The currency market responded to Fed Chairman J. Powell's speech on Tuesday by weakening the US dollar, which had previously received support on the wave of positive data from the US economy and a positive forecast from the Central Bank head for the near future.

Pressure on the dollar was exerted by the "dovish" essentially Powell's speech. In fact, in his own words, he confirmed the continuation of the "soft" monetary rate of the Federal Reserve, saying that he "expects" purchases of short-term Treasury bonds in the second quarter. This was enough to ensure that investors who previously bought the dollar began to close their positions, taking profits.

It can be recalled that the Federal Reserve has been pumping the financial system with dollar liquidity since the fall. This happened after it experienced a shortage in the summer. In fact, without acknowledging this, the regulator began programmatic incentive measures which are very similar to those that B. Bernanke had begun to carry out and continued by his successor J. Yellen. Thus, we believe that the active implementation of such a policy will weaken the dollar, or more precisely, restrain its growth in the currency markets.

Why can this be so? The fact is that the main currencies traded against the dollar themselves experience "weakness." Commodity and commodity currencies remain under pressure in the wake of existing fears that China will significantly reduce demand for commodity and commodity assets. It is enough to pay attention to the collapse in crude oil prices since the beginning of this year.

The euro and the British currency are under pressure from the effects of the "divorce" of the UK and the EU, as well as the general weak economic growth in Europe. Meanwhile, the Swiss franc and the Japanese yen are balancing on the background of either an increase in fears associated with coronavirus, or, conversely, their decline. In practice, it turns out that the dollar, having a good position against these currencies, does not decline due to their "weakness", but at the same time, it itself does not have enough strength to continue strong growth due to the monetary policy of the Federal Reserve.

It turns out that the dollar and its counterparts are balancing due to the "weaknesses" of each other. We believe that this picture will continue in the near future, which means that it is necessary to build strategies for buying and selling the dollar against major currencies, taking into account the above reasons.

Forecast of the day:

EUR/USD is trading above the level of 1.0905. We consider it possible to resume sales of the pair after it crosses this level with the local target of 1.0880 and 1.0840. The main reason for this dynamics is the slurred prospects of the monetary policy of the ECB.

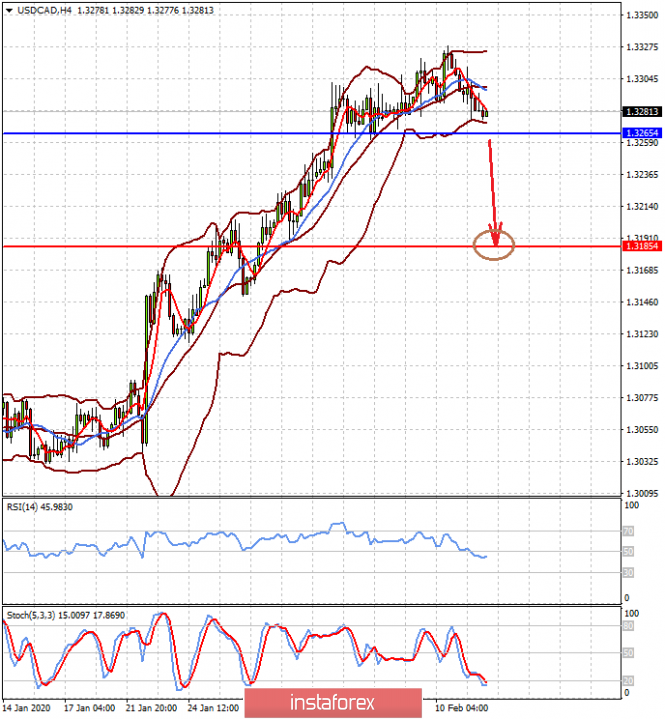

USD/CAD pair is trading above the level of 1.3265. If the idea of lowering crude oil production will be supported, it will support the price of "black gold" and, accordingly, could cause the appreciation of the Canadian currency. Based on this, we believe that a decline in price below the level of 1.3265 may lead to a further decline in the pair to 1.3185.