The British pound showed its intention to resume falling last week. Thus, in the new week, traders will immediately look in the direction of selling the pound/dollar pair. It should also be noted that there weren't any important data that were published in the UK last week. Or rather, none at all. There were no major interesting events in the UK, other than the fact that Boris Johnson was discharged from hospital after undergoing treatment for coronavirus, as well as the resumption of Brexit negotiations in video mode. However, you will agree that both of these messages, even at normal times, would not have caused any reaction from traders. Thus, not only do market participants not react to the macroeconomic background, but the background from the UK itself is quite meagre. We still have to deal with all the data planned for the next week and find out whether they can somehow affect the movement of the pair.

Before we start dealing with statistics, we would like to note that in principle, all movements of the pound are now quite measured. There are no sharp turns, no fluctuations. Therefore, if the pair performed a reversal at the end of last week, then, with a high probability, this is a call to a downward movement. As for statistics, Monday is traditionally a half-day, and data will only be available to traders on Tuesday. Reports on average wages, applications for unemployment benefits for March and the unemployment rate for February are scheduled for this day in the UK. The first and last reports do not interest us now, since the dynamics of wages are not the most important indicator in the crisis, and the unemployment rate refers to February, when there was no epidemic in Great Britain. But the number of applications for benefits is taking over from a similar indicator in the United States. According to statistics on this indicator over the past two years, its normal value has fluctuated between 10 and 30 thousand per month. The forecast for March is 272-300,000. And we believe that, as in the US, this forecast can easily be exceeded. This is at least ten times more than the highest average value. So Britain can follow in America's footsteps and start breaking all records for unemployment. In just a month, 22 million of the approximately 160 million economically active people in the United States lost their jobs. That is almost 14%. In the UK, the economically active population is 33 million and if only 300,000 people lose their jobs in March, it is only 1%. We believe that this forecast is extremely optimistic, because +1% unemployment in the greatest crisis in the last 90 years is practically nothing. Thus, the real numbers may be much worse, and the pound could fall under the sell-offs of traders.

The UK is set to publish inflation for March on Wednesday, April 22, which does not play a special role at this time. The forecasts are more than neutral - 1.7% in annual terms. This figure does not differ from the previous month's value.

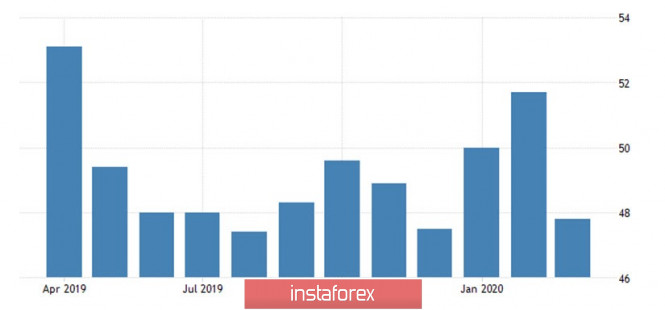

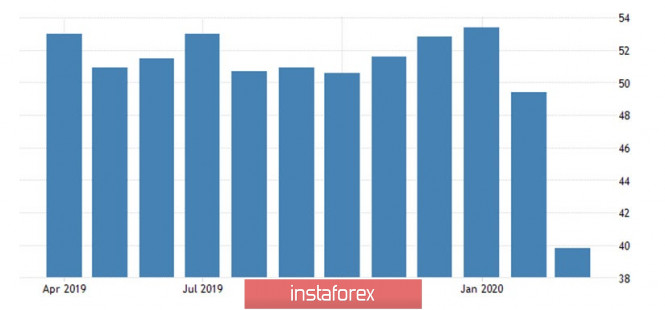

The UK will release business activity indices in the manufacturing and services sector for April on Thursday. The first, after a very good value of 47.8 in March, could fall to 40.8-41.5 in April.

