To open long positions on EURUSD, you need:

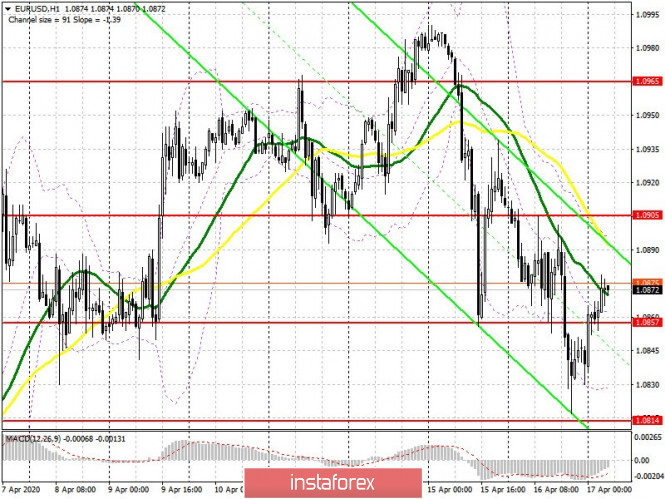

Sellers of the euro yesterday coped with their weekly task and reached the support of 1.0814, from which I advised to open long positions. The increase in applications for unemployment benefits in the US led to a stronger dollar, but today's data on the Chinese economy, where industrial production was nearly not affected by the coronavirus, and the decline in GDP fully coincided with the economists' forecasts, caused the euro to strengthen. Now the bulls are actively fighting for 1.0857, a false breakout on it will be a signal to open long positions in the hope of continuing the growth of EUR/USD to the resistance area of 1.0905, where I recommend taking profits today. We can expect a breakout of 1.0905 only if good eurozone inflation data comes out, which will lead the pair to a high of 1.0965, but the indicator could be much worse than economists' forecasts. If the pressure on the euro returns in the first half of the day, it is best to consider new long positions again when testing the week's low of 1.0814, or buy EUR/USD immediately on the rebound from the April low of 1.0770.

To open short positions on EUR USD you need:

Sellers of the euro achieved a test low of 1.0814, which is clearly visible on the 5-minute chart, and afterwards, they retreated from the market. Now the entire focus is shifted to the 1.0857 area, and the primary task of the bears is to return EUR/USD to this range. This option will raise the pressure on the pair and lead to a repeat test of this week's low of 1.0814, which will preserve the chance of updating the larger support of 1.0770, where I recommend taking profits. In the event of a further upward correction, I recommend returning to long positions only when a false breakout forms in the resistance area of 1.0905, which may occur after the release of weak data on inflation in the eurozone. If you grow above the 1.0905 level, it is best to open short positions immediately for a rebound only after testing the high of 1.0965.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving averages, which acts as resistance at the moment.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

Growth could be limited by the upper level of the indicator at 1.0890. The pair will be supported by the lower border at 1.0825.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20