EUR/USD 1H

The EUR/USD pair resumed the upward movement and worked out the April 19 high at 1.0990 on the hourly timeframe over the past day, as well as the resistance level of the 4-hour timeframe at 1.1008. The pair rebounded from these two levels, once again showing that the bulls did not have enough strength to form a new upward trend, and began a downward correction, which, according to the logic of things, should go into a downward movement inside the side channel of 1.0750-1.0990 that we have been relentlessly talking about in recent weeks. In any case, before traders overcome 1,1008, the downward movement and selling the pair are more relevant and probable.

EUR/USD 15M

We see a weakening upward trend on the 15-minute timeframe. The lowest linear regression channel has already turned down, and the higher is unfolding. This suggests that the fuse of the bulls has dried up and they need new reasons for buying the European currency and continuing the upward trend in the short-term plan. So far, everything suggests that the US dollar will continue to rise in price on the last trading day of the week.

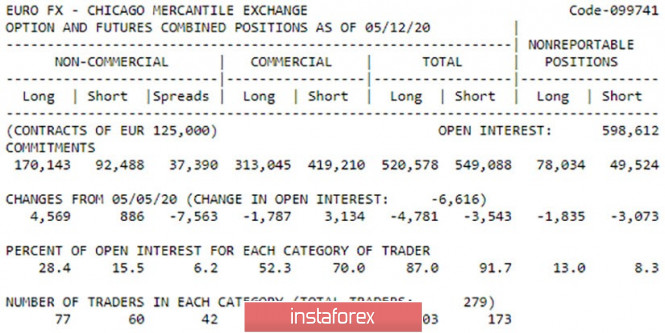

COT Report

The latest COT report dated May 12 showed a new decrease in the number of buy and sell transactions among large traders, by 4,781 and by 3,554. Thus, the general mood of large traders remains bullish (the total number of purchase transactions is higher, 549,000- 521,000), in addition to this, traders managed to stay above the trend line on the 4-hour timeframe. Also, purchase positions increased among entities engaged in professional activities in the foreign exchange market (+4569 purchase transactions). A new COT report will be released today, and its numbers will show how the mood of large traders has changed over the past week. The previous report, we believe, is more than fulfilled.

The fundamental background for the pair at this time remains neutral. This is why there has been a movement in the side channel in recent weeks (unlike, for example, the GBP/USD pair). The top officials of the United States and the European Union regularly appear in public, but their rhetoric, statements and decisions taken do not surprise market participants and, as a result, are not practiced. The coronavirus theme generally receded into the background. Many countries around the world have begun and continue to withdraw quarantine measures while doctors continue to warn of possible new waves of the disease. With a macroeconomic background, it is still easier. Traders have simply ignored it in recent months. In addition, no important macroeconomic publications are planned either in the US or the EU on Friday, May 22. Thus, we believe that nothing should prevent the pair from moving in accordance with the technical picture, that is, down.

Based on the foregoing, we have two trading ideas for May 22:

1) It is possible for the pair's quotes to grow if we overcome the resistance range of 1.0990-1.1008, consisting of two corresponding levels. This will mean that the pair has left the side channel and is ready to form an upward trend with the first target, the March 27 high at 1.1147. Potential to take profit in this case will be about 140 points.

2) The second option - bearish - is more likely. You are advised to sell the euro from the resistance area of 1.0990-1.1008, not forgetting about stop loss in case the bulls still continue to push the pair up. There were already two rebounds from the designated area, so we recommend selling the Kijun-sen line (1.0904), Senkou Span B line (1.0831) and the upward trend line (1.0810) for the pair with targets. Potential to take profit in executing this scenario will be from 40 to 140 points.

The material has been provided by InstaForex Company - www.instaforex.com