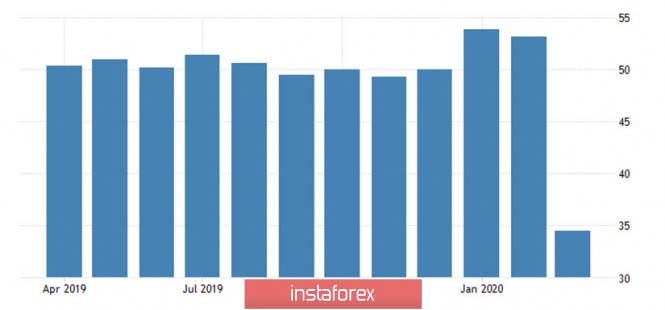

The second indicator – the meager March 34.5 points will fall even more and reach 27.2-29.4. However, as we can see, business activity is falling everywhere, all over the world, so traders should not be particularly impressed with this data. As we have already said, the most important thing now is to understand and comprehend how much the economies of the most developed countries of the world will shrink. China, the United States, the United Kingdom, and the European Union. And also understand whose economy will suffer the most from the epidemic, quarantine, and crisis.

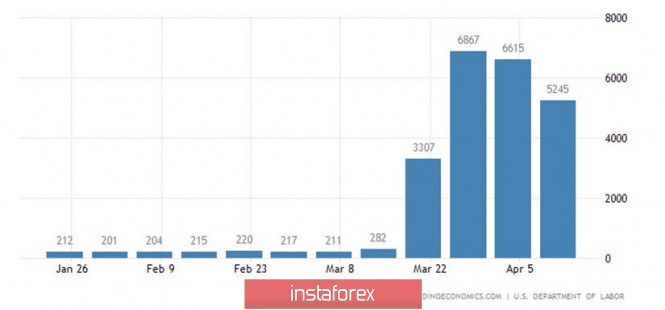

The next report on applications for unemployment benefits in the United States is set to be released on Thursday. Following the values of +3.3, +6.9, +6.6 and +5.2 million applications, an additional +4.5 million applications are expected. The total number of unemployed could increase by more than 26 million in five weeks.

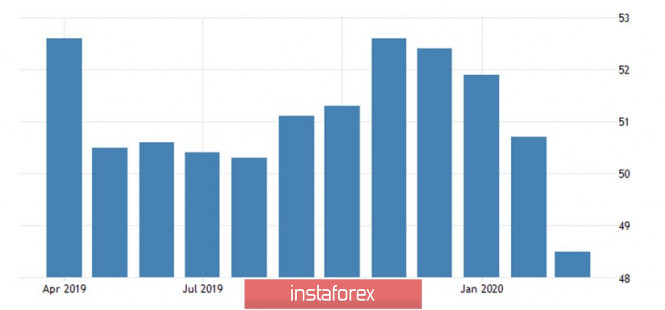

The US index of business activity in the manufacturing sector will be published with a forecast of 37.6–38.5.

An important report on orders for durable goods is scheduled to be published in the US on this day. As we have already mentioned in the EUR/USD review, this indicator is quite important for the US economy and a strong fall can cause pressure on the US currency. A strong fall is very likely. According to forecasts, the drop in the main indicator will be about 12% at once with the usual fluctuation +-2-3%. The volume of orders for durable goods excluding transport can be reduced by 5-6%, and excluding defense orders-by 8-9%. These are huge numbers that perfectly reflect the scale of the economic crisis in the United States. More precisely, the beginning of this crisis.

What can I say about the result? As a result, this week we have only a few reports that can really influence the movement of the pound/dollar pair. These are, first of all, applications for unemployment benefits in Britain and the United States, and orders for durable goods in the United States. However, at the same time, traders may again ignore these reports. However, they remain extremely important and in any case their values should be noted. In the future, when the crisis is over and the global economy begins to recover, these figures will be important for the exchange rate formation of each pair.

The business activity index for the services sector with a forecast of 32.2–32.5. Thus, in the United States, both indexes might fall even further compared to the month of March. However, the indicator of applications for unemployment benefits is still the most important.

Retail sales for March will be released in the UK on Friday, which is likely to decline in volume by 4.5% in annual terms and 4.2% - on a monthly basis.

In technical terms, the pair started a downward movement, but it cannot develop yet, and the sell signal from Ichimoku remains weak. Therefore, traders need to overcome the Ichimoku cloud in order to count on a more or less strong downward movement.

Recommendations for the pair GBP/USD:

The pound/dollar is now trying to move to a new downward trend. We still believe that some unease remains on the market, since the fundamental background is almost completely ignored. This means that you should focus on the technique. Therefore, as long as the pair is located below the Kijun-sen critical line, short positions with targets of 1.2327 and 1.2246 (will be revised at the opening of trading on Monday) remain relevant.

The material has been provided by InstaForex Company - www.instaforex.com