4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: -2.1830

The British pound also starts the last trading week of February with an upward movement. However, in general, the GBP/USD pair keeps a vague movement with a downward bias. On the first trading day of the week, neither the UK nor the US will have any important and significant publications, so traders will be deprived of macroeconomic factors. Since both linear regression channels are directed downward, we still expect the downward trend to resume. However, to find out about the readiness of traders to resume sales, you need to wait for the price to fix below the moving average line.

Despite the absence of a macroeconomic background, we can not say that no events are happening around the British pound right now. For example, French President Emmanuel Macron said that his personal opinion is that the UK and the European Union will not be able to conclude a trade agreement before the end of the "transition period". According to Macron, the parties cannot agree on rules for fishing in British waters. However, there are actually many more stumbling blocks in the negotiations. The President of France only said about the issue that is most important for his country. Recall that France and several other EU countries want to continue fishing in British waters. However, London insists on restricting the access of European fishermen to its waters. British sailors export most of their catch to the EU, so it will really be beneficial for the UK to establish a monopoly on fishing in its waters.

At the same time, the EU's chief diplomat for negotiations with London, Michel Barnier, once again spoke harshly about Boris Johnson's wishes and prospects for a deal. Barnier said that London "will not get the Canadian version of the agreement." According to Barnier, Johnson refuses to understand that each partner has its own trading rules, which are based on geographical location. Moreover, all of them are determined by a number of reasons and factors. Thus, Barnier believes that the "simplicity" of Boris Johnson (who proposes to give London a "Canadian" or at least an "Australian" version of the agreement) is not appropriate in these negotiations. Earlier, David Frost spoke in Brussels, saying that the UK is not going to bind itself to the rules and regulations of the EU after leaving the EU. According to Frost, the UK is not going to make concessions to get a "soft version of the agreement". Frost also noted that the UK itself should determine the standards by which the country and its residents will live. "That's what it's called to be an independent country," Frost concluded. Thus, as we can see, the positions of the parties remain unchanged for about a week before the start of official negotiations between the parties. And these positions do not promise anything good for London or Brussels. If there was enough time, then we could expect that sooner or later the parties will come to an agreement. However, most likely, on the initiative of Boris Johnson, the "transition period" will end on December 31, 2020. And until that date, European diplomats say that it will be extremely difficult to reach an agreement.

Thus, from our point of view, the prospects for the British currency remain very vague. There is no denying that without a trade deal, the UK economy will be hit even harder. If the financial sector is currently losing 70 billion a year, it may start losing even more after 2020. All this will affect macroeconomic indicators, monetary policy, and the exchange rate of the British currency. Thus, in the long term, we are still waiting for the depreciation of the pound. If traders manage to overcome the moving average, the trend will formally become upward and buy positions can be considered, but in extremely small lots, since both channels of linear regression are directed downward.

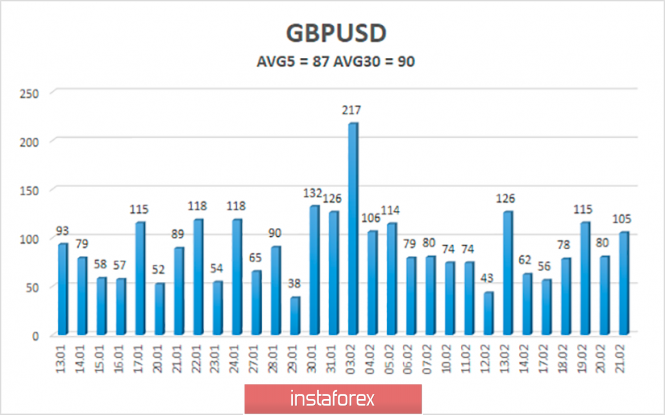

The average volatility of the pound/dollar pair over the past 5 days was 87 points and is characterized as "average" in strength. According to the current volatility level, the working channel on February 24 will be limited to the levels of 1.2867-1.3041. A downward reversal of the Heiken Ashi indicator will indicate a possible resumption of the downward movement.

Nearest support levels:

S1 - 1.2939

S2 - 1.2909

S3 - 1.2878

Nearest resistance levels:

R1 - 1.2970

R2 - 1.3000

R3 - 1.3031

Trading recommendations:

The GBP/USD pair adjusted to the moving average line. Thus, it is now recommended to resume selling the pound with the targets of 1.2909 and 1.2878, if the pair rebounds from the moving average. It is recommended to buy the British currency not before fixing the price above the moving average line with the first targets of 1.3000 and 1.3031, but in small lots since the fundamental factors remain on the side of the US currency.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com