4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - upward.

CCI: 91.3539

On Monday, March 30, the GBP/USD currency pair worked out the Murray level of "3/8"-1.2451, but could not overcome it and rebounded from it, starting a downward correction. More precisely, a kind of downward correction. The Heiken Ashi indicator continues to color bars mainly purple, so there is no downward correction as such. The movement just stalled around the level of 1.2451, but the volatility of the first trading day of the week was 150 points... Well, from a technical point of view, the upward movement is now stopped and you need to wait for the level of 1.2451 to be overcome or other signs of an upward trend to resume trading for an increase. At the same time, both channels of linear regression are directed downward, so the trend in the long and medium-term plans is now downward. However, market participants are still in an overly excited state. And the reasons for this are clear and obvious. Quotes of "black gold" again rushed down. And low oil prices harm both the UK and US economies, as both countries are more exporters of "black gold" than importers. The COVID-2019 virus continues to spread across both countries, continuing to isolate not only their population but also the entire economy, keeping it in quarantine. And we have already said that the economy, unlike ordinary citizens, cannot be out of work for a long time. These people can be quarantined for as long as they want, as long as they have something to live for and something to eat. In developed countries, there are no problems with this yet. But the economy, if it is not moving for a long time, begins to simply deflate and collapse. And with the end of the quarantine and the epidemic, people will be ready to go to work at the moment. But not everyone will have a job after the quarantine because a month of downtime for any economy is 6-12 months of its recovery after. Thus, the panic mood among traders persists and remains quite justifiably.

There will be no important macroeconomic publications in the States today. Thus, traders will have to refocus their attention on the daily speeches of Donald Trump, as well as representatives of the health sector, who are trying to keep the media and the population informed of what is happening. In the UK, the publication of GDP for the fourth quarter is scheduled for Tuesday, March 31. As we have already mentioned in the article on EUR/USD, macroeconomic statistics for the periods up to March 2020 are not very interesting for traders right now. Therefore, even such an important report as GDP can and most likely will be ignored completely. According to experts' forecasts, the value is expected to be 1.1% in annual terms. Most likely, we will not see too large numbers now for a long time. Within 2020, for sure.

Meanwhile, the situation with "coronavirus" in the UK is not improving. According to the latest information, about 135,000 people were tested for the virus, 22,000 tested positive, and 1,408 deaths were recorded. The government informs about the agreement reached with machine-building concerns on the production and purchase of 10,000 artificial lung ventilation devices. In addition, about 20,000 former health workers decided to return to work because of the pandemic. "Thank you to the 20,000 former employees who are returning to the healthcare system. And thanks to 750,000 volunteers who help vulnerable groups of the population. Together we will meet this challenge," Boris Johnson wrote on Twitter.

At the same time, the international rating Agency Fitch downgraded the UK's long-term default ratings in national and foreign currencies. This downgrade means that the UK economy has suffered short-term damage from the COVID-2019 epidemic. In addition to the epidemic, there is still uncertainty about the future relationship between the Kingdom and the European Union. In 2020, GDP is forecast by Fitch analysts to fall by 4%.

US economy Secretary Steven Mnuchin said on Monday that the US economy is facing a "difficult quarter" due to the epidemic, but now all fundamental indicators are normal. According to Mnuchin, now is a great time for long-term investment. In the near future, small businesses will receive instructions on obtaining loans, for which $350 billion has been allocated from the budget. If this money is not enough, then the administration of President Trump will request additional funding. Thus, the Finance Minister believes that the situation will begin to recover in the near future, and the economy will get some relief.

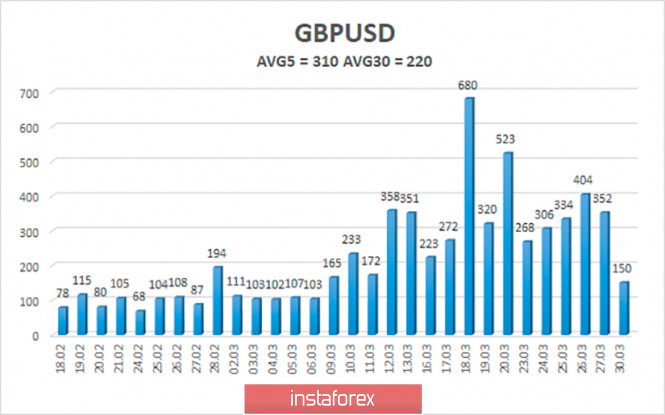

The average volatility of the GBP/USD pair has started to decline again in recent days, and this is good news. At the moment, the average value for the last five days is 310 points. However, the activity of traders on the pound/dollar pair still remains extremely high. On Tuesday, March 31, we expect movement within the channel, limited by the levels of 1.2078 and 1.2698. A downward turn of the Heiken Ashi indicator will indicate a downward correction.

Nearest support levels:

S1 - 1.2207

S2 - 1.1963

S3 - 1.1719

Nearest resistance levels:

R1 - 1.2451

R2 - 1.2695

R3 - 1.2939

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe retains the prospects of an upward movement. Thus, purchases of the pound with the goal of the Murray level of "4/8"-1.2695 remain relevant now. You can exit the longs by turning the Heiken Ashi indicator down. It is recommended to sell the British currency with the goal of 1.1719 if the bears manage to overcome the moving average. We remind you that in the current conditions, opening any positions is associated with increased risks.

The material has been provided by InstaForex Company - www.instaforex.com