4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - down.

CCI: -199.7291

The British pound sharply resumed its downward movement at the auction on February 19 and fell by 80 points. We believe that this development has been brewing for a long time and have repeatedly stressed in their reports that there are no fundamental and macroeconomic reasons for the growth of the British currency. Moreover, from our point of view, the pound remains overbought since its growth at the end of last year is still difficult to explain from logic and economic validity. Thus, we can only wait for days like yesterday, when the reasons for a sharp resumption of the fall of the pound/dollar currency pair were not obvious. In the future, we expect a resumption of the long-term downward trend.

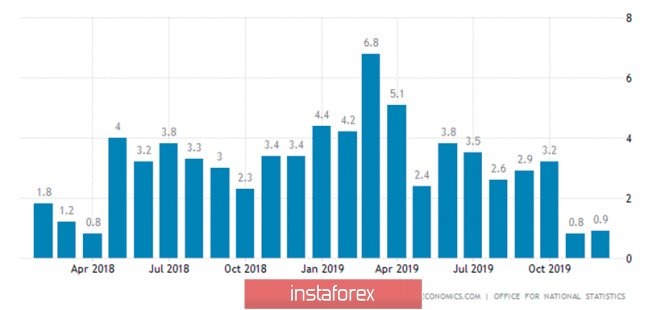

Yesterday, only one important macroeconomic report was expected from the UK – inflation for January. Forecasts predicted an acceleration of this indicator from 1.3% y/y to 1.6% y/y. We questioned this scenario since there were no grounds for such a sharp acceleration. In reality, the consumer price index rose to 1.8% y/y but still lost 0.3% every month. Thus, the following conclusions can be drawn from this release: 1) the report was stronger than the expectations of traders and experts in annual terms; 2) inflation concerning the previous month still slowed down and there is deflation, which negates any positive effect of the acceleration of the annual indicator. What did we see if we looked at this report more closely? Prices in the UK fell by 0.3% compared to December. And the annual indicator shows longer-term changes but this does not reflect the real situation. Either the majority of the market regarded the report in the same way or simply ignored it. However, the British pound did not react to this data in any way. More precisely, it did not react to this data with growth.

Well, negotiations between the EU and the Kingdom on relations after the completion of the Brexit procedure are already becoming a byword for market participants. These very negotiations have not even started yet, however, both sides regularly make statements. The essence of each statement is to list their terms of the agreement, which are very far from the opinion of the opposite side. This time the statement was made again by the chief negotiator from the alliance, Michel Barnier. He once again said that Britain would not get the same trade agreement as Canada. He said: "The trade agreement will contain various aspects, such as fishing, for example, which will reflect the uniqueness of the circumstances (territorial and economic proximity between the EU and Britain). It (the agreement) can not be compared with Canada or Japan." Michel Barnier also indicated the EU's desire to work hard to reach a consensus. "We remain ready to offer the UK an ambitious partnership," Barnier said. So now it's up to Boris Johnson, who should now voice why Britain will not accept the terms offered by the European Union.

On Thursday, February 20, the macroeconomic background for the British pound will be contained in the report on retail sales for January. According to experts' forecasts, this indicator will increase by 0.7% in annual terms and by 0.7% in monthly terms. If you look at the data from the last 24 months, it becomes obvious that the growth rate of retail sales is slowing and may reach the minimum values for the last 2 years. This report may become another disappointing event for the bulls of the GBP/USD pair and the British pound.

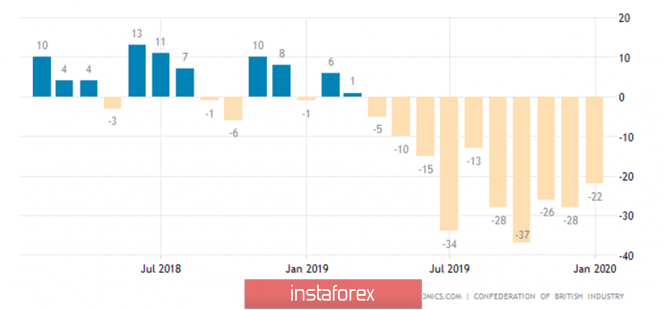

Also, a less significant report on the change in the number of CBI industrial orders will be published, which has long been in the negative area, showing a reduction in the volume of these orders. Thus, the industrial production index is falling due to declining orders for industrial products. And if a new reduction in volumes is found today, then we should not expect any improvements from industrial production. In general, in the last 9 months, the report on industrial orders in Britain signals only a reduction.

Thus, today the British currency can be supported by the retail sales report if its value exceeds +0.7% y/y. Otherwise, traders will get new grounds for selling the British currency. From a technical point of view, the downward movement has already resumed. Both channels of linear regression were directed downward, indicating a downward trend in different time plans.

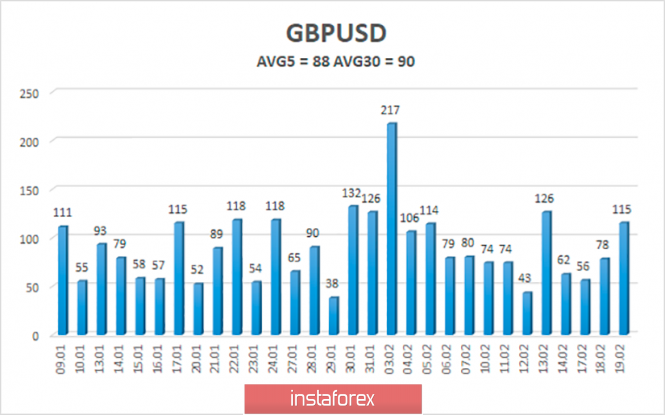

The average volatility of the pound/dollar pair over the past 5 days has increased to 88 points and is characterized as "average" in strength. According to the current volatility level, the working channel on February 20 will be limited to the levels of 1.2829-1.3005. The macroeconomic background will be present on Thursday, so traders can expect to maintain the current levels of volatility.

Nearest support levels:

S1 - 1.2909

S2 - 1.2878

S3 - 1.2848

Nearest resistance levels:

R1 - 1.2939

R2 - 1.2970

R3 - 1.3000

Trading recommendations:

The GBP/USD pair resumed its downward movement and settled below the moving average. Thus, it is now recommended to sell the pound with the targets of 1.2878, 1.2848 and 1.2829 before the Heiken Ashi indicator turns up. It is recommended to buy the British currency not earlier than the reverse price fixing above the moving average line with the first targets of 1.3031 and 1.3062.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com