The investors turned their attention again for the second time from the coronavirus pandemic to unprecedented incentive measures from the world Central Banks, but primarily from the Fed. On Tuesday, demand for risky assets sharply increased on all world trading platforms, and the US dollar began to gradually retreat in the currency markets.

In our opinion, such a change of mood in the markets is explained not only by the huge incentive measures presented, but also by the understanding by market participants that troubles come and go, but unique investment opportunities in much depreciated assets, and even against the backdrop of large-scale QEs, are not so common, you can even say that this unique opportunity can only be once in a lifetime.

The US dollar remains under pressure, as not only the wave of demand for risky assets pushes its rate down, but also a noticeable weakening of interest in it as a safe haven in catastrophic crisis situations. The normalization of the situation with coronavirus in China and generally in Asia, as well as the latest news that the number of deaths in Italy began to decline, make the markets look to the future when the influence of this infection will decline and the economies of affected countries will begin to recover.

We expect that the weakening of the US dollar will continue, but only in the case that tension around the coronavirus situation gradually subsides. Most likely, we will not see any bursts of panic since everyone had enough of them. Moreover, severe measures to counter the spread of COVID-19 have been introduced in Europe and the United States, and the first results of these measures are already evident - news of a decrease in the death toll in Italy.

Observing the development of the situation, we believe that at the moment it may be interesting to sell the dollar against major currencies, with the exception of the yen and the franc.

In general, we believe that the present moment is a turning point and extremely interesting for active actions in the financial markets.

Forecast of the day:

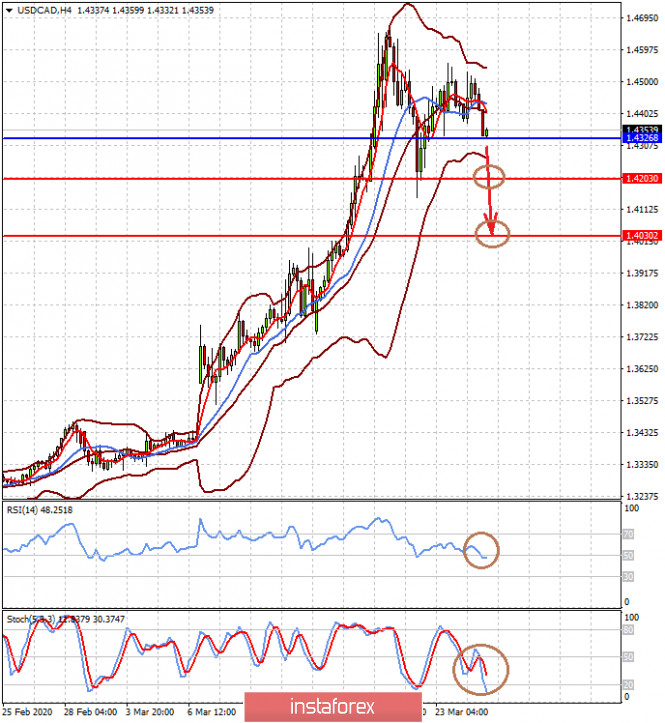

The USD/CAD pair is trading above the level of 1.4325 amid renewed oil price growth and general positive on global markets. Thus, we believe that our earlier forecast remains valid. Also, we believe that the pair still has prospects for declining to the level of 1.4200, and then to 1.4030.