In recent days, the financial world has lived only because it does not stop looking at how negotiations are going on to reduce oil production. It was probably even better that the weekend in Europe and North America was quite long. After all, they have not worked since Friday, since they celebrated Good Friday. Mexico's stubbornness, which agreed to sign the agreement only on Sunday, naturally led to a sharp drop in oil prices. But in the end, the largest exporting countries were able to compromise, and agreed to reduce production by more than ten million barrels per day. It will begin to operate in May. And the very signing of this agreement will negatively affect the dollar, since the stabilization of the oil market will start the process of gradual stabilization of the commodity markets, and then the stock market. As a result, global financial risks will be reduced, and large investors will begin to gradually transfer capital from the United States to other markets.

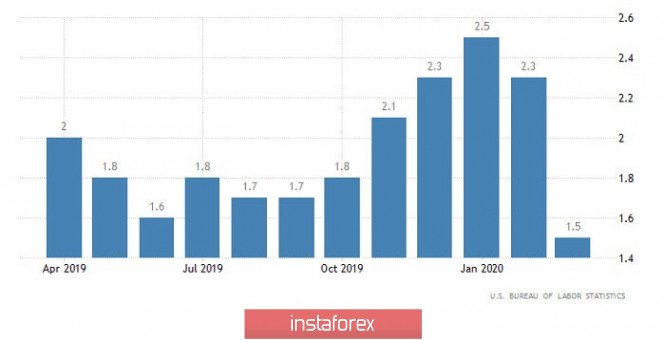

But it is not just the agreement to reduce oil production that will put pressure on the dollar. After all, despite the holiday, US data on inflation was released last Friday, confirming the fact of its decline from 2.3% to 1.5%. In theory, this is not direct high-profile news, because even preliminary data said exactly the same. However, when such a significant slowdown in inflation is actually confirmed, it seriously affects investor sentiment. After all, a sharp decline in inflation is an absolute cause for concern for the Federal Reserve, which may seriously think about the possibility of another refinancing rate cut. Another thing is that today is another non-working day in Europe, so the market reaction will be somewhat restrained. Although both negative factors for the dollar are quite serious.

Inflation (United States):

From the point of view of technical analysis, we see a slowdown expressed in a narrow flat of 1.0920/1.0950, where the quote invariably continues to move. In fact, market participants have remained neutral since last Friday, showing minimal activity.

In terms of a general analysis of the trading chart, the daily period, the development is fixed at about 50%, relative to the previous inertial move.

It can be assumed that the narrow fluctuation within 1.0920/1.0950 will still remain for some time, but the slowdown could play into the hands of speculators, eventually consolidating a local surge in activity. The tactics of trade remain unchanged, in terms of breaking through one or the border of slowdown.

We will specify all of the above into trading signals:

- We consider purchase positions higher than 1.0955, with the prospect of a move to 1.0970-1.1000.

- We consider selling positions lower than 1.0915, with the prospect of a move to 1.0890-1.0850.

From the point of view of a comprehensive indicator analysis, we see that by keeping the quotes at the peak of the correction move, the indicators of technical instruments unanimously signal a purchase.