in GBP/USD, which will lead to larger growth in the area of a high of 1.3052, on which the pair's further direction depends. Consolidating above this level will open a direct road to the area of 1.3093 and 1.3133, where I recommend taking profits. In the scenario of maintaining pressure on the pound, it is best to return to long positions only after the formation of a false breakout in the support area of 1.2967, but I recommend buying GBP/USD immediately for a rebound after updating a low of 1.2928.

To open short positions on GBP/USD you need:

Bears today will closely monitor the report on the consumer price index in the UK, since weak inflation will allow the Bank of England to lower interest rates without hesitation if necessary. The formation of a false breakout in the resistance area of 1.3010 will be a direct signal to open short positions, which will lead to a test of the lows 1.2967 and 1.2928, where I recommend taking profits. If the inflation rate is not as weak as economists expect, then the bulls will regain the 1.3010 area. In this case, it is best to consider new short positions only after updating the high at 1.3052, or sell GBP/USD immediately for a rebound from the 1.3092 area with the aim of a downward correction of 20-30 points.

Signals of indicators:

Moving averages

Trading is carried out below 30 and 50 moving average, which saves the likelihood of continued decline in the pound.

Bollinger bands

A break of the lower boundary of the indicator in the region of 1.2975 will increase the pressure on the pair. A break through the upper level at 1.3040 will lead to an increase in GBP/USD.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.