Markets continue to ignore weak fundamental data and forecasts published by central bankers. Gold, amid all that is happening, is nearing October 1, 2012's high, at the level of 1800.

Traders ignored the Fed statements over the weekend, but it's clear that the demand for risky assets is unlikely to increase in the near future, especially considering the weak reports that were published on Friday regarding the state of the US economy. Meanwhile, the British pound is to continue its decrease against the US dollar, after another failed negotiations on trade relations between the UK and the EU.

Yesterday, Fed Chairman Jerome Powell made a number of forecasts saying that in the second quarter of 2020, the US economy will shrink by 20%, and total unemployment will reach above 25%. According to him, at present, the authorities need to coordinate their actions and continue to support both the business and the households that are most exposed to the coronavirus, so financial support should be provided over the next 3-6 months, until the effects of the economic downturn cease to have such a strong impact on the economy and population of the country. Powell did not rule out the possibility that the US economy may face a crisis comparable in scale to the Great Depression.

With regards to the COVID-19, the United States is still pushing to conduct an investigation on the virus, threatening sanctions against China if it refuses to cooperate. This weekend, US Secretary of State Mike Pompeo revealed that there are no movements in the investigation, as China continues to refuse providing the necessary information for an objective assessment. Pompeo also said that all proposals to help China determine where the virus came from were rejected.

The data published on Friday regarding US retail sales disappointed traders, because of the record drop observed in the April index. According to the report, the data turned out to be much worse than economists' forecasts, as many households were forced to abandon shopping because of the proliferation of COVID-19, as well as the decrease on goods available for purchase. Thus, US retail sales in April dropped immediately by 16.4%, much lower than economists' forecast of no more than 11%. In March, sales were already down by 8.3%.

Industrial production in the US also showed a similar record drop in April of this year, due to the suspension of plant operations and interruptions in the supply chain. According to the US Federal Reserve, the index fell immediately by 11.2% in April, slightly lower than economists forecast of 11.1%. The manufacturing industry suffered the most, with a 13.7% decline recorded in production.

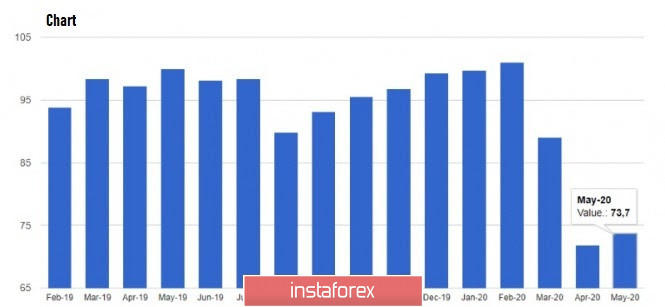

The only good news on Friday was the report on consumer sentiment in the US, which slightly improved in early May, due to the expectations of government assistance. The report published by the University of Michigan revealed that the preliminary consumer sentiment index rose to 73.7 points in mid-May, up from economists forecast of 65.0 points. However, experts continue to note that many consumers do not expect a quick economic recovery, and are increasingly worried about problems related to employment and income.

Meanwhile, production activity in the area of New York Fed declined in May this year. According to the report, the manufacturing index turned out to be -48.5 points in May, much lower than economists forecast of -60.0 points. A slight increase in production activity in the first half of the month had a positive effect on the indicator, but more than 63% of respondents reported deteriorating business conditions.

As for the technical picture of the EUR/USD pair, the situation has not changed much. Trading continues to be conducted in the side channel, and buyers of risky assets need to make maximum efforts to break through the upper border at 1.0850, which will lead to an increase of the euro to the area of the 1.0900 and 1.0980 highs. Meanwhile, in case of a breakdown of the lower boundary of the side channel in the area of 1.0775, demand on the euro will decrease, which will bring the pair to the lows of 1.0700 and 1.0630.

GBP/USD

The pound resumed its decline against the dollar, after the lower border of the correction channel was broken through, the main reason of which is the failed trade negotiations between the UK and the European Union last Friday. Given the current state of the UK economy, the additional problems associated with trade relations after Brexit only exacerbated the situation. Recall that the transition period after Brexit ends at the end of this year, and as stated in the EU, should be extended to continue consultations. However, at the end of last year, British Prime Minister Boris Johnson announced that he does not plan to make such a request to his European partners, and so far had not changed his opinion regarding it.

The most problematic issues related to the settlement of trade relations between the UK and the EU are the conditions for duty-free trade. The EU has put forward a number of requirements for compliance with common standards in the areas of environmental protection, regulation of labor relations and social support, but the UK does not want to comply with these requirements. The next EU summit will be held in June this year, and the trade negotiations will resume on June 1.

As for the technical picture of the GBP/USD pair, there is a clear bearish mood in the pound, so opening buy positions will not be profitable. Thus, it is best to wait for the major lows to be updated in the areas of 1.2000 and 1.1930, and look for attempts to form the bottom in these ranges. Sellers attempt to break down the support level of 1.2075, the success of which will lead to further sell-offs of the pound. Meanwhile, in case of an upward correction, the increase will be limited by the resistance levels 1.2180 and 1.2250.

The material has been provided by InstaForex Company - www.instaforex.com