The risk appetite continues to increase on Wednesday morning, partly due to the lifting of restrictive measures around the world, partly due to increased expectations about the successful testing of coronavirus vaccines, of which at least a dozen are being tested. Expecting a sharp increase in activity, the head of the Federal Reserve Bank of St. Louis Bullard noted that "the third quarter is likely to be the best quarter of all time in terms of growth." Indeed, it is difficult to disagree, especially after the Atlanta Federal Reserve Bank predicts a 40% drop in GDP in the 2nd quarter and a 32% decline in the New York Federal Reserve.

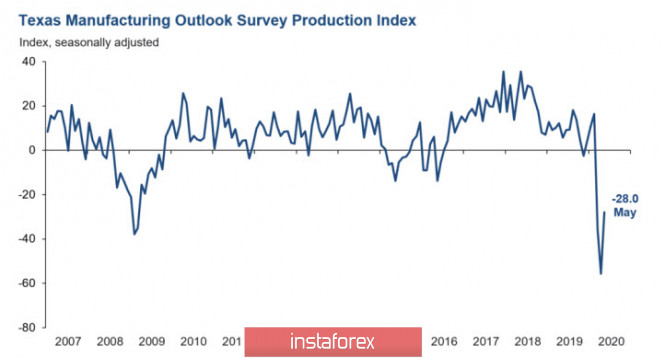

Meanwhile, the Chicago index of activity from the Federal Reserve Bank fell in April from -4.97p to -16.74p, while the Dallas industrial index in May rose from the failed -74p. to -49.2p., in the same proportions, output is growing.

As can be clearly seen, more than a third of the April decline was won back, and all this within one month. Hopes for a strong pullback will continue to increase demand for risk, even though the situation looks bleak in absolute terms, and the US economy is not moving away from a deep recession, but continues to fall.

The corrective weakening of the dollar is unlikely to be deep, and today, it will most likely begin to recover against commodity currencies, since there is no reason for a steady increase in demand for risk.

EUR/USD

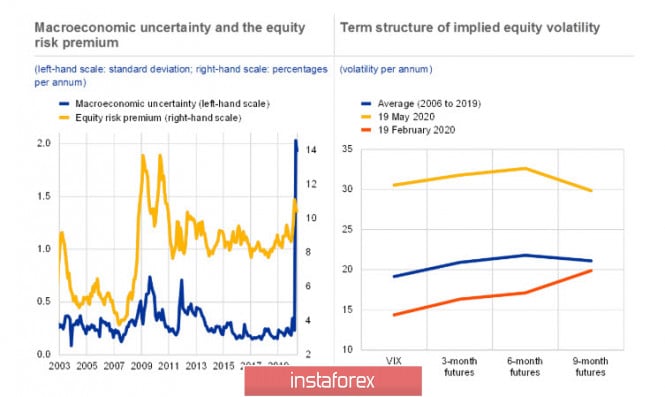

The ECB issued a report on the financial stability of the eurozone, taking into account the assessment of the consequences of the COVID-19 pandemic. As noted, the risks significantly increased in several areas at once. Banks' profitability will decline in 2020. An active decrease in the credit ratings of borrowers, a sharp increase in sovereign debt, and budget deficits in 2020 are expected.

Noting that the ECB's urgent measures to block the negative consequences of the pandemic avoided a collapse, the bank directly says that it will take a long period of support for financial institutions until the economic recovery becomes sustainable.

As a result, risk premiums have risen markedly due to high uncertainty. As long as there is a slight positivity in the markets, high premiums will contribute to the growth of demand for risky assets. However, if the growth of GDP and corporate profits go according to a pessimistic scenario, a sharp decline in asset prices can take place.

The report shows a clear desire of the ECB to contain the growth of assets, since the Euro zone economy is not able to reach a sustainable recovery, and excessive demand for assets increases the risk of another wave of decline.

The ECB's position will restrain the growth of the euro. As long as the EUR/USD is below the upper limit of the range 1.1000/20, it must be kept in mind that the Fed does not need a strong dollar at all, in addition to the June 12 meeting, it is likely that another stimulus package will be prepared, which will push EUR/USD up. In the short-term, the probability of breaking through the range is higher; EUR/USD is likely to grow with the target of 1.1140.

GBP/USD

The British pound rose sharply on Tuesday amid rumors of a likely softening of the EU's position in the Brexit negotiations, but the growth ended as quickly as it began, as no specifics other than a possible concession on fishing issues appeared. This concession is too small to expect a successful conclusion of the negotiations, and therefore the driver for the growth of the GBP has not been formed.

Even the performance of the Bank of England chief economist Andy Haldane, who said that the regulator did not consider the possibility of introducing negative rates, did not help. In the conditions of economic recovery, the probability of this step seemed low.

A break of resistance level of 1.2296 improved the technical picture for the pound, the probability of testing 1.2426 and 1.2467 increased slightly, but no more. There are still few fundamental reasons for growth, and in case of a pullback below 1.2290, the bearish mood will increase again.

The material has been provided by InstaForex Company - www.instaforex.com