EUR/USD 1H

The EUR/USD pair continued the downward movement that started after a rebound from the levels of 1,1008 and 1,0990 during the last trading day of the past week on the hourly timeframe. Recall that these levels are resistances, which are also located near the upper border of the side channel 1.0750-1.1000, in which the pair has been trading in recent weeks. Thus, since traders did not succeed in reaching the upper limit, now everything speaks in favor of the downward movement. At the moment, quotes have reached the support area of 1.0881-1.0892, from which the pair has previously rebounded repeatedly. Therefore, there may be some delay near this area before the pair continues to move down. An upward trend line is still in action, supports trading on the increase, and this is the ultimate goal for the current movement.

EUR/USD 15M

We see that the upward trend is complete on the 15-minute timeframe, both linear regression channels are directed down, and the price is below the moving average line. Thus, we clearly have a downward trend in the short term.

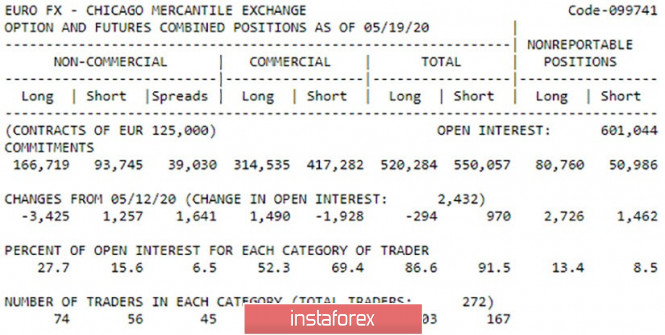

COT report.

The latest COT report of May 19 showed that big traders who engage in professional activities with the aim of earning exchange rate earnings continued to reduce purchases of euro currency and increase sales in the reporting week. The growth of the latter was small, only 1257 contracts, but in aggregate with -3425 contracts for selling, we have a serious deterioration in the mood of traders regarding the euro. The total number of purchase contracts also decreased by 294 units, and the number of Short-deals increased by 970 units. Thus, we see that the mood of traders remains bearish and only increases. Therefore, we can even count on overcoming the upward trend on the hourly chart and forming a new downward trend.

The fundamental background for the pair remains neutral at this time. It is because of it that there has been a movement in the side channel in recent weeks (unlike, for example, the GBP/USD pair). Traders regularly receive certain messages, news and news regarding top officials of the United States and the European Union, possible actions on the international arena of these countries, changes in monetary policy, the consequences of the pandemic crisis, and so on at their disposal. But the problem is that the nature of the news is approximately the same for both countries. Like macroeconomic statistics. The economy continues to contract in both the European Union and the United States, the Federal Reserve and the European Central Bank require Congress and the European Commission additional monetary incentives, which are blocked in the first case by Democrats, and in the second - by the inability of 27 countries to come to a common opinion on the sources of financing for the new aid package and its volume. The calendar of macroeconomic events is generally empty today, so volatility may decrease, however, we are waiting for continued downward movement, according to the technical picture.

Based on the foregoing, we have two trading ideas for May 25:

1) It is possible for quotes of the pair to increase if the price rebounds from the area of 1.0881-1.0892, however, we would not recommend traders to process this signal, since it can be false. If the bulls show a desire to buy the euro again, then it can be determined by consolidating the price above the critical line Kijun-sen. In this case, we recommend buying the pair with a target of 1.0990. Potential to take profit in this case will be about 40 points.

2) The second option - bearish - is more likely. You are advised to sell the euro after overcoming the area of 1.0881-1.0892 with the targets of 1.0847 (Senkou Span B line) and an ascending trend line, around which the future fate of the euro/dollar pair will be decided. Potential to take profit in executing this scenario will be from 30 to 70 points.

The material has been provided by InstaForex Company - www.instaforex.com