4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -25.9038

The euro/dollar currency pair starts the fourth trading day of the week near the moving average line. During yesterday's trading, the pair fell sharply to the Murray level of "1/8"-1.0864 but immediately rebounded from it. Thus, at the moment, it is unclear whether the downward movement will continue or the euro/dollar pair will try to resume its upward movement. One way or another, we note an increase in volatility in the currency market, which affects almost all currency pairs.

While the US dollar is again becoming more expensive, oil is again becoming cheaper, and traders are again beginning to show signs of panic. Donald Trump is stopping funding the WHO. We have already written about this in the final article for April 15. A little later, it also became known that the payments promised by the US government in connection with the crisis caused by the COVID-2019 epidemic are being delayed because of what Donald Trump wants... to have his personal seal on every check. Thus, all payments will be delayed for several days, and US Treasury Secretary Steven Mnuchin is personally instructed to make sure that each check has the inscription "President Donald Trump".

At the same time, it is not just the United States that are thinking about easing quarantine measures. In the European Union, where the first signs of passing the "peak" of the epidemic are noted, a "road map" for lifting the quarantine has been drawn up. This was stated by the President of the European Commission Ursula von der Leyen on April 15. "Our recommendations are based on three main factors: slowing the spread of the coronavirus, sufficient health system capacity, and surveillance and monitoring capabilities," von der Leyen said. The head of the European Commission noted that so far we are not talking about the complete lifting of the quarantine, these are just plans. The European Commission recommends removing the quarantine measures gradually and carefully analyzing each relaxation. According to the European Commission's plan, the first factor is a significant reduction in the number of new coronavirus infections and a reduction in the number of deaths over a long period of time. The second criterion is the capabilities of the healthcare system. Will it be able to cope with the influx of patients if the number of patients increases as a result of the removal of some of the quarantine measures? The third factor is monitoring what is happening. Each step of removing the quarantine should be carefully analyzed. This requires mass testing for the COVID-2019 virus in order to make accurate and real conclusions about the results of lifting the quarantine. It is also reported that each EU member state can decide for itself what actions related to quarantine it should take, and how to meet each criterion. However, all EU members must adhere to the scientific principle in countering COVID-2019, and EU member states must clearly coordinate their actions with other members of the Alliance. EU member states should show solidarity and respect for other countries that have been most affected by the epidemic.

It is also reported that first of all, the removal of quarantine measures will concern educational institutions, then shopping centers will open, and only last of all – places of public catering. At the very end, the internal and external borders of the European Union will be opened. "Travel restrictions will first be lifted between areas with a relatively low level of virus spread," the European Commission said. Also, the head of the European Commission, Ursula von der Leyen, said that the "coronavirus" epidemic has already cost the EU three trillion euros.

On Thursday, April 16, certain macroeconomic statistics will be available again to market participants. However, yesterday, we already witnessed how macroeconomic data is being processed. No way. Thus, the probability that today traders rush to analyze reports and build their trading strategies based on them is low. However, there is one report that clearly deserves attention and cannot be ignored. But first things first. Early this morning, German inflation will be published. Core inflation is forecast to fall from 1.7% y/y to 1.3% y/y, while core inflation is forecast to fall from 1.7% to 1.4% y/y. This report is the least interesting. Next, the change in industrial production in the European Union for February will be published. That is, for the month when the pandemic was not yet raging in the EU. Even so, it is expected to decrease by 2.0-2.2% in annual terms. This report is also unlikely to cause any market reaction.

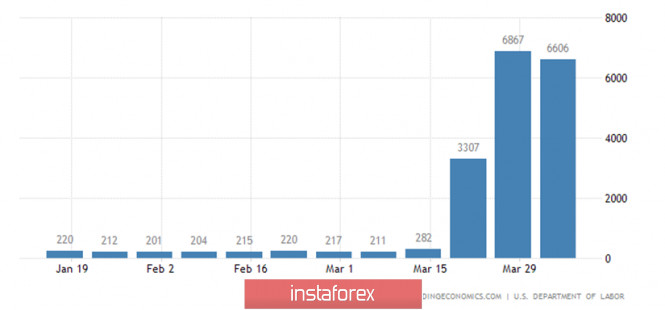

After that, the next report will be released on the number of applications for unemployment benefits in the United States. Recall that the last three reports showed a total of 16.7 million applications for benefits. The forecast for the week of April 4-10 indicates a new 5.1 million requests. Thus, the total number of Americans who lost their jobs in one month could be 21.8 million. From our point of view, this is a huge figure that cannot fail to affect the American economy. However, now we are more interested in whether there will be any market reaction to the new unemployment report? Almost any value of the report should cause the US currency to fall. You need to be prepared for this option. However, no one knows what the market will do in reality. We remind you that the market is not just small traders who carefully track macroeconomic statistics. They are also major players who often drive the market. And if the situation is as it is now (panic, market collapse, epidemic, quarantine, and crisis), then large traders carry out currency operations based on their own strategies, without paying attention to statistics. This is approximately what we have seen in the last month and a half.

From a technical point of view, the trend has now changed to a downward one, and the pair has worked out the Murray level of "1/8"-1.0864. Thus, the downward movement may continue within the new downward trend. This conclusion can be made if the pair's quotes go below the level of 1.0780 – the previous local minimum. Otherwise, it is likely to move inside the side channel for some time. It should also be noted that there is a possibility that market participants are again starting to look at the dollar as the most secure currency. Therefore, the US currency can become more expensive without any reason. In all this situation, we recommend paying close attention to technical indicators, especially "fast" ones, such as Heiken Ashi.

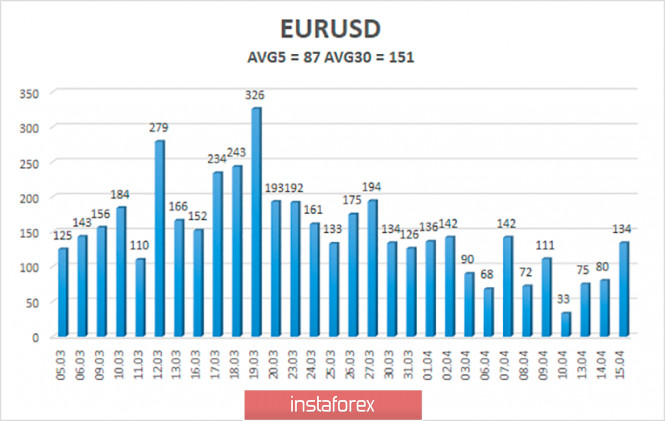

The volatility of the euro/dollar currency pair as a whole continues to decline, but at the end of the past day, it rose to 87 average points. Thus, we are afraid that now a new wave of panic and strong volatility will not begin, in which it is extremely difficult and dangerous to trade. On April 15, we expect the pair's quotes to move between the levels of 1.0833 and 1.1007. A reversal of the Heiken Ashi indicator to the top may indicate the resumption of the upward trend and help to overcome the moving average.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1108

R3 - 1.1230

Trading recommendations:

The euro/dollar pair started moving down, but at the moment, it is trading near the moving average, so it is unclear whether it has been overcome. Thus, first of all, traders are advised to wait for some time until the price "detaches" from the moving average line. If it "flips off" upwards, it is recommended to trade for an increase with the goals of the Murray level of "2/8"-1.0986 and the volatility level of 1.1007. It is recommended to sell the euro/dollar pair if the price "flips off" down, with targets at 1.0864 and 1.0833.

The material has been provided by InstaForex Company - www.instaforex.com