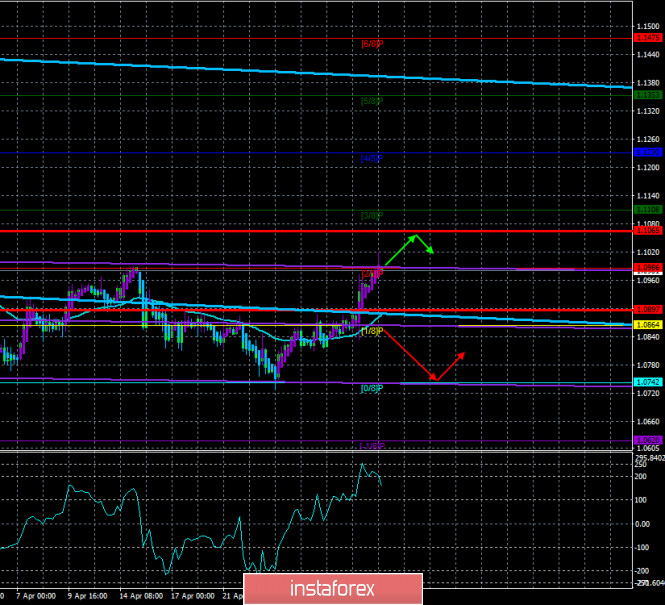

4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - upward.

CCI: 157.1972

The EUR/USD currency pair on Monday, May 4, has every chance to start a downward correction. The reasons for this are banal and simple. The market is not currently in a panic stage, so we do not expect a recoilless movement in one direction by several hundred points. There are a few fundamental reasons for the growth of the euro currency. The pair worked out the Murray level of "2/8"-1.0986, from which it had previously rebounded. On Monday, there will be no important statistics that could hypothetically affect the movement of the pair and support the euro currency. Thus, from our point of view, we will see a correction at the beginning of the week. However, it is still extremely difficult and even impossible to make forecasts for the long term. The reason is also simple and obvious - "coronavirus". In previous articles, we have already said that the countries of Europe and the United States are beginning to gradually weaken the quarantine measures, but no one knows how this step will end. Let's hope that it is not the second wave of the epidemic, but if it were so easy and 100% accurate to predict the development of the epidemic, then this epidemic would not have happened. The quarantine has helped reduce disease rates, but this does not mean that the virus will not return, for example, in the fall or winter, when most people on the planet are prone to diseases. And at the moment, we can not say that the virus is gone. It just slowed down. But people keep getting sick, they keep dying. Thus, it is completely impossible to say when the vaccine will be created, when the epidemic will end, when the negative impact on the economy will end, when the economy will begin to recover, and when it will fully recover, and how much the economy of each country will decline. But these factors will influence the exchange rates of the euro and the dollar. Thus, we believe that predicting the movement of the pair in the long term is like guessing on coffee grounds. We still recommend that traders trade strictly in accordance with technical analysis because it is the one that responds most quickly to reversals, trend changes, and corrections.

As we have already said, it makes no sense to talk about the future of each currency now. However, we can speculate about what exactly awaits any economy. For example, the economy of the European Union. According to the absolute majority of experts, the whole world is racing towards the worst crisis in the last 100 years. Absolutely all countries will suffer from it, but political scientists and economists believe that the EU will have the worst (although the latest GDP data predict the largest fall in the American economy). The problem is that the EU can always print money or create it in bank accounts (functions of the ECB), or take it on credit. But how to distribute the created or raised funds? Even in peaceful years, the process of channeling financial flows is a long process, since there are 27 countries in the EU. Now, when some countries (Spain, Italy, France) have suffered more from the crisis, and others (Germany, Finland) are less affected, accordingly, the amount of assistance to all EU participants needs different. However, the very essence of the European Union implies the principle of unity and mutual assistance. This means that rich countries will have to help the poor. This is precisely the position that the increasingly rich do not like, who believe that less well-off countries should live within their means and form their reserve funds for a rainy day. But, as practice shows, Italy itself does not form any funds, it is knocked out of the EU norms on the budget and the maximum state debt, and now it requires huge amounts of assistance from the European Union. Amounts for which all EU members will pay. The idea with the "coronabond" at the moment has failed. The European Council could not approve the total amount of aid to the European economy, as well as the sources of attracting this money. No, Europe is not poor, and it feels no worse than the rest. But the greater the differences between countries, the greater the risk of falling European economy, the higher the probability of a split of the European Union. The UK has shown that it is possible to leave the EU, and London makes it clear to the whole world that the country almost fled the Alliance and does not want any new agreements on "mutually beneficial" terms. London is now ready to cooperate and trade either on terms that are favorable to it or will look for other markets and partners for cooperation. And, as we can see, the British are not afraid of this prospect at all. Other EU countries, again the wealthiest, can count as well. Therefore, it is very important for Europe that the current crisis, which is unknown how long it will continue, does not end in the collapse of the EU. This is, of course, the most pessimistic scenario, but who could have predicted 10 years ago that Britain would want to leave the EU?

Many experts also note that the current crisis has already become much stronger than the debt crisis in 2008-2009. Then Europe had to save small states with small economies (Greece, Cyprus, Ireland, Portugal), for which about 500 billion euros were spent. Now the problems are experienced by European giants (Spain, France, Italy), whose economies are estimated in trillions of euros, respectively, requiring much higher costs for salvation. Several trillion euros have already been spent and several more are required.

From a technical point of view, now the pair has formed an upward trend. The Heiken Ashi indicator continues to color the bars purple, so the upward movement is still expected to continue. Only a reversal of the Heiken Ashi indicator downwards will indicate the beginning of a correction or the end of an upward trend. Both linear regression channels are directed sideways, which indicates that there is no trend movement in the medium and long term. In principle, if you look at the entire chart of the EUR/USD pair, you can see with the naked eye that after the strongest movements in late February – early March, the pair is now consolidating. It's just not in a narrow price range, as we previously expected, but in a range of 250 points wide – between the levels of 1.0750-1.1000. Now the pair's quotes are just near its upper limit.

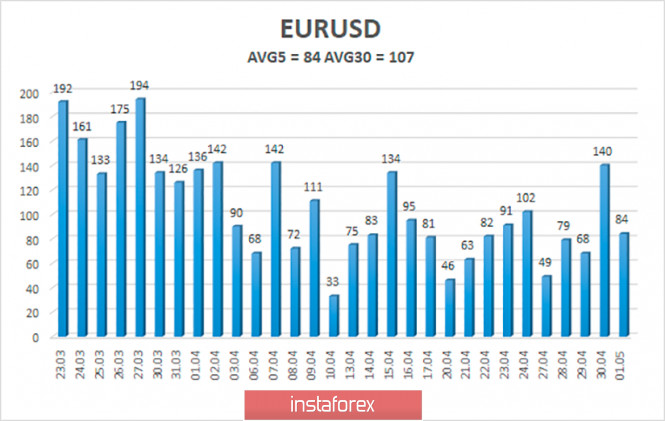

The volatility of the euro/dollar currency pair as of May 2 is 84 points. Volatility, therefore, remains average in strength, close to high, and there is still no reason to expect a new wave of panic. Today, we expect the pair's quotes to move between the levels of 1.0897 and 1.1065. The reversal of the Heiken Ashi indicator downwards may signal the beginning of a downward correction.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair overcame the moving average and continues to move up. Thus, traders are recommended to stay in the purchase of the euro currency with targets at levels 1.0986 and 1.1065 until the Heiken Ashi indicator turns down. It is recommended to consider selling the euro/dollar pair not before fixing the price below the moving average line with the first target of 1.0742.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com