To open long positions on GBP/USD, you need:

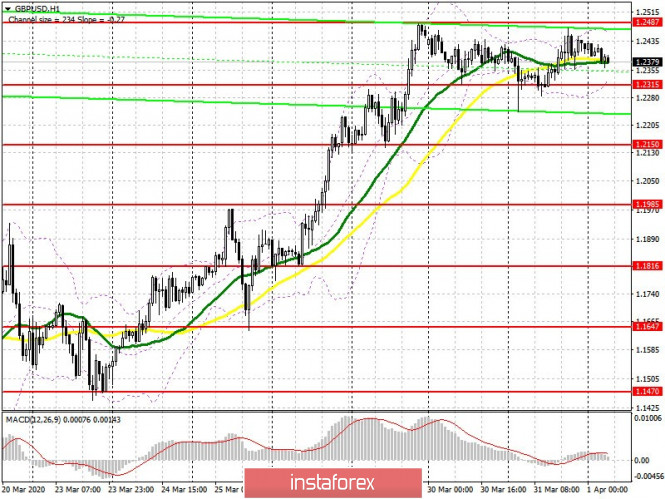

The pair's growth from yesterday afternoon after the support test of 1.2315, below which the bears did not manage to break through, which is clearly visible on the 5-minute chart, led to the growth of GBP/USD in the resistance area of 1.2487, above which the bears did not let go. Now trading is conducted in the middle of the channel, and I do not recommend taking any actions from there. While the pair is above the 1.2315 area, we can expect continued growth of GBP/USD in the resistance area of 1.2487, the breakout of which will provide a direct path to the highs of 1.2605 and 1.2686, where I recommend taking profits. In the scenario of a correction of the pound to the 1.2315 level, you do not need to rush to open long positions. It is best to wait for the support test of 1.2150, or buy immediately for a rebound from the low of 1.1985. Given that the release of important fundamental statistics on the UK economy is not planned for today, most likely in the first half of the day, trading will take place in a side channel.

To open short positions on GBP/USD, you need:

Nothing is over yet for the sellers of the pound, since they did not allow this week's high to be updated yesterday, which may indicate the reluctance of large buyers to return to the market at current levels. Bears need to try to get the market back under their control, and to do this, they need to gain a foothold below the support of 1.2315. The fourth attempt to do this in the European session may lead to a breakout of this area and a larger sell-off of GBP/USD to the area of lows 1.2150 and 1.1985, where I recommend taking profits. The 1.1985 support test will also indicate the resumption of the bear market. In the scenario of an attempt by the bulls to regain the upward trend, only the formation of a false breakout in the resistance area of 1.2487 will be the first signal to open short positions. Otherwise, it is best to sell the pound on a rebound from the highs of 1.2605 and 1.2686.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving average, which indicates the lateral nature of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

Growth will be limited by the upper level of the indicator in the 1.2450 area. A break of the lower boundary of the indicator at 1.2350 will raise pressure on the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20