A new wave of panic mood collapsed the US stock market again, pulling down other global stock markets in Asia and Europe as well. The panic surrounding its impact on the global economy seems to have reached its peak. It continues for the second week now, with a slight upward roll in between weeks.

As we mentioned earlier, the main reason for this phenomenon was simply an unprecedented information attack on the minds of investors and ordinary people on the issue of coronavirus from the world's media. This problem is extremely inflated, although, in truth, the death rate from this scourge is significantly lower than from a simple flu. However, investors, frightened by the media about the spread of this infection around the world, are dumping risky assets, since they believe, and not unreasonably, that it is panic, and not the infection itself, that will have a significant negative impact on the growth of the world economy.

In the wake of another collapse in the United States, the currency market reacted in the usual way which is by weakening the US dollar against the "safe haven" currencies: Japanese yen and the Swiss franc, as well as other major currencies, with the exception of the Australian and Canadian ones. Against this background, the fall in the yield of American treasuries has resumed. Thus, the benchmark yield of 10-year-old traders at the time of writing is declining by 9.56% to the level of 0.837%. What is interesting is that such values were not reached even in the critical year of 2008, after the beginning of the latest global crisis. This confirms once again that the reaction of the markets to the problem overblown by the media is inadequate and overblown.

It can be agreed that there has been a decline in business activity in China, Europe and America, but it was the result of panic again, thereby closing the circle. And the Fed, yielding to these sentiments, has only increased these fears with its decision this week to cut interest rates by 0.50%.

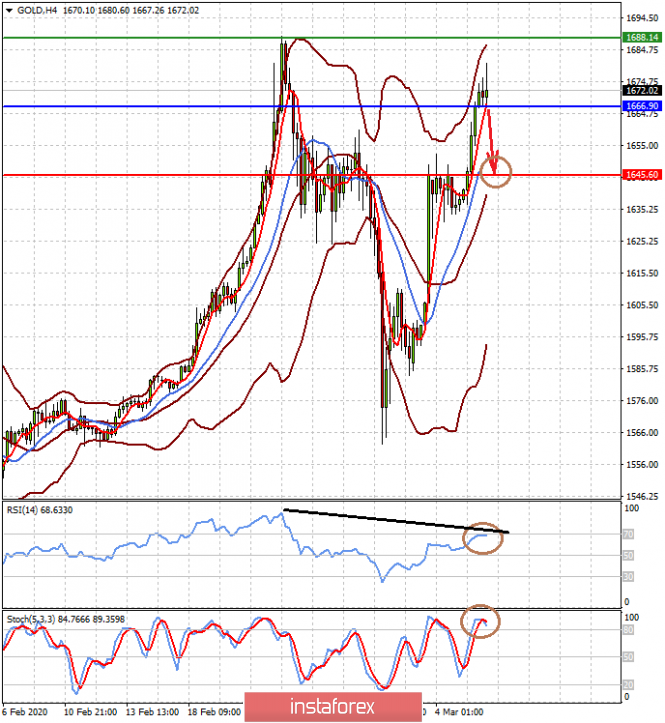

Of course, on this wave, the price of gold gains support again, which rushed in the spot market to the local maximum reached on 24.02.

Assessing the entire emerging situation in the markets, we believe that the dynamics of the currency market, and not only it, will fully remain captive to the topic of the coronavirus and its impact on its spread and effect on the global economy. We believe that in a situation of extreme panic, the US dollar, as well as the currencies of emerging economies, as well as commodity currencies will remain under negative influence.

Today, US employment data will be released. We believe that even if they turn out to be better than expected, this is unlikely to lead to a noticeable rebound in the dollar, since the markets expect another decline again in the Federal Reserve's interest rates already at a regular bank meeting this month.

Forecast of the day:

The price of gold is above the level of 1666.90. If the data on the number of new jobs, as well as the level of average wages in America are higher than expected, this could lead to a local decline in quotes by 1645.60 in the wake of profit taking.

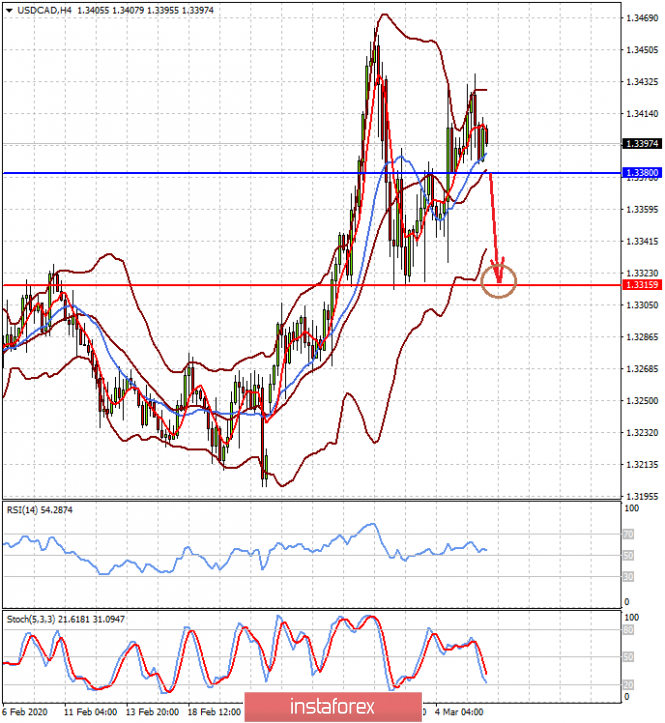

The USD/CAD pair is consolidating above the level of 1.3380 in anticipation of the result of the meeting between OPEC and Russia on another decline in crude oil production in order to maintain prices for black gold. If consensus is reached on this issue and profit taking begins in the markets, we expect the pair to decline to the level of 1.3315 after breaking through the support level of 1.3380.