GBP/USD 1H

An upward movement also began on the hourly chart for the pound/dollar pair on May 18, but within the framework of the downward channel. Traders managed to work out the Kijun-sen line of the Ichimoku indicator by the end of the first trading day of the week, which runs at a price level of 1.2205, as well as a resistance area of 1.2196 - 1.2216. In addition, quotes of the pair rose to the upper line of the descending channel, which means that the bulls need to overcome three important barriers at once on Tuesday, May 19. Moreover, the first attempt has already failed. Therefore, we believe that the pound could resume to fall with the target of 1.1987 today.

GBP/USD 15M

The lower linear regression channel clearly shows the corrective movement against the main trend on the 15-minute timeframe. Quotes of the pair approached the upper line of the downward channel and will now try to turn back down. The first step towards changing the short-term trend will be consolidating below the moving average line. After that, the downward movement may resume, given the unsuccessful attempts to overcome important resistance on the hourly timeframe.

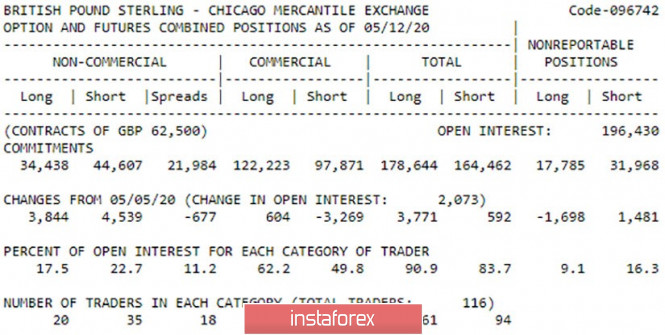

COT report

The latest COT report for May 12 shows that the total number of buy and sell transactions among large traders per week increased by 4,000, mainly due to purchases. However, the total number of transactions for the purchase is still only 16,000 more than transactions for selling. Such an imbalance persists for a long period of time, and it was not enough for the pair to begin forming an upward trend. In the reporting week, professional traders opened more new deals for selling (4539), which means that most of them are waiting for the British currency to fall again.

The fundamental background for the British pound remains sharply negative. And, unlike the euro currency, we can safely say that it is precisely because of it that the pound has become cheaper in recent weeks. Traders are wary of buying the pound due to uncertainty with Brexit, with trade negotiations with Brussels, Boris Johnson's implacable position in dialogue with Europe, because of the severe collapse of the British economy as a result of the coronavirus pandemic, which the British authorities coped with as badly as the Americans. The macroeconomic background for the British pound is also absolutely negative, but at least it was offset due to the no less negative background from the United States.

On May 19, we have two main options for the development of the event:

1) The initiative for the pound/dollar pair remains in the hands of the bears, as the price continues to be located inside the downward channel on the hourly timeframe. Thus, we recommend buying the British pound not before consolidating the price above this channel for the first purpose, the resistance level of 1.2325. The next goal, in case of overcoming the first, is the Senkou Span B line - 1.2445. Take profit will be about 75 points in the first case and 190 points in the second.

2) Sellers have great chances to implement their trading ideas. A price rebound from Kijun-sen and the area of 1.2196 - 1.2216 will be enough to resume selling the pair with the target of the support level of 1.1987. In this case, take profit will be about 200 points.

The material has been provided by InstaForex Company - www.instaforex.com