The market essentially froze in anticipation of at least some news. What is macroeconomic, what about the coronavirus epidemic. At the same time, frankly, macroeconomic data still has a very limited impact. Data is clearly not enough to determine the mood of market participants. At the same time, frankly, reports regarding the coronavirus epidemic are clearly more important at the moment, which is generally not surprising.

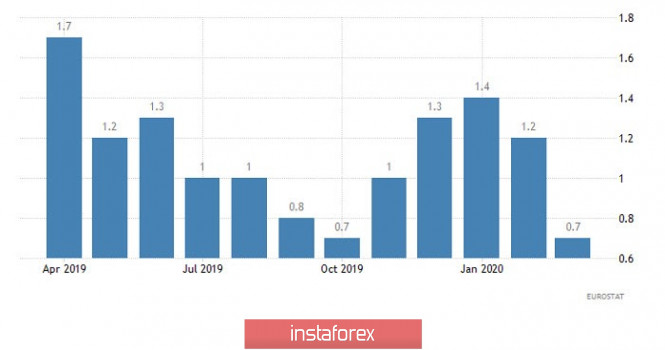

If we talk about macroeconomics, then the European session was accompanied by a weakening euro, under the influence of inflation data. As expected, the final data confirmed a preliminary estimate, which showed a decrease in inflation from 1.2% to 0.7%. A rather noticeable decrease in inflation, in itself, is a rather negative factor. But in the current conditions, this could be another reason for the European Central Bank to think about the possibility of reducing the refinancing rate to negative values. The issue scares investors even more than the fact of a slowdown in inflation.

Inflation (Europe):

But while European traders are more oriented towards macroeconomics, their overseas colleagues pay more attention to news reports on the coronavirus epidemic. The euro grew when the US session opened. Surprisingly, this process coincided with many reports that Europe has already passed the peak of the epidemic, and despite the extension of the restricted quarantine regime, restrictive measures are gradually being mitigated in many countries. For example, starting today non-grocery stores and museums will open in Germany. But, so far appeals and conversations on this topic do not go beyond such in the United States. But the fact is that it is too early to talk about when the peak of the epidemic has passed. And almost certainly, the coronavirus theme will be in focus today. Moreover, the macroeconomic calendar is completely empty. And given the fact that in general, relatively positive dynamics are observed in Europe and the United States, and the number of new cases of coronavirus infection also seems to be declining, the situation looks uniform. In other words, we are unlikely to see serious fluctuations.

But while European traders are more oriented towards macroeconomics, their overseas colleagues pay more attention to news reports on the coronavirus epidemic. The euro grew when the US session opened. Surprisingly, this process coincided with many reports that Europe has already passed the peak of the epidemic, and despite the extension of the restricted quarantine regime, restrictive measures are gradually being mitigated in many countries. For example, starting today non-grocery stores and museums will open in Germany. But, so far appeals and conversations on this topic do not go beyond such in the United States. But the fact is that it is too early to talk about when the peak of the epidemic has passed. And almost certainly, the coronavirus theme will be in focus today. Moreover, the macroeconomic calendar is completely empty. And given the fact that in general, relatively positive dynamics are observed in Europe and the United States, and the number of new cases of coronavirus infection also seems to be declining, the situation looks uniform. In other words, we are unlikely to see serious fluctuations.

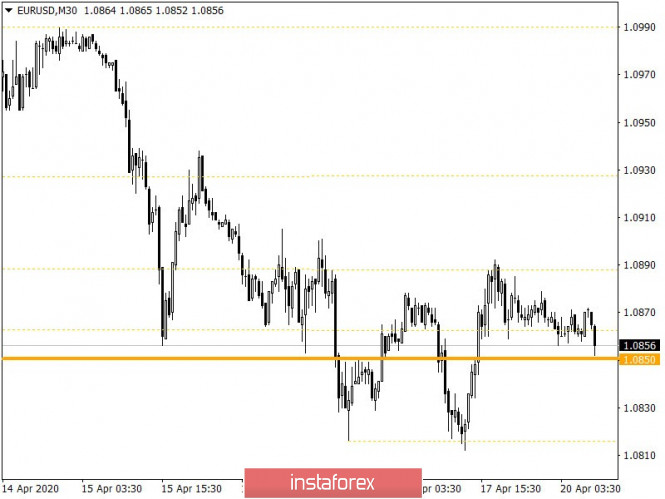

From the point of view of technical analysis, we see a gradual downward movement, during which the quote locally went down to the area of 1.0810, but after which there was a rebound. In fact, the consistent amplitude singled out the variable boundaries of 1.0810/1.0890, within which the quote evolves.

In terms of a general review of the trading chart, the daily period, 80% working out the trading path on 04/07/20-04/14/20 is recorded, which confirms the theory of downward interest.

We can assume a local movement in the direction of 1.0815, where you should carefully analyze the behavior of the quote, since the risk of maintaining an amplitude of 1.0810/1.0890 is on the market. It is worth considering that if we do not have trading positions, then it is possible to think about them below the 1.0845 mark.

From the point of view of a comprehensive indicator analysis, we see a predominant downward interest in all time sections.