Economic calendar (Universal time)

There are practically no important indicators in today's economic calendar. We can only note the consumer confidence index, the publication of data on which was expected at 15:00 (USA).

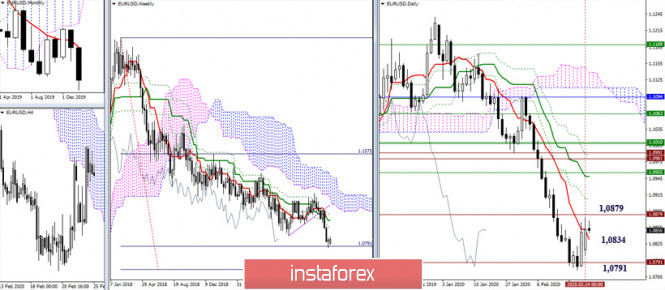

EUR / USD

The players on the increase were able to keep the situation yesterday and did not allow the opponent to form a rebound from the resistance encountered in the daily short-term trend. Thanks to this, we can say that the bulls insist on the development of a corrective rise. This week, we close the month. If the downside players cannot fix the close within the downward trend (the minimum extremum is 1.0879), and throw only a long shadow of the monthly candle in its direction, then most likely, the activity in March and strengthening of moods will come from the opponent.

In the lower halves, the inability of players to increase reliably to go beyond the correction zone deprives them of support for some technical indicators. And only the continuation of the rise and the formation of new highs can change the situation on H1. The upward reference points within the day are the resistance of the classic Pivot levels 1.0881 - 1.0910 - 1.0948. The key support is located today at 1.0843 (central Pivot level) and 1.0815 (weekly long-term trend).

GBP / USD

On the first day of the week, the pair failed to realize anything that would make a difference. The current resistance is still 1.2958 (daily Tenkan), further with the quality of resistance 1.2986 (Fibo Kijun) - 1.3028 (Kijun) - 1.3066 (daily Fibo Kijun + weekly Tenkan). The role of key supports in this sector remains at the levels of 1.2920 (weekly Fibo Kijun) - 1.2882 (monthly Fibo Kijun).

At the moment, the struggle for key levels continues in the lower halves, they are located at 1.2922-39 (central Pivot level + weekly long-term trend) today. So, developing the above levels will provide an initial advantage for players to increase. Further, updating the highs (the first 1.2980) and overcoming the resistance of the higher halves, which strengthen the intraday resistance of the classic Pivot levels 1.2957 - 1.2990 - 1.3025, will be of importance.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com