GBP/USD 1H

The pound/dollar pair also made an impressive jump on Tuesday, so the US currency fell against two major European currencies. However, we do not believe that buyers have completely seized the initiative and are now ready to form an upward trend. From our point of view, the overall fundamental background remains negative for the pair, so it will be extremely difficult for the pound to show growth in the medium term. Nevertheless, technical factors are now speaking in favor of continuing the upward movement, possibly after a round of downward correction. Thus, buyers can lower the pair to three important levels of 1.2259, 1.2270 and 1.2280 at once, around which they can start buying the pound with renewed vigor. Consequently, a price rebound of this area will trigger new purchases and growth. We believe that it is more likely to overcome the 1.2259-1.2280 area with a further resumption of the downward trend.

GBP/USD 15M

Both linear regression channels are directed upwards on the 15-minute timeframe, signaling a strong position of buyers in the last trading day. At the same time, the GBP/USD pair has pinned itself below the moving average line on this chart, which is the first signal for a possible correction. After yesterday's strong growth, correction is the most likely scenario.

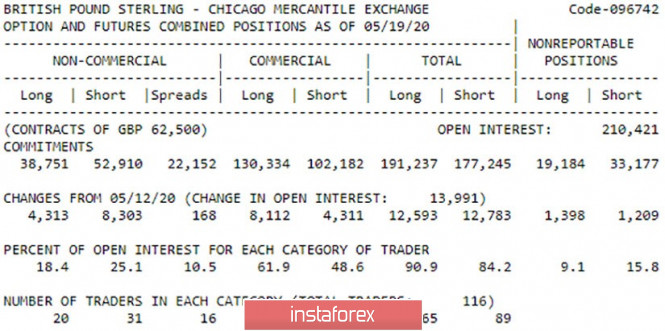

COT Report

The latest COT report for May 19 shows that the total number of buy and sell transactions among large traders per week increased by 29,000, and in equal proportions. Thus, large traders began to more actively trade the pound. And at the beginning of the current trading week, this became noticeable by the increased volatility of the pair. During the reporting week, professional traders continued to actively sell the British currency (+8303 sales contracts) and they were much less active in acquiring purchase contracts (+4313 in total). Thus, from our point of view, the mood for the GBP / USD pair remains more downward. It is on the basis of this conclusion that we expect the resumption of sales of the British currency.

The fundamental background for the British pound remains negative. In the early days of this week, no important events are planned in either the US or the UK, which buyers used. The fact is that it is very difficult to buy the pound when the macroeconomic background is present. And besides the macroeconomics there is also a general fundamental background, which continues to put pressure on the British currency. Buyers do not want to deal with medium-term and long-term transactions, since it is completely unclear what awaits the UK economy in the third and fourth quarter of this year, not to mention the longer term. Thus, the growth potential of the pound is already limited due to Brexit and the so far failed negotiations with the EU. In the coming months, we recall that the Bank of England may lower its key rate in the negative zone and expand the program of quantitative easing, which will be another reason for traders to sell the pound/dollar.

We have two main options for the development of the event on May 27:

1) The initiative for the pound dollar pair fell into the hands of the bulls, as they crossed the important Kijun-sen and Senkou Span B lines. Thus, purchases of the British pound are relevant now, but a new signal is needed to open deals. Such a signal may be a price rebound from the area of 1.2259-1.2280 after a downward correction. Take profit will be about 110 points in this case.

2) Sellers temporarily lost their positions, but will be ready to join the game below the 1.2259-1.2280 area. If the pair below this area is consolidated, we recommend selling while aiming for the support area of 1.2196-1.2216, as well as the May 18 low at 1.2073. In this case, Take profit will amount to about 40 to 180 points.

The material has been provided by InstaForex Company - www.instaforex.com