Forecast for May 8:

Analytical review in H1 scale:

For Gold, the main key levels on the H1 scale are: 1753.89, 1740.22, 1731.37, 1718.34, 1707.86, 1701.25 and 1691.00. Here, we continue to monitor the ascending structure of May 1. The continuation of the upward movement is expected after the breakdown of the level of 1718.34. In this case, the target is 1731.37. A short-term upward movement, as well as consolidation is in the range of 1731.37 - 1740.22. For the potential value for the top, we consider the level of 1753.89. Upon reaching which, we expect a downward pullback.

Short-term downward movement is possible in the range of 1707.86 - 1701.25. The breakdown of the last level will lead to an in-depth correction. In this case, the target is 1691.00.

The main trend is the upward structure of May 1

Trading recommendations:

Buy: 1719.00 Take profit: 1730.00

Buy: 1732.00 Take profit: 1740.00

Sell: 1707.00 Take profit: 1702.00

Sell: 1700.00 Take profit: 1693.00

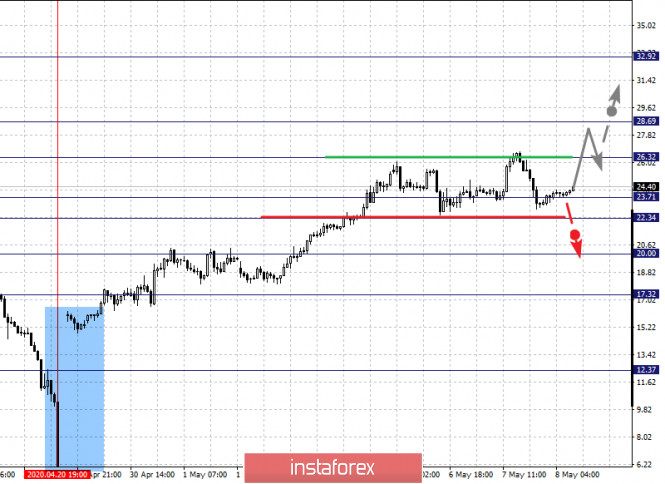

For Oil, the main key levels on the H1 scale are: 32.92, 28.69, 26.32, 23.71, 22.34, 20.00 and 17.32. Here, we are following the development of the ascending structure of April 20. The continuation of the upward movement is expected after the breakdown of the level of 26.32. In this case, the goal is 28.69. Price consolidation is near this level. As a potential value for the ascending structure, we consider the level of 32.92. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 23.71 - 22.34. The breakdown of the last level will lead to an in-depth correction. Here, the target is 20.00. This level is a key support for the top. The price passing this level will lead to the formation of initial conditions for the downward cycle. In this case, the potential goal is 17.32.

The main trend is the upward structure of April 20

Trading recommendations:

Buy: 26.32 Take profit: 28.60

Buy: 28.80 Take profit: 31.85

Sell: 23.71 Take profit: 22.40

Sell: 22.28 Take profit: 20.50

For Silver, the main key levels on the H1 scale are: 16.11, 15.91, 15.64, 15.44, 15.31, 15.20 and 15.01. Here, the price registered the expressed potential for the upward cycle of May 5. The continuation of the upward movement is expected after the breakdown of the level of 15.44. In this case, the target of 15.64. Price consolidation is near this level. The breakdown of the level of 15.64 will lead to a pronounced movement. In this case, the target is 15.91. For the potential value for the top, we consider level 16.11. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is possible in the range of 15.31 - 15.20. The breakdown of the last level will lead to an in-depth correction. Here, the goal is 15.01. This level is a key support for the upward trend.

The main trend is the upward structure of May 5

Trading recommendations:

Buy: 15.45 Take profit: 15.62

Buy: 15.65 Take profit: 15.90

Sell: 15.31 Take profit: 15.21

Sell: 15.19 Take profit: 15.03

For Natural Gas, the main key levels on the H1 scale are: 2.363, 2.302, 2.192, 2.068, 2.008, 1.882, 1.815, 1.724 and 1.663. Here, we are following the development of the upward structure from April 27. At the moment, the price is in correction from this structure and has formed a pronounced potential for a downward movement. Short-term downward movement is expected in the range of 1.882 - 1.815. The breakdown of the last level should be accompanied by a pronounced downward movement to the level of 1.724. For the potential value for the bottom, we consider the level of 1.663.

A short-term upward movement is possible in the range of 2.008 - 2.068. The breakdown of the last level will have the subsequent development of an upward trend. In this case, the first potential target is 2.192.

The main trend is the rising structure of April 27, the stage of deep correction.

Trading recommendations:

Buy: 2.008 Take profit: 2.064

Buy: 2.075 Take profit: 2.190

Sell: 1.880 Take profit: 1.820

Sell: 1.805 Take profit: 1.740

The material has been provided by InstaForex Company - www.instaforex.com