After the optimistic mood of investors in April, which was based on the expectation of a gradual opening of economic activity in Europe and the USA, as well as on the expectations of advancement in the invention of a medicine for COVID-19, May began with a rather slow activity, except for the dynamics in the crude oil market.

Investors actively bought shares of companies in April after a landslide of markets in March, which was explained by expectations that the markets were supposed to have a "V" shaped recovery of the world economy after a gradual weakening of quarantine measures. But by May, these moods were slightly corrected. It became clear that this will most likely not happen, that the global economy is likely to face a "U" shaped recovery. And the reason for this may not be the influence of coronavirus on economic activity, but the beginning of a new company in the United States and its allies with the search for the culprit in this pandemic, the role of which, as expected, was assigned by China.

Threats of new trade duties in the heated trade war initiated by Washington frighten investors, forcing them to recall the events of 2018 and 2019, which led to high volatility in the markets and a drop in risk appetite. We believe that the risk of a new trade escalation in the" ruins " of Europe and the United States after the coronavirus pandemic will cause more significant damage to the economies of both the States themselves and their satellites in Europe. The Desire Of D. Trump to finish off in the economic sense of its main competitor in the face of China can lead to extremely weak rates of recovery of economic activity in the United States and Europe. It may turn out that Washington, wanting to deal with Beijing, saws the branch on which it sits.

This is a very dangerous situation, which could lead to the strengthening of centrifugal forces in Europe, followed by the collapse of the euro area, and America itself may face local manifestations of separatism. This is like a certain kind of Maxim of the likely development of events. If we talk about the smallest possible trends, then the resumption of the US-China trade war in the face of extreme US insecurity from the consequences of COVID-19 may cause Trump to lose in the presidential election.

As for the likely development of events in the near future, given the unexpectedly inappropriate activity of trump, this will cause high volatility in the stock markets, probably the beginning of consolidation in commodity currencies and the weakening of the single currency. The expected decline in the dollar has stalled until there are more compelling reasons to resume risk appetite in the markets.

The quotes of crude oil, as well as industrial goods, after reaching local maximums, will most likely begin to consolidate in anticipation of a response from China to Western claims.

Among the important events today, we single out the publication of data on China's export, import and trade balance, which turned out to be positive overall, except the annual value of imports, which declined by 14.2% against a decrease of 1.0% a year earlier. Today, the market will also focus on the number of initial claims for unemployment benefits in America. An increase of 3 million is expected against 3 million 839 thousand a week earlier.

Given the high importance of the values from the labor market, it can be assumed that if they are slightly below the forecast, this will become some basis for a positive reaction in the markets.

Forecast of the day:

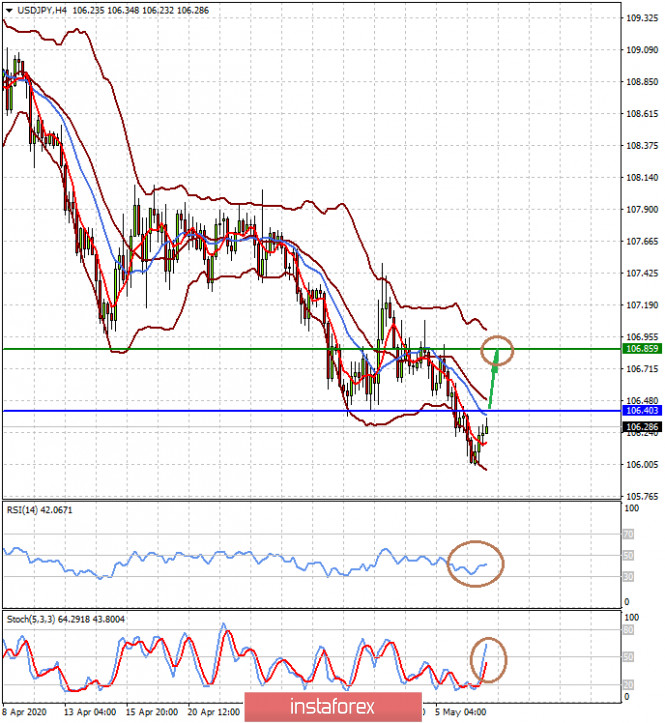

The USD/JPY pair is in a downward trend, but the good data on the Chinese economy released today, as well as a possible decline in the number of applications for unemployment benefits in the United States, can stimulate risk appetite in the markets. This can lead to a rebound of the pair up to 106.85 or even higher to 107.00, but only after breaking through the level of 106.40.