Yesterday, the publication of the construction report in the United States was cancelled. It became the most notable event of the day. Honestly, the situation is rather unusual. Recently, similar events have happened several times. However, that was less important data from the UK. Usually, it concerns some kind of data on housing prices and only in the United Kingdom. This time, the cancellation of the US construction data changed everything. The events did not develop as expected. Thus, throughout the day, the British pound was weakening.

The pound had every reason to fall. Inflation plunged to 0.8% from 1.5%. Market participants were certainly prepared for such a development of events. Thus, the reaction was relatively restrained. The worst thing is the monthly data, which showed that in April, consumer prices dropped by 0.2%. This is definitely a sign of the beginning of deflation. If this tendency does not change, we will see a negative dynamic in the near future and in annual terms. And that will be deflation.

Inflation in the United Kingdom:

Today, the pound may receive a reason for growth. This reason is the preliminary data on business activity indices. The fact is that the services PMI is expected to rise to 21.0 from 13.4. The manufacturing business activity is likely to increase to 34.0 from 32.6. As a result of all this, the composite index is anticipated to grow to 22.0 from 13.8. However, the situation may develop in a completely different way. After all, until recently, it was predicted that indices will continue to decline. Just a couple of days ago, forecasts indicated a decrease in the services business activity index, lower than 10.0. The same is true for the composite PMI. Such forecasts are not unfounded, since easing of quarantine restrictions is somewhat delayed and the opening of all kinds of shops and restaurants, in fact, is postponed to June. Thus, it is highly likely that we will see just a decrease in the indices. However, if the basic forecasts are confirmed, the pound may strengthen insignificantly, at least until the US indices are released.

The UK's composite business activity index:

Elsewhere, the process of lifting the quarantine measures in the United States is gradually moving forward. More and more states are deciding to ease lockdown. Thus, it is not surprising that business activity indices are expected to grow. The manufacturing PMI is likely to rise to 39.0 from 36.1. The services business activity is projected to increase to 32.0 from 26.7. As a result, the composite business activity index is expected to grow to 32.5 from 27.0. Given the high importance of American statistics, such results will contribute to further strengthening of the dollar.

Composite business activity index in the United States:

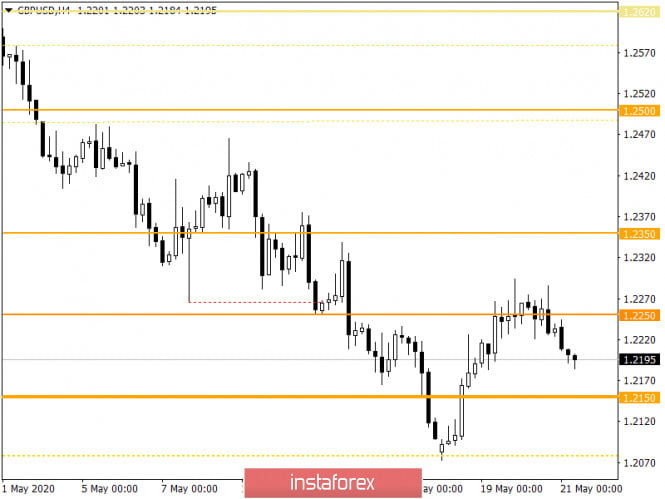

In terms of technical analysis, we see a significant inertial move that led the quote to the area of interaction of the trading forces 1.2240 / 1.2280, where the quote slowed down and moved on to the recovery phase. It should be taken into account that the inertial move did not violate the integrity of the clock cycle set in the first days of May, thereby maintaining downward sentiment in the market.

Analyzing the trading chart in general terms, the daily period, it is worth noting the consistent recovery process, where the flat formation 1.2150 // 1.2350 // 1.2620 no longer plays a key role in the market.

It can be assumed that the recovery process will gradually return the quote to the point of variable support on May 18. However, before this, a temporary freezing of prices within the 1.2150 / 1.2180 region may occur.

Specifying all of the above into trading signals:

- It is better to consider opening short positions below the level of 1.2180, with the prospect of a move to 1.2150. The second stage proceeds from taking profit below 1.2140, with a move to 1.2100-1.2080.

- It is preferable to open long positions in terms of local pullbacks in the recovery process above 1.2205, towards 1.2240.

From the point of view of a comprehensive indicator analysis, you can see that the technical tools have returned to the original sell signal, due to the recovery process.