4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - downward

Moving average (20; smoothed) - sideways.

CCI: -10.5743

The GBP/USD currency pair remains above the moving average line with great difficulty on February 19 and is now thinking about which way to move next. On the one hand, there is still an upward trend. On the other hand, there are no forces for the bulls to move up and there are no fundamental reasons for buying the British currency. In the first two trading days of the week, macroeconomic statistics from Britain provided little support for the British currency, however, the most important indicators again showed a negative trend. This is why the UK economy continues to slow down and key indicators of its condition continue to decline. Moreover, almost every day traders receive information that negotiations on a trade deal between Britain and the European Union are becoming more complicated, even before they have even begun. Both sides put forward completely opposite conditions and declare that they will not make a deal without the other party fulfilling them. Thus, two weeks before the official start of the negotiations, we can only say that there is no understanding between Brussels and London. Thus, the negotiations will be extremely difficult. Well, for the pound, the failure of negotiations only means a potential new fall against the US currency. In this case, the UK economy will be subjected to another strong blow and will continue to slow down with a 95% probability.

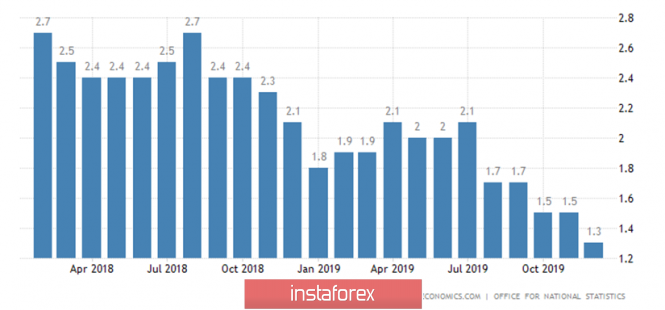

On Wednesday, February 19, one important macroeconomic report is scheduled in the UK. We are talking about inflation in January. According to experts' forecasts, the consumer price index will grow to 1.6% in annual terms and will lose 0.4% in monthly terms. Given the fact that since August 2018, inflation in Britain has been slowing almost non-stop. In January, it turns out that the first serious acceleration in a year and a half may follow. However, only the consensus forecast indicates the value of +1.6% y/y. Many other experts say that the figure does not exceed 1.4% y/y. Thus, given that the indicator should decrease on a monthly basis, we believe that the forecast of 1.6% will not be fulfilled. Recall that the British currency will receive support only if the forecast is confirmed by the real value or even exceeded. Otherwise, most likely, traders will be disappointed again, which may cause new sales of the British currency. The pound in recent weeks can not determine the direction of movement and it is constantly thrown from side to side. Thus, it is impossible to be sure of logical processing of macroeconomic information for traders.

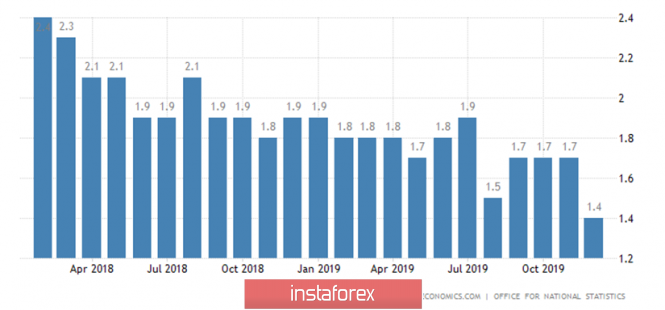

It is also worth noting a more secondary indicator of core inflation, which does not take into account changes in the cost of seasonal goods, food, and energy, which are volatile or unpredictable. Thus, it is the basic CPI that is the more accurate measure of inflation. However, even in this case, nothing good is observed for the UK, since the base indicator is also slowing down, as well as the main one. In recent months, it has fallen to 1.4% y/y, and experts' forecasts suggest that it may accelerate to 1.5% y/y in January. In the same way with the main indicator, it is necessary to exceed the forecast value in order for the pound to be in demand at today's trading. A very minor retail price index that reflects changes in prices only for a certain group of products, which is formed based on the subsistence minimum, is unlikely to interest market participants seriously.

There won't be a single important publication in the United States today or tomorrow. There will only be a secondary producer price index, which is also likely to be ignored. From a technical point of view, the upward movement may resume, but much will depend on the nature of macroeconomic statistics from Albion.

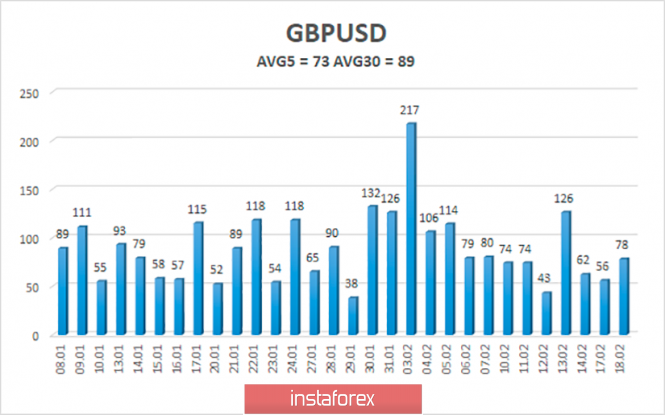

The average volatility of the pound/dollar pair has decreased to 73 points over the past 5 days and continues to decline overall. According to the current volatility level, the working channel on February 19 will be limited to the levels of 1.2927-1.3071. Today will depend on the only report on inflation in Britain.

Nearest support levels:

S1 - 1.3000

S2 - 1.2970

S3 - 1.2939

Nearest resistance levels:

R1 - 1.3031

R2 - 1.3062

R3 - 1.3092

Trading recommendations:

The GBP/USD pair held above the moving average line. Thus, purchases of the pound with a target of 1.3062 remain relevant as long as the pair remains above the moving average. The macroeconomic background may support the British currency today. It is recommended to return to more reasonable sales of the pound after fixing the price below the moving average line with the first targets of 1.2970 and 1.2939.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com