4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 189.7511

The EUR/USD currency pair spent the fourth trading day of the week in a strong upward movement and left the side channel limited by the levels of 1.0750-1.1000. Thus, now the bulls have the opportunity to form an upward trend. However, the prospects for the European currency still remain very vague, if you pay attention to the fundamental background. However, most traders have opted for the euro currency, which means they should accept it and follow the "trend". The pair's volatility has been at a fairly high level of about 100 points per day for three days in a row. However, this is not panic.

Yesterday was marked by macroeconomic publications in Europe and the United States, which traders have been waiting for since the beginning of the week. Recall that in the first three trading days of the week, no important reports were published either in the United States or the European Union. At the same time, the pair diligently stormed the $ 1.10 level and still overcame it over the past day, not without the help of macroeconomic statistics, which in recent months, since the beginning of the "coronavirus" epidemic, was ignored in 95% of cases. However, yesterday's reports could not be ignored by market participants. More precisely, one report... But first things first. The first consumer price index in Germany for May was published in a preliminary assessment. As expected, the main indicator of inflation slowed to 0.6%, and the harmonized indicator - to 0.5% y/y. However, as you can easily guess, these data did not interest traders at all. We have repeatedly said that inflation has changed from "one of the most significant" reports to "one of the least important" since the beginning of the epidemic in the world. This is because inflation serves as a benchmark for many central banks. It is from inflation that regulators start when changing the parameters of monetary policy in order to stimulate economic growth. However, now there is no question of any growth anywhere (perhaps except in China), so inflation does not matter much.

We do not even consider reports on the European Union on consumer confidence and business optimism, as they did not cause any reaction from traders in normal, quiet times. But from overseas today we received a whole scattering of macroeconomic information, and in general, the package of statistics can be called very ambiguous. To begin with, the index of orders for durable goods turned out to be much better than traders expected. The main indicator decreased by only 17.2% in April, with a forecast of -19%, the indicator excluding defense and aviation orders fell by 5.8% instead of the forecast -10%, and the indicator of orders excluding transport lost only 7.4%, while experts predicted losses of around 14%. However, these figures are not at all optimistic. By and large, experts simply did not guess the scale of the reduction, but the cuts themselves did not disappear. Thus, on the one hand, the report was better than traders' expectations, but on the other – it was still a failure. Next, the first-quarter GDP in the US was published in a preliminary estimate. The previous value (also preliminary) was -4.8%, according to the new estimate of experts, the loss will be 5.0%. Thus, this report was worse than the traders' expectations. The last significant report of the day - the report on applications for unemployment benefits - showed an increase of another 2.1 million primary applications, but the indicator of secondary applications fell to 21 million, which is really good news since the value a week earlier was 25 million. This means that with the end of the quarantine (or, better yet, with the easing of the quarantine) in America, several million Americans have returned to work, which means that unemployment may already begin to decline. Thus, one report from overseas is still possible to write in the "plus" of the American currency. Unfortunately for the dollar, market participants paid attention only to the first two reports and this is logical since they reflect the current state of the US economy. Accordingly, from the point of view of the "foundation", the upward movement of the EUR/USD pair was absolutely justified yesterday.

From a technical point of view, the pair's quotes broke out of the limits of the side channel in which they were trading for several weeks and now, logically, the bulls can try to form a new upward trend. However, we still believe that the euro currency does not have strong fundamental support now either. It is only necessary to recall all the problems with agreeing and accepting all the aid packages for the European economy that have been proposed and considered in recent weeks. So far, there is no positive news, which means that the European economy may continue to shrink. Moreover, every proposal to save the economy of the European Union implies the provision of assistance to countries most affected by the epidemic (Italy, Spain, Portugal), however, these countries do not want to get into new loans and then give them back for decades, and the "Northern" countries are not going to finance the recovery fund, from which the money will then be distributed free of charge.

The last trading day of the week should be spent in much calmer trading. Several macroeconomic publications are also planned for this day, but they are all of a frankly secondary nature. In Germany, a report on retail sales for April will be released today, which may show a decrease of 14.3% in annual terms and 12% in monthly terms. The European Union will publish inflation for May in a preliminary estimate. The main indicator is expected to slow down to 0.2%, and the base indicator to 0.8% in annual terms. The GDP of Italy and France in the first quarter will also be known. The Italian economy may lose about 4.8% y/y, while the French economy may lose 5.8% y/y. In the afternoon, data on personal income and spending of the American population for April will be released in the United States. The first indicator is expected to decrease by 6.5%, and the second – by 12.6%. Despite the fact that almost all of today's reports may prove to be failures, we believe that there will be no reaction from traders to them. First, as we have already said, they are not of the first importance, and secondly, the markets are absolutely ready for such values, given the global crisis, quarantine, and epidemic.

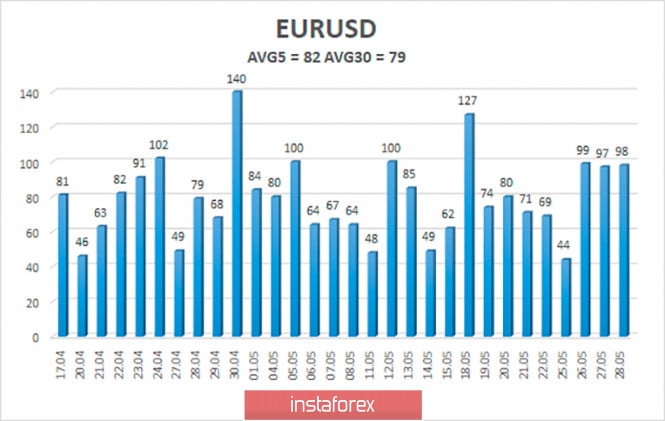

The average volatility of the euro/dollar currency pair as of May 29 is 82 points. Thus, the value of the indicator is still characterized as "average". Today, we expect the pair to move between the levels of 1.1003 and 1.1167. The reversal of the Heiken Ashi indicator downwards signals a downward correction after strong growth.

Nearest support levels:

S1 – 1.1047

S2 – 1.0986

S3 – 1.0925

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1169

R3 – 1.1230

Trading recommendations:

The EUR/USD pair continues a strong upward movement and broke out of the side channel. Thus, after overcoming the upper line of the side channel near the level of 1.1000, buy orders with the goals of 1.1108 and 1.1167 became relevant, and it is recommended to keep them open until the Heiken Ashi indicator turns down. It is recommended to return to selling the pair if the price is re-anchored below the moving average line with the first goals of 1.0925 and 1.0864.

The material has been provided by InstaForex Company - www.instaforex.com