EUR/USD 1H

The EUR/USD pair continued its upward movement on the hourly timeframe during the penultimate trading day of the week, left the side channel of 1.0750-1.1000, which was trading for several weeks. Thus, the bulls indicated their intention to build a new upward trend. We have already mentioned in our fundamental analysis articles that we do not see why the European currency can continue to grow in value in the medium term. However, the technique does not deny this possibility. The immediate goal for trading to increase is the March 27 high, which is a kind of last line of resistance on the way of the euro/dollar to forming an upward trend. If buyers manage to overcome this level as well, then the euro's position could improve significantly in the coming weeks. Upward movement is currently supported by a long-term trend line (the lowest), a short-term trend line and an upward channel.

EUR/USD 15M

We see how buyers continue to dominate the market on the 15-minute timeframe. Both linear regression channels are directed upward, clearly signaling the upward trend of the pair. There are still no signs of a reversal of any channel. The pair cannot consolidate for a long time even below the moving average line.

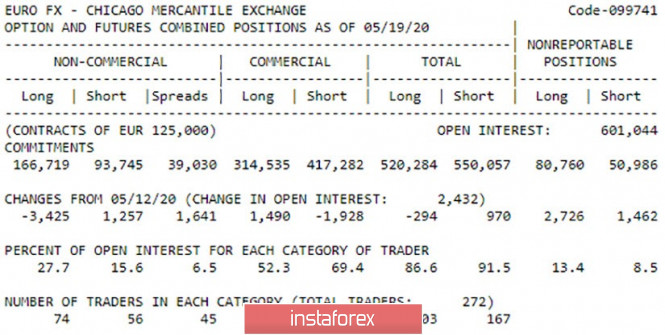

COT report

The latest COT report showed that large traders who trade for foreign exchange earnings, and not for hedging and current activities, continued to reduce euro purchases and increase sales in the reporting week. The growth of the latter was small, only 1257 contracts, but in aggregate with -3425 contracts for sale, we have a serious deterioration in the mood of traders regarding the euro. The total number of purchase contracts also decreased by 294 units, and the number of Short-deals increased by 970 units. Thus, we see that the mood of traders remains bearish and only intensifies. However, bidding this week shows that the US dollar failed to extract dividends from this, and the euro continues to rise in price. Thus, the new COT report can show an improvement in the position of large professional buyers.

The overall fundamental background for the pair remains neutral. However, yesterday,

US data on orders for durable goods and GDP provided support to the euro. Traders were not able to ignore them, since another decline was recorded in the US economy, which provoked overcoming the side channel of 1.0750-1.1000. Today, all macroeconomic reports of the day are secondary, so we do not expect them to be worked out. On the last trading day of the week and month, the pair may begin to adjust due to the desire of traders to take part of the profit on open positions. The euro may soon be under pressure again, as all the plans of the European Commission to stimulate the economy could fail. For example, Angela Merkel said that she expects "difficult negotiations" at the next EU summit and that "they (negotiations) are unlikely to be completed at it." France also notes that the proposed €750 billion plan is unlikely to be agreed upon and supported by all 27 participating countries as early as June. At the same time, it is noted that "September is already too late."

Based on the foregoing, we have two trading ideas for May 29:

1) It is possible for quotes to grow further with the goals of the resistance level for the 4-hour chart of 1.1111 and the March 27 high at 1.1147. These two goals could be fulfilled on Friday, but at least we expect a downward correction in the afternoon, which will be logical for the end of the month. In any case, before quotes leave through the lower border of the ascending channel, the pair maintains high chances of continued growth. Potential Take Profit will be from 35 to 70 points.

2) The second option - bearish - involves consolidating the EUR/USD pair under the upward channel, which will allow sellers to be engaged and start trading lower with targets at 1.0982 (Kijun-sen) - 1.0945 (upward trend line) - 1.0891 (Senkou Span B) - 1.0830 (ascending trend line). Overcoming each of the obstacles will allow you to keep short positions open. Potential Take Profit range from 40 and 200 points.

The material has been provided by InstaForex Company - www.instaforex.com