Yesterday's development of events clearly demonstrated that the pound does not have the strength to independently change the trend for the strengthening of the dollar. On the whole, good data on the labor market made it possible for the pound to slightly improve its position. But only for a while, as it already returned to where it started when the US session opened. And today, it can repeat yesterday's scenario.

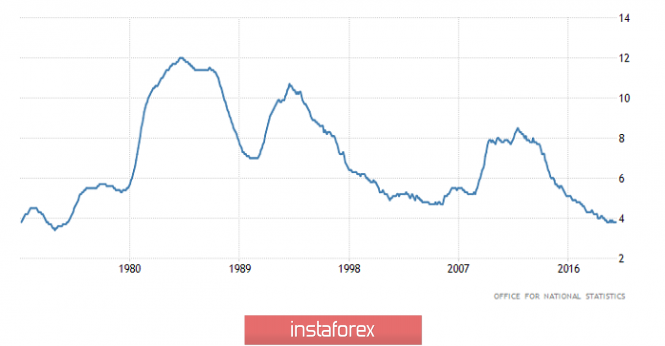

The first thing that catches your eye is the unemployment rate, which has remained unchanged, which means it continues to be at the lowest level of 3.8% since the first half of the 70s. Moreover, it has been at this level for four consecutive months. The growth rate of the average wage, and even taking into account overtime, slowed down from 3.2% to 2.9%, which is significantly worse than even the most pessimistic forecasts of 3.0%. This means that consumer activity will inevitably decline. Another thing is that the negative salary was more than offset by applications for unemployment benefits, of which there were only 5.5 thousand, instead of 15.0 thousand. Moreover, the previous data was reviewed for the better, from 14.9 thousand to 2.6 thousand. Employment did not grow by 120 thousand, but by 180 thousand. That is, the slowdown in wage growth is offset by a good increase in employment. In other words, salaries may not grow, but there are more of those who are employed. So aggregate demand should only grow.

Unemployment Rate (UK):

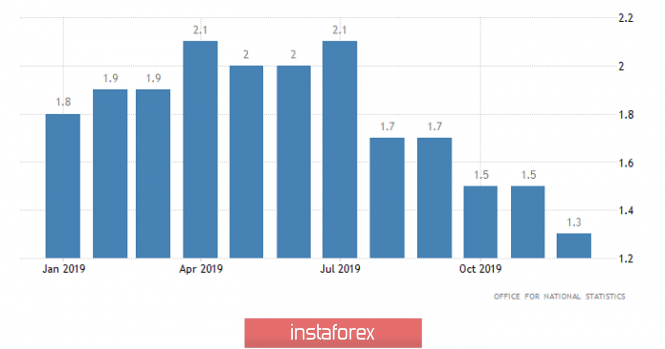

But this was only enough for the pound to temporarily strengthen its position. Since everything has returned to normal when the US session opened. And apparently, today we are waiting for a repetition of yesterday's scenario. The pound will begin with inflation in the UK, which should grow from 1.3% to 1.4%. To some extent, this will confirm that employment growth fully compensates for the slowdown in wage growth and that nothing threatens aggregate demand.

Inflation (UK):

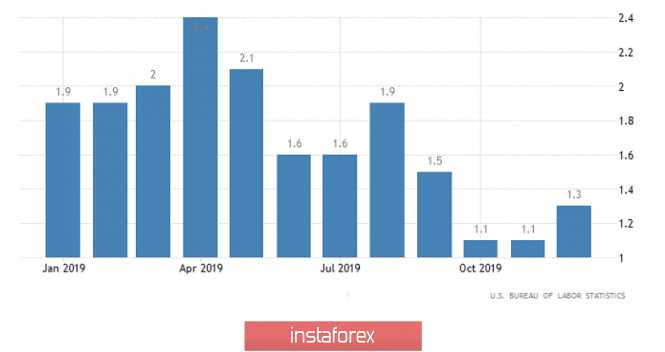

But the pound will be forced to return when the US session opens. This time, for a completely objective reason, in the form of an acceleration in producer prices in the United States, from 1.3% to 1.7%. After all, this means that nothing is threatening inflation, which is above the target level of 2.0%, which means that the Federal Reserve has more reason to think about raising the refinancing rate. What can be reflected in the content of the minutes of the meeting of the Federal Open Market Committee. The text of which is set to be released today.

Manufacturer Prices (United States):

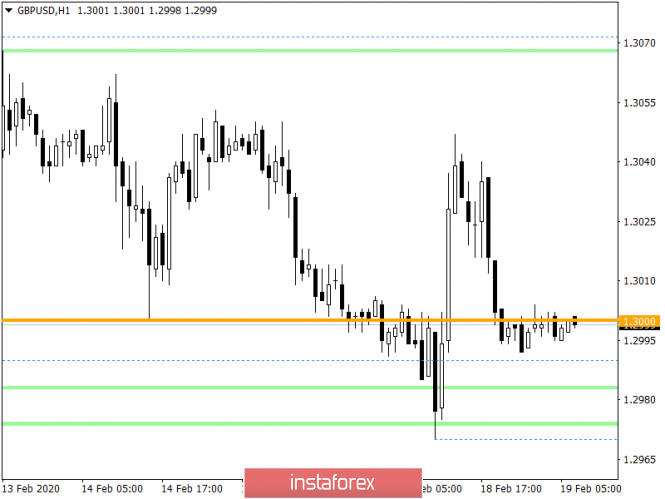

In terms of technical analysis, an attempt was made to work out the psychological level of 1.3000, both in the downward and in the upward direction, but in the end the quotation continued a peaceful fluctuation along the control level. In fact, we have been concentrating within the range of 1.3000 for 2.5 days, without having any fundamental changes.

Considering the trading chart in general terms, we see a fluctuation that remains within the top of the medium-term upward trend, where the clock component is already in the process of changing the mood.

It is likely to assume that the quotation will continue to concentrate within 1.2980/1.3050, where the current consolidation of 1.2992/1.3005, may play the role of local acceleration. The tactics of work are considered in terms of the initial move in the direction of 1.2950, at the time of the breakdown of consolidation, with the subsequent return of the price to the area of 1.2980/1.3000.

From the point of view of a comprehensive indicator analysis, we see a stable downward interest that occurs in a single burst when the price is concentrated within the psychological mark of 1.3000. In case of continued amplitude fluctuations, indicators for shorter periods will be unstable.