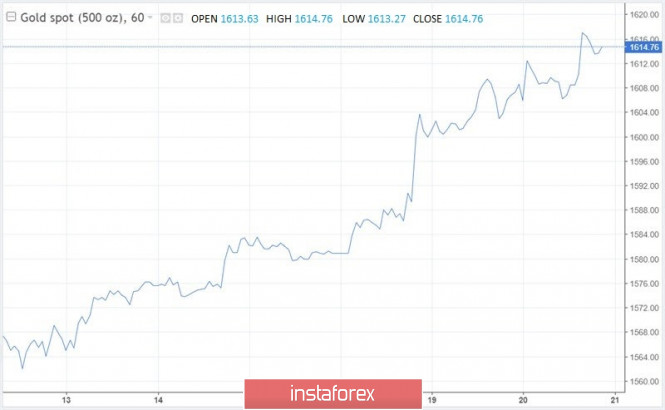

Gold returned to its seven-year highs, soaring above $1,600 per ounce. However, the yellow precious metal did this not because of, but contrary to. At first glance, gold is growing amid uncertainty about the impact of the coronavirus outbreak on the global economy. Trying to smooth out the negative consequences of the epidemic, central banks soften their monetary policy, which negatively affects the exchange rates of national currencies. As a result, the precious metal denominated in euros, yens and other monetary units feels rather confident.

Stocks of gold ETFs expand for the sixth week in a row, tire of rewriting record highs.

The strengthening of the precious metal positions occurs despite the confident tread of the US stock indices and the greenback's growth. Investors redeem failures in the securities markets, because they are confident that China will cope with the misfortune that has befallen it thanks to large-scale monetary and fiscal stimulation. While corporate profit growth in the United States is slowing, cash flow earnings are still high and loan rates remain low. In addition, the Federal Reserve can support the S&P 500 at any time by resorting to monetary expansion.

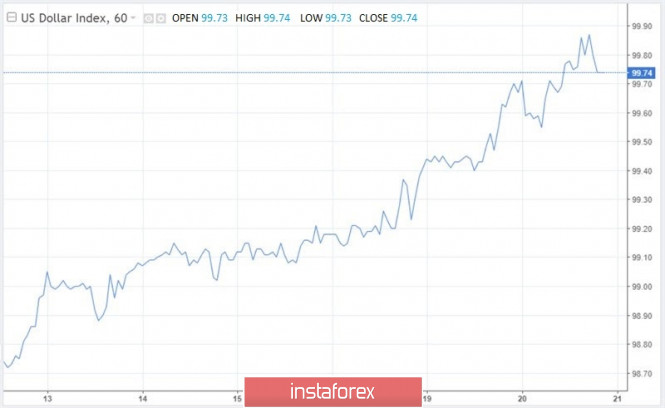

No less surprising is the synchronous growth of the gold exchange rate and the USD index. Since the beginning of the year, the US currency has risen in price to the basket of its main competitors by more than 3%, and an ounce of gold - by 6%.

The greenback is stronger than ever thanks to the US economy, which is firmly on its feet, and the significant inflow of capital to the US securities market. The USD index reached three-year highs and came close to 100 points.

"The dollar seems to be winning in the face of risk, when its profitability against the background of extremely low volatility of exchange rates is still standing out, and the US stock market continues to look better than the securities market elsewhere. Risk aversion also supports the dollar thanks to the demand for defensive assets, including US treasury bonds," said the currency strategists at National Australia Bank.

Nevertheless, investors prefer to leave a place in their portfolios for precious metals as well, apparently trying to insure the risks of a possible correction of the S&P 500 index and the US central bank's return to the cycle of preventive interest rate cuts. Greenback revaluation slows inflation, so it is possible that the regulator will want to stimulate it by cutting interest rates.

Meanwhile, the decline in US Treasury bond yields lends a helping hand to the bulls in gold. Investors buy debt instruments for the same reasons as precious metals: they are frightened by the uncertainty associated with the coronavirus epidemic. It should be noted that the fall in rates does not occur only in the United States. For example, since the beginning of the year, the yield on Chinese ten-year government bonds has fallen by more than 25 basis points due to the potential slowdown of the Chinese economy and incentive measures by the People's Bank of China. By the end of January, non-residents increased their stocks of debt obligations of the PRC by $14 billion, to a record $2.2 trillion.

In 2019, falling global debt market rates and weakening major world currencies became the main drivers of the gold rally. The XAU/USD situation for bulls continues to be favorable in 2020 due to the coronavirus epidemic.

The main question now is how long the new virus will excite the minds of investors.

According to UBS experts, if the global economy can withstand the blow, then the risks of gold correction will increase.

In turn, Deutsche Bank strategists maintain an optimistic outlook on the prospects for precious metals.

"Trade protectionism continues to have a chilling effect on global economic growth, central banks in developing countries are still looking for an alternative to the US dollar as a reserve asset, global monetary policy remains stimulating, and inflation is below target levels, while the geopolitical situation poses serious risks", - experts noted.

According to them, perhaps the hype around gold is only just beginning.

Thus, it is quite possible that in the face of easing fears about the coronavirus, gold will undergo moderate corrective pullbacks, maintaining the momentum for the increase formed in December. Moving up from one area of consolidation to another, quotes can develop growth up to levels near $1,700 per ounce, which could be observed at the beginning of 2013. A more extreme scenario for the coming months implies an acceleration of prices to $1,800 per ounce (peak values of 2012).

The material has been provided by InstaForex Company - www.instaforex.com