EUR/USD 1H

The EUR/USD pair showed multidirectional movements in a narrow price range not exceeding 50 points on the hourly timeframe during the first trading day of the week. The bears did not manage to overcome the support area of 1.0881-1.0892 on Monday, as well as the Senkou Span B line of the Ichimoku indicator for the 4-hour timeframe. Thus, the downward movement has stalled so far, and no signals have been received to open new sales. Nevertheless, the euro's fate remains in the hands of sellers, as they can resume the pair's sales today. We believe that the pair should fall to an ascending trend line in the short term, which now lies near the 1.0810 level, and possibly to the lower border of the side channel of 1.0750-1.1000. The bulls' potential is limited so far to the 1.0990-1.1008 range. We can conclude that the bulls will try to form a new upward trend above this area.

EUR/USD 15M

We see that the downward trend is still preserved on the 15-minute timeframe, however, the lower linear regression channel turned sideways. Monday was an absolute flat, so such a channel reversal is not surprising. Everything will now depend on the Senkou Span B line. The pair can be sold when you overcome this.

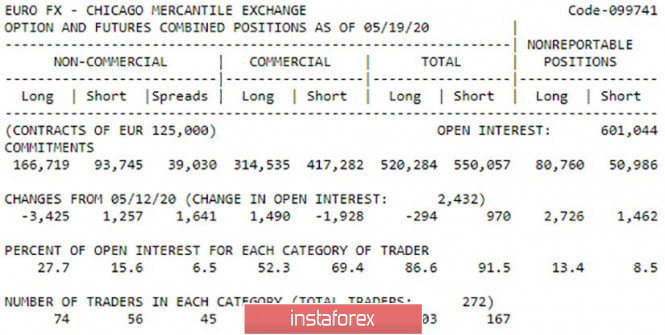

COT Report

The latest COT report of May 19 showed that large traders who engage in professional activities with the aim of earning exchange rate profit continued to reduce purchases of the euro and increase sales in the reporting week. The growth of the latter was small, only 1257 contracts, but in aggregate with -3425 contracts for sale, we have a serious deterioration in the mood of traders regarding the euro. The total number of purchase contracts also decreased by 294 units, and the number of Short-deals increased by 970 units. Thus, we see that the mood of traders remains bearish and only intensifies. Therefore, we can even count on overcoming the ascending trend line on the hourly chart, but for now we are just waiting for quotes to fall to this line.

The fundamental background for the pair remains neutral at this time. Nothing interesting happened in the world (meaning events that could affect the pair here and now) and no macroeconomic report was published on the first trading day of the week. The calendar of macroeconomic events also does not contain anything interesting on Tuesday. Thus, the pair's volatility and the activity of market participants may continue to remain low today. Perhaps the situation will change on Wednesday when ECB President Christine Lagarde and ECB Vice President Luis de Guindos make speeches. However, we believe that when a pair is trading in the side channel, it does not need special motives to continue moving between its borders. In general, we recommend that traders continue to monitor any messages on the subject of the US-Chinese confrontation, as they can be potentially very important.

Based on the foregoing, we have two trading ideas for May 26:

1) It is possible for the pair to grow if the price rebounds from the area of 1.0881-1.0892, however, we would not recommend traders to process this signal, since it can be false. Buyers of the euro are advised to enter when the pair consolidates above the Kijun-sen line (1.0939). In this case, we recommend buying the pair with a target of 1.0990. Potential to take profit in this case will be about 50 points.

2) The second option - bearish - is more likely. You are advised to sell the euro after overcoming the area of 1.0881-1.0892 and the Senkou Span B line (1.0871) with the aim of an ascending trend line (approximately 1.0810), around which the future fate of the euro/dollar pair will be decided. Potential to take profit in executing this scenario will be 55 points. Given the pair's volatility in recent days, taking profit is quite high.

The material has been provided by InstaForex Company - www.instaforex.com