4-hour timeframe

Average volatility over the past 5 days: 199p (high).

The EUR/USD currency pair began the fourth trading day of the week by continuing the correctional movement. We have already talked about the prospects of the currency pair in recent articles. Thus, the overall picture of the situation remains the same. In fact, now the key issue for the markets is still the issue of lifting quarantine measures in the United States. Recall that Donald Trump believes that "the cure for the disease should not cost the economy more than the disease itself." The American president believes that the epidemic is an epidemic, and the largest economy in the world should work, otherwise it will cease to be so. Approximately the same opinion is shared by representatives of various large banks in the world. Many predict a fall in the US economy from 12% to 25% if quarantine measures continue until the summer. Trump's sincere desire to prevent depression, the willingness to neglect the lives and health of the US population in order to be re-elected in the 2020 elections. These are the issues that traders are most interested in right now. What will change for the dollar if quarantine is canceled? We believe that, firstly, the US stock market will begin to recover. Secondly, the US currency will begin to be in even greater demand and may grow significantly against the euro, the pound and other currencies, which, by the way, is completely unnecessary for Trump. However, this is short term. If Americans go to work, then with almost 100% probability the virus will spread all over America in a matter of weeks, maybe days. It is unclear how will the economy work if around 70% to 100% suffers from pneumonia, albeit in mild manifestations.

James Bullard, the Chairman of the St. Louis Federal Reserve, also understands the danger of the current situation. According to him, 46 million people may be laid off because of the epidemic, and the unemployment rate will jump to a record 30%. Bullard also believes that all the measures taken by the White House will not save the economy from a recession or even a depression. After all, if the virus continues to spread and block the work of all spheres of life in America, then after a while, new incentives will be needed. And if the Federal Reserve and the Treasury Department constantly solve the problem by injecting new trillions of dollars into the economy, sooner or later there will be a collapse.

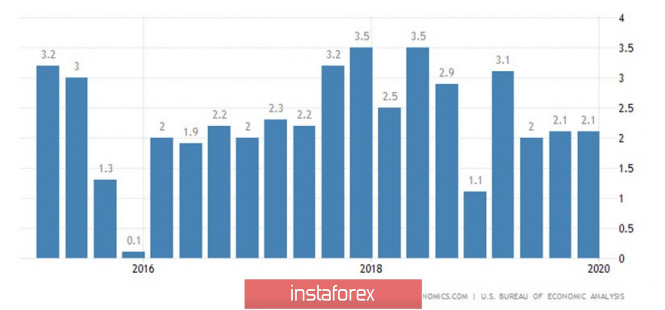

The United States has planned significant macroeconomic releases on Thursday, March 26. Firstly, this is an important indicator of GDP for the fourth quarter. According to expert forecasts, it will amount to 2.1% y/y, which fully coincides with the value of the third quarter. In general, it turns out that US GDP will continue to lose growth and is virtually guaranteed to decline in the first quarter of 2020. In addition, the index of expenditures on personal consumption of the US population for February will be released today, which in the current conditions is a secondary indicator. Even GDP is likely to be ignored by market participants.

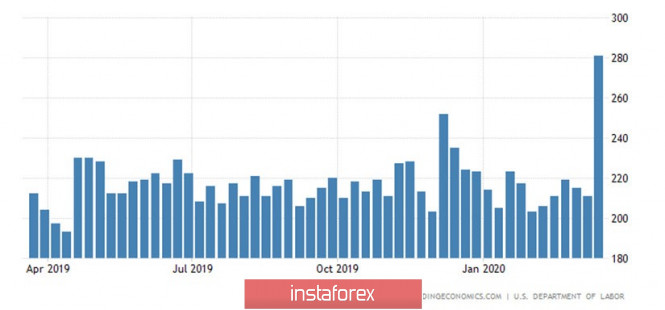

But the indicator of the number of applications for unemployment benefits for the week before March 20 can significantly affect the US currency and the demand for it. Recall that a week earlier the number of new applications reached 281,000 with a normal value of the indicator of about 220,000. Now, one million applications for benefits are immediately forecasted, which means a sharp jump in unemployment. This is not surprising given the epidemic and quarantine. However, in reality, the numbers may be even more negative. And this can provoke the fall of the US currency.

4-hour timeframe

Average volatility over the past 5 days: 351p (high).

The GBP/USD currency pair remained above the Kijun-sen critical line on March 26. The pound/dollar fell to this line during the US trading session on Wednesday, but rebounded from it, therefore, according to the Ichimoku system, the likelihood of continued upward movement is also considerable. The next step of the bulls will be an attempt to gain a foothold inside the Ichimoku cloud. However, we draw the attention of traders once again to the fact that the pair remains in a very excited state, so quotes may resume falling at any time simply because market participants consider the US currency to be the safest in times of crisis. We also pay attention to how reluctantly the pair is correcting, despite the high volatility.

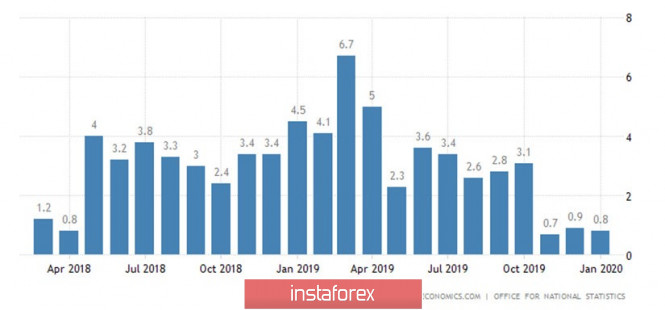

The key report today will, of course, be the report on applications for unemployment benefits in the United States, not GDP. However, several indicators will be published in the UK that may interest market participants. The greatest attention may be given to the indicator of retail sales in February. The indicator itself is interesting, but we have repeatedly focused the attention on the fact that the markets are not too interested in February reports at this time. Thus, no matter what the real numbers of the report are, traders are likely to ignore it.

The last thing I would like to say: The coronavirus infected 71-year-old heir to the British throne, Prince Charles. Doctors say that the disease in a member of the royal family is mild. It was not possible to establish exactly who the member of the royal family was infected from, since in recent weeks Prince Charles has participated in many events with a large crowd of people.

Recommendations for EUR/USD:

For short positions:

The euro/dollar continues a corrective movement on the 4-hour timeframe. Thus, it is recommended to sell the euro if the price consolidates below the critical line with the first goal, the level of volatility is 1.0677. The second target is the support level of 1.0476.

For long positions:

Formally, you can buy the EUR/USD pair now, since the price has crossed the Kijun-sen line, the Senkou Span B line is for the first purpose. However, we believe that the prospects for the upward movement are vague at the moment, so we advise that you trade for an increase, do so very carefully and in small lots .

Recommendations for GBP/USD:

For short positions:

The pound/dollar is trying to resume the upward movement, rebounding off the Kijun-sen line. Thus, it is recommended to sell the British pound with the goal of a volatility level of 1.1510 only after the price has consolidated below the critical line. The second goal is the support level of 1.1229.

For long positions:

You can the GBP/USD pair now, since a rebound from the Kijun-sen line has been made, with the first goal the level of volatility is 1.2212, but with very small lots. Also, as in the euro's case, it is recommended to keep in mind the increased risks when opening any positions.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dashed lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movements:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com