Recent events in the oil market have had little impact on the dynamics of the main currency pairs. The key beneficiary of this situation was the greenback - the dollar index again crossed the 100-point line, reflecting increased demand across the entire spectrum of the market. The US currency currently dominates almost all pairs, but dollar bulls are behaving quite modestly, compared to the recent hype that was associated with the spread of the coronavirus. There is more uneasiness than panic in the currency market – a contradictory fundamental background does not allow the dollar to spread its wings, but the historical anti-records that oil traders set yesterday caused anti-risk sentiment to increase, thanks to which the greenback then grew in price. But this price dynamics is not confident – soon traders will switch to other fundamental factors that are more important for the forex market. Therefore, you should not invest in the greenback based only on yesterday's unrest.

But first, a little more about what happened yesterday. An anti-record was set in the oil market – the value of May WTI oil futures fell below zero for the first time in the history of exchange trading. Quotes dropped to the level of -40 dollars per barrel. The opening price was at the level of 18 dollars, so yesterday's collapse is about three hundred percent relative to the closing levels of Friday's trading. In addition, traders paid attention to another record - the difference between the near and next WTI futures increased to $40, again for the first time in the history of observations.

If we talk about the reasons for such price dynamics, they are quite banal. The reason, in fact, is the lack of demand. Due to this factor, investors withdrew from the May contracts, not shifting to the following (June) contracts. The fact is that if a trader does not have time to close the current contract on paper, then he faces a physical supply of oil. As a rule, raw materials are delivered to the Cushing terminal in the US state of Oklahoma. Stocks in this oil storage facility are rapidly growing, amid a lack of demand. Therefore, it is quite logical that no one wants to buy a contract that expires on the next day and at the same time obliges to take delivery of it. There was no demand even when traders offered to pay extra for the purchase of such futures (in fact, this is why the price went into negative territory), since energy companies do not have enough space to store oil against the background of lack of demand.

The situation that has developed with oil futures contracts, of course, is unpleasant. This is another reminder of the global crisis, the weak demand for oil and the lack of hope for an early recovery of the oil market. The situation with the spread of COVID-19 led to stagnation in the market, overcrowded storage facilities and an excessive supply level. But, according to experts, despite the fact that many players closed their positions in the financial market yesterday, there is no critical overstock in the physical market, and a sharp drop in prices occurred at the time when contracts were executed. That is why the foreign exchange market reacted so weakly to yesterday's events. In addition, today the cost of futures for WTI with delivery in May has returned to positive territory: at the moment, the price on the NYMEX exchange has risen to $1.40. June WTI futures also rose in price to $21.33.

Given such a rebound, it can be assumed that currency market traders will soon switch to other fundamental factors that will directly affect the dynamics of the US currency. Therefore, you are advised to ignore the EUR/USD pair's current fall to the 1.0850 level - the dollar strengthened due to yesterday's nervousness in the commodity market. More powerful news is needed in order to confirm the downward movement of the EUR/USD. Moreover, today's dynamics of WTI and Brent does not make it possible for dollar bulls to continue their mini-rally.

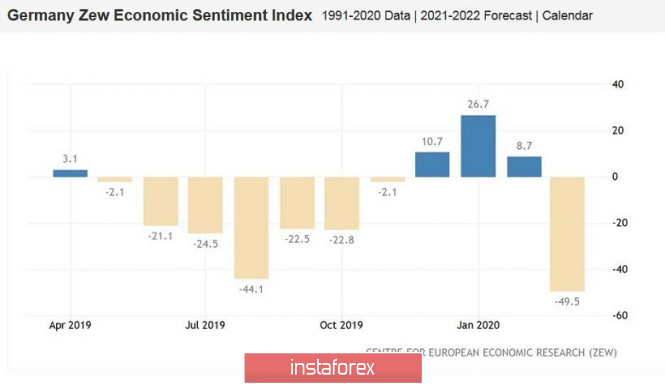

But you should pay special attention to today's report from the Centre for European Economic Research (ZEW Institute). Positive dynamics are expected in both Germany and the eurozone as a whole, although indicators will remain deep in the negative area. So, if the German index reached -49 points in March, then it should rise to -40 in April. Doubtful achievement, but the dynamics are important here. The euro will be under strong pressure if the figure continues to decline further. There are certain prerequisites for this: the coronavirus factor, the pessimistic report of the IMF, the dovish rhetoric of Lagarde, the slowdown in inflation, weak German data - all these circumstances cannot but affect the mood of entrepreneurs. But here it is worth emphasizing that the European currency will stay afloat if the real numbers coincide with the forecast values. Otherwise, if the downward trend is of a larger scale, the EUR/USD pair bears will receive a reason to fall.

Thus, the risk of losing a short position is quite high at the moment - that is, on the one hand, you can take a chance and sell from current positions, with a downward target of 1.0800 and a mandatory stop loss at 1.0910 ( in this price area, the lines Tenkan-sen, Kijun-sen and the middle line of the Bollinger Bands indicator on the daily chart coincided). However, trading decisions after the release of data from the ZEW Institute (09:00 London time) will look more justified - if the indicators come out in the green zone, it will be problematic for the bears to pull the pair to the bottom of the eighth figure, while the probability of a correction to the resistance level of 1.0910 will increase in many ways.

The material has been provided by InstaForex Company - www.instaforex.com