Minutes ago the FED announced that its cutting rates to zero and the launch of a $700billion quantitative easing program. This will at least initially put USD under lots of pressure. As we explained in our last analysis EURUSD bulls want to see a higher low.

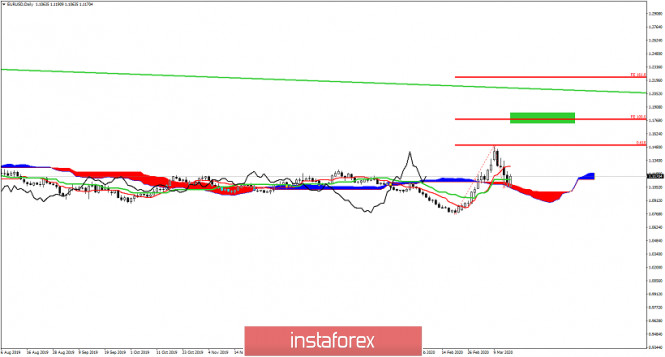

Blue lines -Fibonacci retracement

Yellow rectangle- key support level

EURUSD is bouncing again after the FED intervention. Price had stopped at a major support level as we explained in our last analysis. EURUSD could very well have formed a higher low and could now start its new upward move that will eventually push price towards 1.17-1.18. For this to come true we need to see a sequence of higher highs and higher lows. At the same time we should not see price break below the yellow rectangle area and last week's lows.

Key short-term support is at 1.1050. Bulls do not want to see this level broken. We are bullish as long as price is above this level.

The material has been provided by InstaForex Company - www.instaforex.com