EUR/USD

An emergency meeting of the FOMC Fed was held last night in order to cut the base rate immediately by 0.50% - from 1.75% to 1.25%. The last time the Federal Reserve convened an extraordinary meeting on the rate was back in the crisis year of 2008. The Fed exceeded market expectations, as investors already doubted a double rate cut at a scheduled meeting on the 18th, assuming one decrease by a quarter point in March and April. But since the growth on expectations last week was very high, the euro responded moderately directly to the news. Daily growth amounted to 36 points at extremely high volumes, which indicates the closure of positions opened in the period from February 21. When the entire volume is closed, the euro will unfold in decline. We can only say that by such actions the Fed officially recognized the current situation in the US as a crisis, as it was in 2008. Obviously, the crisis is not so much in the danger of the coronavirus as in the ruptured problems of the United States itself. Now we have to wait for technical conditions to form for strengthening the dollar as a safe- haven currency.

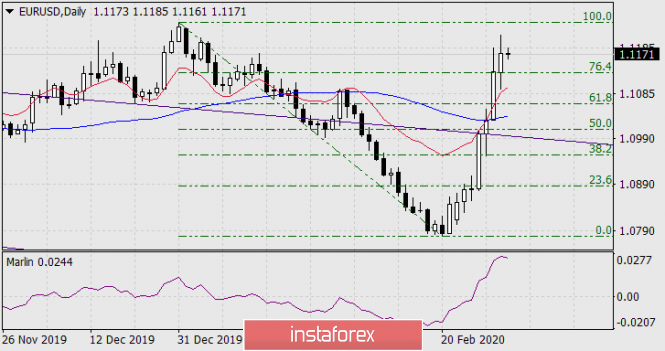

The signal line of the Marlin oscillator is moving down on the daily chart. So far this is the only sign of the upcoming cooling of the market.

On the four-hour chart, yesterday's events only slightly affected the oscillator, the signal line continues to consolidate at the lower boundary of the range highlighted in gray. A price drop under yesterday's low (1.1095) will be the first signal for a reversal. In this case, we are waiting for the price at the Fibonacci level of 50.0%, towards which the MACD indicator line (blue) is aiming.

The material has been provided by InstaForex Company - www.instaforex.com