The rapid growth of the single European currency was more like an outburst of emotions accumulated over two days of inactivity. After all, the market essentially did not work on Friday and Monday. Either European exchanges were closed, then American ones. Not only were all the exchanges opened yesterday,but interesting macroeconomic data were released as well. So, traders who are bored with their activities, began to pour out accumulated energy in advance, going in the direction of not the most joyful forecasts for the US real estate market. But to everyone's surprise, the data turned out to be completely different than expected. However, nothing has changed, and the dollar could not recoup its losses.

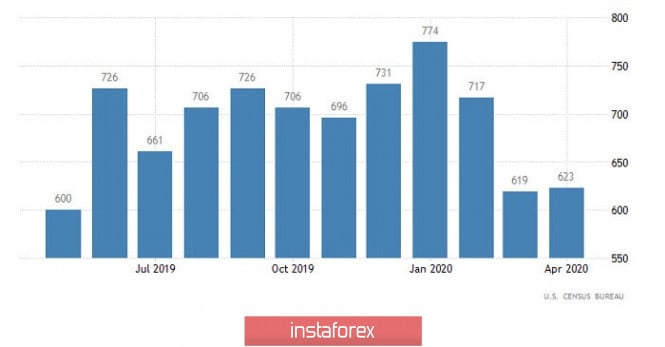

Instead of being reduced by 21.1%, sales of new homes in the United States grew by 0.6%. Moreover, according to S&P/CaseShiller, housing price growth rates accelerated from 3.5% to 3.9%. But they should have slowed down to 3.0%. Yes, the forecasts were depressing, and the growth of the single European currency was quite justified for itself. But the final data should have led to an instant pullback, with the subsequent strengthening of the dollar. However, nothing of the kind happened. Instead, we saw stagnation and consolidation.

New Home Sales (United States):

The White House saved the dollar from strengthening. Just at the time when many market participants were already thinking about buying back dollars, reports began to arrive that Donald Trump was holding a meeting on the possibility of imposing sanctions on China. This alone was enough to deter investors from hasty and rash actions. After the meeting, the US president threatened China with a serious retaliation attempt to "occupy" Hong Kong. It is this strange and absurd wording used by American officials in relation to China's National Security Act. It is not yet clear what the United States will take, but it is clear that any step will only worsen relations between the two largest economies in the world. And no one needs this in the conditions of the deepest economic recession of the world economy. One needs to recover from the epidemic of coronavirus. Washington's sharp attacks in the direction of Beijing will only delay the world economy's exit from the economic pit. So the markets were in limbo when it is completely not clear what will happen next. Moreover, Washington is the culprit of all this. And although today there is a slight rebound in the dollar, it is more of a technical nature.

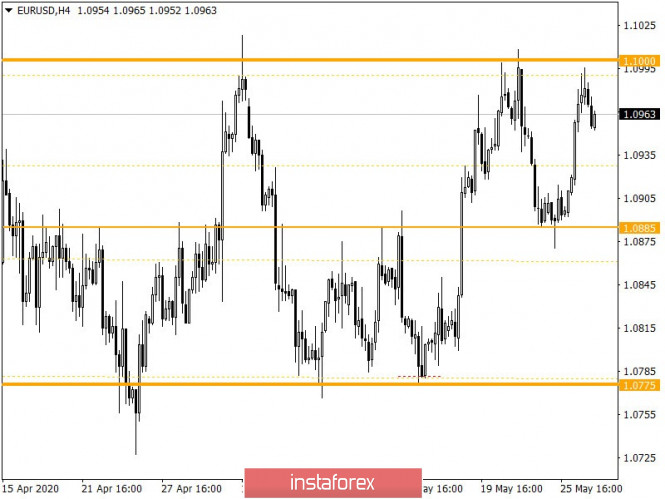

From the point of view of technical analysis, we see the next rapprochement of the price with the upper limit of the flat formation of 1.0775/1.1000, where a stop occurred on a natural basis and as a fact a rebound in the opposite direction. It is worth noting that in this case, the ascending path was built from the average deviation of the channel of 1.0885, where the support point was found earlier in the period.

In terms of a general review of the trading chart, the daily period, it is worth highlighting the sequence of measures within the flat formation, which has already acquired a scale of almost two months.

It can be assumed that a price rebound from the 1.1000 border could theoretically return the quote to the average deviation of 1.0885, if the legitimate basis remains on the market.

Specifying all of the above into trading signals:

- We consider selling positions lower than 1.0950, in the direction of the average deviation of 1.0885.

- Buying positions should be considered higher than 1.1020 in the direction of 1.1080, but only if the upper border of the main flat falls and the clock component of the market changes.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments signal a prevailing upward interest, by finding the price in the upper part of the flat formation.