4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: 173.2524

The EUR/USD currency pair could not continue its downward movement after it settled below the moving average. Yesterday, the pair returned to the area above this line and resumed its upward movement in accordance with the scenario we announced earlier. Thus, the price continues to move to the level of 1.1000, which is located just above the Murray level of "2/8". After working out this level, further upward movement will depend on the Heiken Ashi indicator, then a downward turn will indicate the beginning of a correction. Both channels of linear regression are directed downward, but we are not yet considering the option of resuming the downward trend. Volatility continues to decline, which can not but please traders who want to trade consciously and in accordance with the fundamental background.

It just so happens that in recent days, the fundamental background is simply bursting at the seams from the volume of various information. Among the key topics of recent days: the Eurogroup talks on the adoption of a package of assistance to the European economy for 540 billion euros, the publication of the minutes of the last two Fed meetings, the next report on applications for unemployment benefits in the United States, the OPEC meeting, and the Fed's new actions to stimulate the American economy. We cannot say that all of the above topics are affecting the EUR/USD pair currently. From our point of view, traders reacted yesterday only to the report on applications for benefits, which showed an additional 6.6 million requests. And it is already good that market participants have begun to react at least a little to what is happening in the world, and not just buy a particular currency for their goals and their trading strategies. Now the process of predicting future movements of the pair is a little easier.

However, let's go back to the list of topics listed above. Let's start with the fact that the minutes of the last two meetings of the Fed did not cause any reaction from traders and did not contain fundamentally new and unexpected information. The final communique said that the Federal Reserve is ready to keep the key rate at a low level for as long as necessary and will not start raising it until the beginning of the US economic recovery. Thus, it is already easy to assume that in the next year there will be no talk of tightening monetary policy in the United States. The Fed also announced an unlimited quantitative stimulus program, as well as a number of other programs to support the American economy. In other words, the Fed will pump money into the economy by all means, so that it does not collapse. In a crisis and a global epidemic, this is absolutely logical, and the ECB and other Central banks are now doing the same. The meeting of the Eurogroup, which is just designed to approve the package of assistance to the European economy, has not yet ended, so there is no new information on this topic. However, most experts agree that the 540-billion package will be approved by 19 Eurozone Finance Ministers. We are talking about saving Italy and Spain in the first place, which was most affected by the "coronavirus" epidemic.

Meanwhile, Bloomberg experts estimate that the consequences of the current crisis will be overcome at least by the end of 2021. And then we are talking primarily about developed countries, such as the United States or Germany. Developing countries will recover their economies for at least 5 years. The total loss of the world economy will amount to about 5 trillion dollars, which is equivalent to 8% of world GDP. Analysts at Citigroup and JPMorgan agree with these forecasts and also "promise" a reduction in global GDP of at least $ 5 trillion. Bloomberg also notes that despite absolutely gigantic monetary and fiscal incentives, the economy will not recover earlier than in two years.

At the same time, many analysts and traders are closely watching another event of the day, which takes place just at these hours. We are talking about the OPEC meeting, which is designed to solve the problems of low oil prices. Quotes of "black gold" in the run-up to the meeting are growing, which may be a good sign. After all, low oil prices do not benefit any member of OPEC, that is, the number one energy-producing countries in the world. Thus, there is only one way out of this situation: to make concessions and reduce oil production. Only in this case, the commodity market will stabilize, and many countries that export oil will not get an additional blow to the economy in an already difficult time, when the "coronavirus" epidemic is raging all over the world. We are talking, for example, about the same United States, the same Great Britain, and Russia. The key issues of a possible agreement relate to Saudi Arabia, which wants the Russian Federation to increase oil cuts; to Russia, which does not want to go to the conditions of the Saudis; and to the States, whose shale companies suffer huge losses, but it seems they are not going to reduce oil production. This topic has a very indirect relation to the currency market, however, it should not be overlooked, since all world markets are closely linked to each other.

Meanwhile, Donald Trump "saddled his favorite horse" and again made a statement that "coronavirus" will be able to win soon. According to Trump, "the United States is ahead of schedule in slowing the spread of infection." "I don't like to talk about it too loudly, because suddenly nothing happens. But I think that this will take place in the near future," the odious US leader said. Well, members of the US National Academy of Sciences made a statement that completely refutes Trump's words that "the virus will not survive the warm season". According to scientists, only a small number of people on the planet are immune to the COVID-2019 virus. Thus, the weather will not significantly affect the decrease in the growth rate of the pandemic. This information was sent to the White House by the Academy of Sciences. Scientists also provide examples of warm countries where the virus is also spreading very quickly – Iran and Australia.

Lastly, I would like to mention the speech of Christine Lagarde, the ECB President, who said that European governments need to support each other in difficult times. "Fiscal and monetary policy must be coordinated, and conditions must be equal for all countries in dealing with the emergency," Lagarde said. Lagarde also rejected the possibility of widespread cancellation of debt obligations, but at the same time admitted that the crisis should be overcome first with minimal losses and only then think "how to pay off debts".

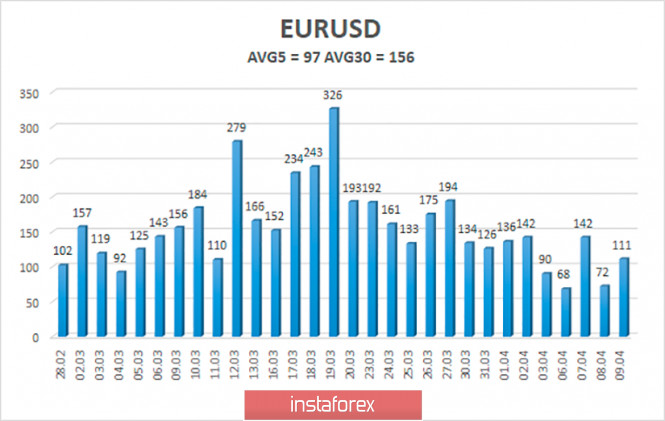

The volatility of the euro/dollar currency pair remains quite high but continues to decline. As of April 10, the average volatility is less than 100 points - 97. We believe that the markets continue to return to normal, however, there may be new outbursts of panic. Today, we expect a further decrease in volatility and price movement between the levels of 1.0843 and 1.1037. The pair is aiming for the 1.10 level, and the reversal of the Heiken Ashi indicator downwards will indicate the possible completion of the upward movement.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1108

R3 - 1.1230

Trading recommendations:

The EUR/USD pair continues its upward movement. Thus, traders are now recommended to consider purchases with the goals of the Murray level of "2/8"-1.0986 and 1.1037. It is recommended to sell the euro/dollar pair not before fixing the price below the moving average line and the Murray level of "1/8"-1.864 with the first goal of 1.0742.

The material has been provided by InstaForex Company - www.instaforex.com