News about the slowing or increasing spread of COVID-19 around the world is currently the main impulse of the markets. Emergency measures to support national economies have been taken by all the leading countries, which act according to the common logic and take similar actions.

A global contraction in the global economy is becoming apparent despite the fact that data on trade and industrial production for March will not be published soon. The dynamics of PMI reduction does not give any other result than the recognition that the economic shock will be stronger than in 2008.

A certain positivity follows from recent reports from Italy, the Netherlands and Portugal, which report a slowdown in the spread of the coronavirus. The experience of China shows that the active period can be reduced with due effort to two months, so the business is already beginning to prepare for a "life after the pandemic," assessing both the depth of the fall into the recession and the prospects for recovery.

The strong decline in the dollar over the past 10 days is primarily due to the fact that the spread of the virus in the United States is currently the main threat that can plunge the world into economic chaos. Yields on 10-year US Treasures stuck in the range of 0.6% -0.7% and investors fear that the publication of ISM reports on employment data in March this week will be worse than market expectations. The Dallas Fed report on business activity in March showed a drop from 1.2p to -70p, and although it more closely reflects the state of the US oil industry, there is no reason to believe that the services sector will withstand the attack of COVID-19.

The panic is increasing, so in the coming days, another wave of oil decline, growth in demand for gold and other protective assets is likely.

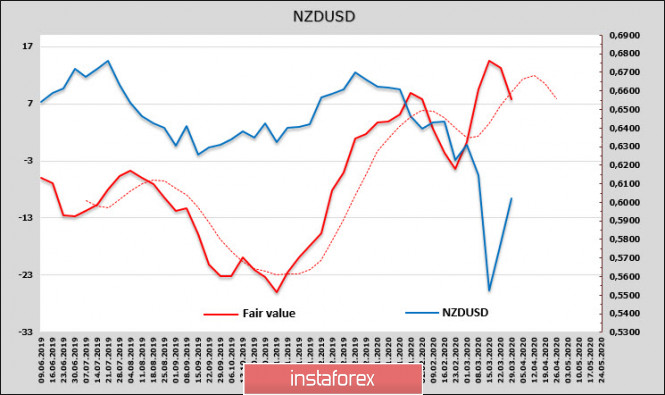

NZD/USD

Last week, the RBNZ announced the first QE program in its history, which is called the Large Asset Purchase Program (LSAP), began redeeming bonds, having previously cut the rate and eased the requirements for the core capital of banks.

The actions of the RBNZ completely repeat the measures of other large central banks, which, one by one, turn into a "lender of last resort". A certain positive effect was obtained, the government is implementing its aid package of 5% of GDP, however, the program can be expected to expand, as several countries have introduced measures of up to 10% of GDP.

The depth of economic decline is visible now. The business optimism index from the RBNZ fell in March from 19.4p to -63.5p, which is worse than during the 2008 crisis, the outlook for the near future is negative.

The quarantine in New Zealand will last at least 4 weeks. According to ANZ Bank estimates, the reduction in GDP in Q1 quarter can reach 5-6% of GDP, and in the 2nd quarter up to 17%. Such forecasts cannot provide any support for the New Zealand dollar. Although the CFTC report showed a minimal change in aggregate position, the estimated fair price started moving downwards.

It is still higher than the spot, and therefore, the short-term impulse of NZD/USD can continue to the resistance of 0.6199, however, the long-term prospects of the kiwi will deteriorate. Under current conditions, it is logical to enter short positions from current levels with a stop of 0.6175 and a target of 0.5905 / 10.

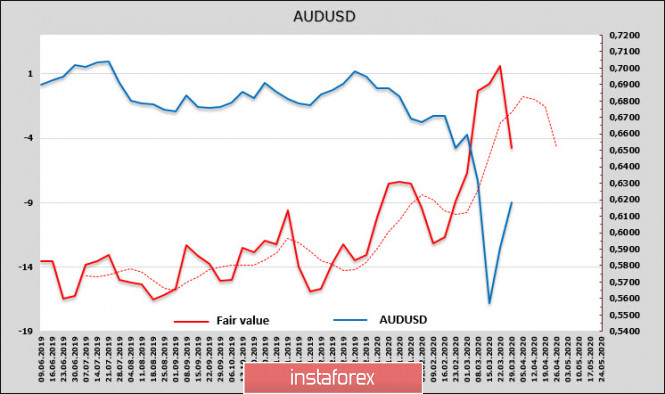

AUD/USD

A strong 7% increase in the S & P / ASX 200 index on Monday is the result of the launch of the third government package of financial support for the economy, which includes wage subsidies for the most affected firms, the total aid package will reach $ 130 billion, or 6.5% of GDP.

The dynamics of the estimated fair price AUD is negative, so the current growth of AUD/USD is close to completion.

The recommendations are the same as for NZD - the bullish momentum is close to exhaustion and the Australian currency is near the pivot point. The AUD will likely return to the zone 0.6020 / 70, after which there will be an increase in the downward movement, the subsequent targets are 0.5970 and 0.5870.

The material has been provided by InstaForex Company - www.instaforex.com