To be honest, the market behaved strictly in accordance with published macroeconomic data yesterday. But to see this, excuse me for sarcasm, you need a microscope. The scale of the movements is so small that it even surprises. Usually, all the data that was published yesterday led to one hundred point movements. In relation to yesterday, we have to talk about the highest movement of points by twenty or thirty. At the same time, to put it mildly, the market completely ignored the data on applications for benefits. So it is not necessary to say that the market is gradually normalizing.

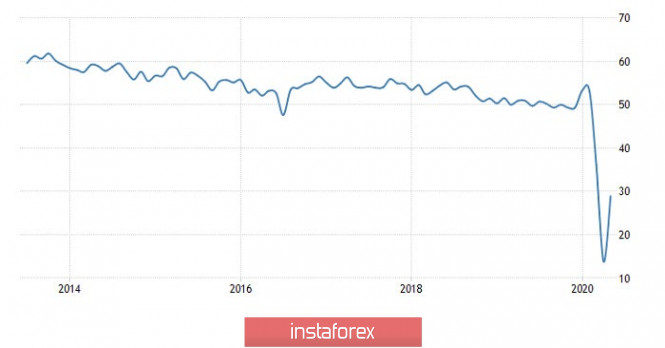

It all started with a modest strengthening of the pound, which was due to preliminary data on business activity indices. In particular, the index of business activity in the services sector grew from 13.4 to 27.8, and the production index, from 32.6 to 40.6. As a result, the composite business activity index grew from 13.8 to 28.9. It is understandable that the growth of the indices is because of increasing optimism in the business, due to the beginning of the gradual removal of restrictive measures introduced due to the coronavirus epidemic.

Composite Business Activity Index (UK):

Business activity indices in the United States began to grow exactly for the same reasons. Thus, the index of business activity in the manufacturing sector increased from 36.1 to 39.8, and in the service sector, from 26.7 to 36.9. All this led to the fact that the composite index of business activity grew from 27.0 to 36.4. Business is gradually reviving. The market is tired of an endless stream of bad news. So everyone is optimistic about the lifting of restrictive measures that could lead to increased consumer activity and trigger economic growth. And of course, that the US data led to a change in trend, and the dollar began to strengthen.

Composite Business Activity Index (United States):

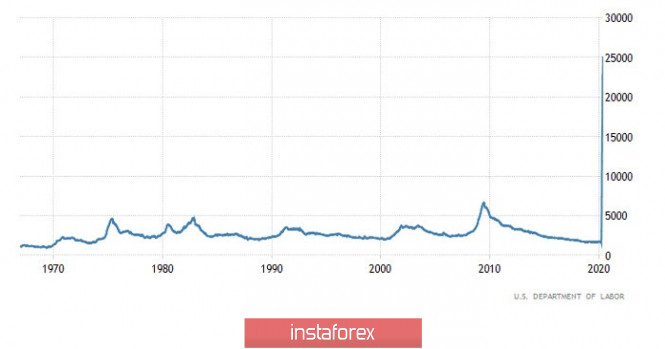

However, the market ignored labor market data, tired of bad news, which hinted that business hopes were not destined to come true. Although the number of initial applications for unemployment benefits continues to decline, and it only reached 2.438 million this time, this is still more than ten times the normal value. Moreover, the number of continuing claims continues to grow, and has already reached 25,073 thousand. That is, the record set last week was broken. So lifting the restrictions imposed due to the coronavirus epidemic will not necessarily lead to an increase in consumer activity. After all, if people were left without work, and could not find a new one, then it is clear that they will greatly reduce their costs. But for now, the market does not want to see this. Investors are hungry for at least some hint of a bright future.

Repeated Unemployment Claims (United States):

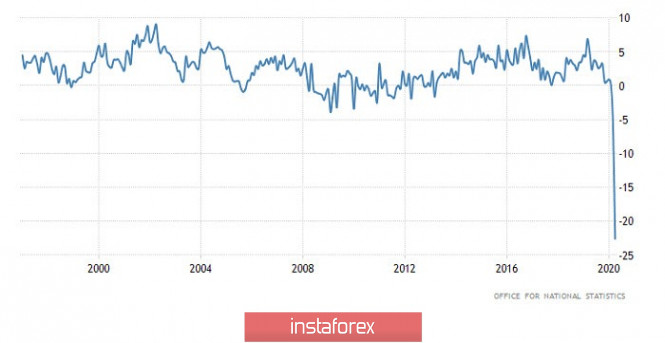

The trend set for the pound to weaken will continue during the US session. And this time, the pound should blame British statistics, which showed an acceleration in the pace of decline in retail sales from -5.8% to -22.6%. This is the deepest decline in the past at least a quarter century. Nothing of the kind was observed even in 2008-2009. This perfectly reflects the state of consumer activity, which is practically nonexistent. Also, this clearly hints that the mood of the business is clearly overly optimistic. So the further weakening of the pound should not surprise anyone.

Retail Sales (UK):

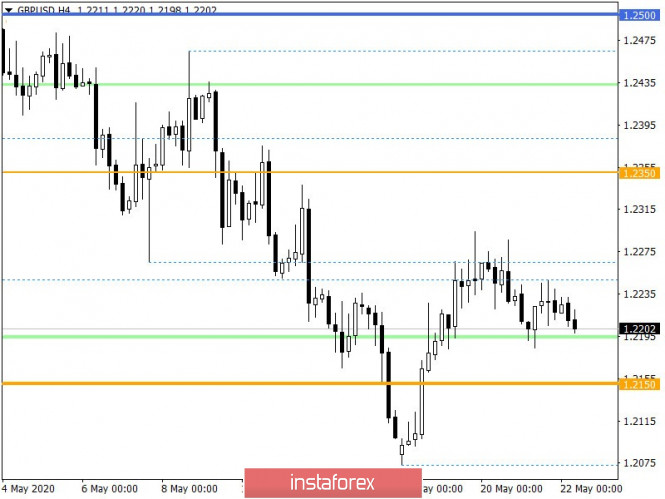

In terms of technical analysis, we see extremely low activity over the past two days, where the quote slowed down its movement near the area of interaction of the trading forces 1.2240/1.2280. The recovery process, the relatively earlier inertial move has not yet arrived, but it's signs are already being felt on the market.

Considering the past two days in detail, one can see a gradual shift of the flat formations, which indicates a downward slope, which may contribute to the recovery process.

Analyzing the trading chart in general terms, the daily period, it is worth noting that the downward tact from May 1 is still preserved in the market where the recent inertial move did not violate the integrity of the early movement set for the period.

It can be assumed that the recovery process will gradually, but still occur, where, in order to change the market sentiment and move to a new level, the quote needs to be consolidated lower than 1.2180, which will cause the price to fall further.

An alternative scenario considers a more significant slowdown, relative to the past two days, that is, the quote stops updating local lows and goes into an oscillation between the values of 1.2185/1.2285.

Specifying all of the above into trading signals:

- Short positions, we consider lower than 1.2180, with the prospect of a move to 1.2150. The second step comes from consolidating prices lower than 1.2140, with a move to 1.2100-1.2080.

- Long positions, we consider in terms of a wider lateral course, in case of price taking higher than 1.2250, towards 1.2280.

From the point of view of a comprehensive indicator analysis, it can be seen that the indicators of technical instruments regarding hourly and daily periods indicate a sell signal, reflecting the general interest of market participants.