The CFTC report confirmed the trend towards a stronger dollar and the bullish mood is developing. The total long position increased by 1.4 billion and reached 11.4 billion dollars. At the same time, a clear increase in gold demand should be noted. The price of the April futures reached 1682.55 at the opening of the week, updating the seven-year high.

On the other hand, oil loses about 2.5%, as a result, Asian stock indexes are in the red zone, the largest losses are mainly in commodity indices in Australia and New Zealand, each of which has decreased by more than 2% as of 5.00 Universal time.

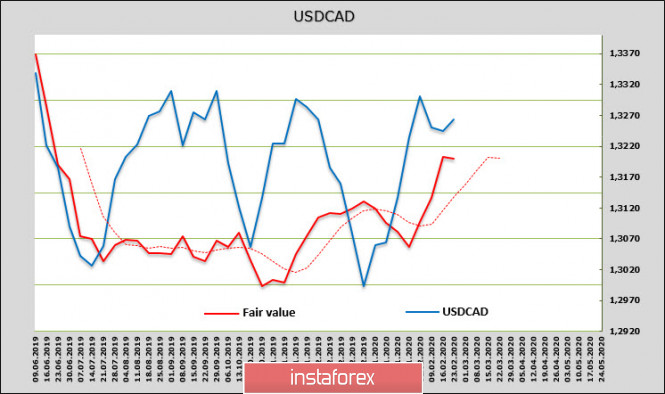

USD/CAD

The loonie with varying success resisted the strengthening of the dollar last week and the most obvious reasons are still rising oil prices, the difference in profitability spreads, as well as a positive inflation report for January. The correlation between CAD and WTI oil reached 68%, which is a good sign for the Canadian currency, because it indicates that the market is guided by traditional indicators and to a lesser extent by geopolitics or the threat of the spread of the COVID-19 epidemic.

Meanwhile, the next meeting of the Bank of Canada will be held on March 4, while the consensus of the market is that the rate will remain at the same level of 1.75%, although some banks are of the opinion that there will be a decrease in the rate by 0.25%. The chances of a rate cut are also reduced after the inflation index rose from 2.2% to 2.4%.

By Monday's opening, USD/CAD is moving up again from the level of the current price, which is calculated on the basis of the balance of T-bills yield the state of the stock market and currency positioning of speculators according to CFTC reports.

Since the USD/CAD rate is close to the calculated one, the correctional impulse to the downside has already been consumed or is close to consumption. The level of 1.32 is supportive, and it is likely that a local basis is formed to resume growth, since the current level is in the growth phase, which means that players are reviewing their portfolios in favor of the dollar, and this review should lead to another wave of growth on the spot.

The nearest resistance is 1.3268 and 1.3278. They are unlikely to resist on Monday, the goal is to get to the level of 1.3329. And given the increase in panic at the opening of trading on Monday morning, this scenario looks most likely.

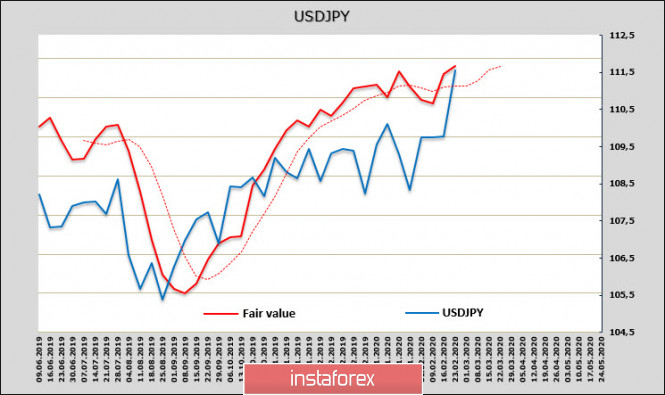

USD/JPY

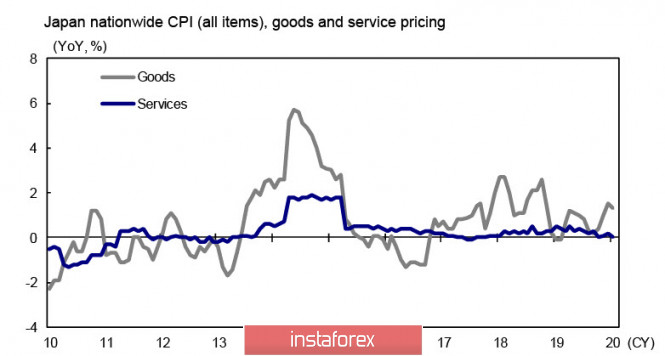

The consumer price index rose in January by 0.7%, while prices for goods rose by 1.3%, while prices for services fell 0.2% from the December level. Services account for more than half of all inflation components, and therefore there is no chance that general inflation will be able to sustainably reach the target level of 2%.

One of the main factors affecting the level of prices for services is the growth of wages. In conditions when corporate incomes are declining, there is no reason to rely on the growth of workers' incomes, while prices in the services sector, directly or indirectly related to tourism or housing construction, will noticeably decrease. At the same time, a sharp slowdown in China's economy leads to lower commodity prices, which also puts pressure on inflation in Japan. As an aid, price dynamics will not seek to target the Bank of Japan, but rather, the threat of deflation will be stronger every month.

The CFTC report showed minimal dynamics in the currency exchange contracts for the Japanese yen, but you need to pay attention to the fact that for three months the yen was trading in a narrow range relative to the dollar, while the estimated current price level indicated a growing probability of a breakdown from the upward range, which happened last week.

The gap between the spot and settlement prices has narrowed to a minimum, but the dynamics of the estimated price is such that further growth in USD/JPY should be expected, which can be prevented by a sharp increase in the panic index on world markets.

The head of the Bank of Japan Haruhiko Kuroda said on Sunday that the country's monetary authorities are ready for action if it is necessary to level out the impact of coronavirus on the Japanese economy. This is the case, and the likely steps on the part of the Bank of Japan and the government will be the main constraints on the growth of the yen.

The resistance test 112.39 looks very likely. In case of breakdown, this level will turn into support, and the yen will be targeted at 114.58.

The material has been provided by InstaForex Company - www.instaforex.com