4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: 83.1255

The British pound continued its upward movement on the second trading day of the week and continues it at the beginning of the third trading day. Thus, market participants continue to look favorably towards the British currency, but most likely, things are exactly the opposite. This demand for the US currency has decreased in recent days, so we are seeing a banal upward correction. We have repeatedly said that in the context of the global crisis, all countries are experiencing serious problems with the economy. However, in the UK, these problems are multiplied by questions related to Brexit and the lack of trade deals with the US and the European Union. Therefore, in the long term, we expect that the downward trend that began in 2014 will continue.

Last night, Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin addressed the US Congress, naturally in the format of a video conference. We already said the day before that both of these speeches are unlikely to cause a serious market reaction since the main theses of both economists has already been repeatedly expressed. In the context of another and at the same time the strongest crisis since the Great Depression, Mnuchin and Powell generally speak very often, so market participants do not have to guess what actions their agencies are preparing to take. Steven Mnuchin at a speech before the banking committee said that the US will come out stronger after the crisis. He said that the Ministry of Finance has already provided about $ 250 billion to all those in need. However, Mnuchin believes that the threat of irreparable damage increases the longer the "lockdown" continues. Jerome Powell, in his part of the conference, said that the Ministry of Finance and the Federal Reserve should do more to help the economy. Powell has previously called on Congress to approve new aid packages, as the current ones are not enough. However, Republicans and Democrats once again quarreled and so far failed to push a 3-trillion-dollar package of financial assistance through Congress. "The feeling that the economic recovery may be slower than we would like is growing. This means that we need to do more," Powell said. The head of the Federal Reserve also noted that in a crisis, support for the unemployed is a key focus of the government and relevant agencies. "The authorities have taken large-scale measures, but it is not clear whether this is enough to stabilize the economic situation," Powell concluded. Thus, both of the country's top economists said they would do everything in their power and called for more funding for the hard-hit American economy. Nothing new.

At the same time, the US President again attacked the World Health Organization. This time, Donald Trump threatened to leave the organization in a month. Trump still believes that the WHO helped China hide real information about the "coronavirus" pandemic. The US leader again quotes statements from WHO representatives who approve the official position of the Chinese authorities that the COVID-2019 virus is not transmitted from person to person. However, according to Trump, at that time other information was already available that was opposite in meaning. In addition, the American leader is infuriated by the fact that the WHO criticized the United States for excessive border closures for Chinese visitors at a time when China itself has already been declared a strict quarantine. On March 3, WHO stated that "COVID-2019 is not spreading as effectively as flu". Thus, the head of the White House believes that the WHO, along with the PRC, is responsible for the fact that the epidemic has spread throughout the world. The US leader said that if within the next month WHO does not demonstrate detachment from China and reorganization in its work, the US will completely stop funding and consider withdrawing from this organization. "I cannot allow American taxpayers' money to continue to fund an organization that obviously does not serve America's interests," Trump concluded.

Today, the UK is scheduled to publish the consumer price index for April. As in the case of the Eurozone, we believe that this report will not have a strong impact on the mood of traders. However, in annual terms, inflation may slow down to 0.9%, and in monthly terms, it may reach -0.1%. Late in the evening, the minutes of the last meeting of the US Federal Reserve will be published. We remind you that no important decisions were made during this meeting. Therefore, the protocol itself is most likely not to be interesting. Moreover, in the past three days, Jerome Powell has spoken three times, and once - Steven Mnuchin. Markets already have all the necessary information about possible actions of the US government, the Treasury Department, and the Fed. Thus, we believe that traders will not learn anything new and interesting from this protocol.

From a technical point of view, the pound/dollar pair left the 400-point wide consolidation channel. However, on the 4-hour timeframe, the pair was fixed above the critical line on the Ichimoku indicator and above the moving average line on the "linear regression channels" trading system. Thus, the trend has already changed to an upward one. Therefore, a new upward trend may begin to form, but we are still inclined to the option with strong multidirectional movements.

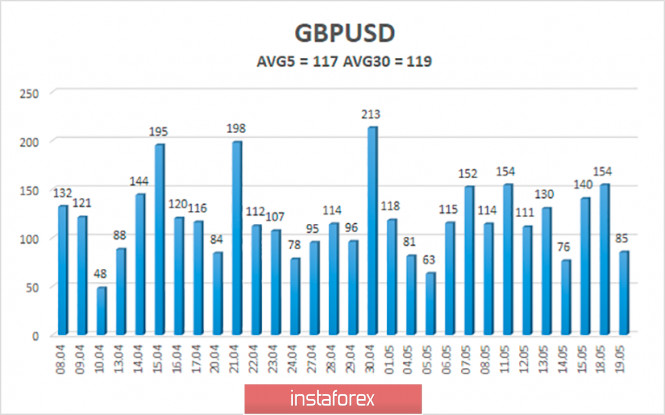

The average volatility of the GBP/USD pair remains stable and currently stands at 117 points. On Wednesday, May 20, thus, we expect movement within the channel, limited by the levels of 1.2130 and 1.2364. A downward turn of the Heiken Ashi indicator will indicate a possible resumption of the downward trend or a round of downward correction against the newly formed upward trend.

Nearest support levels:

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2268

R2 – 1.2329

R3 – 1.2390

Trading recommendations:

The GBP/USD pair continues its upward movement on the 4-hour timeframe. Thus, it is now recommended to trade the pound/dollar pair for an increase with the goals of 1.2329 and 1.2364 before the Heiken Ashi indicator turns down. It is recommended to sell the pound/dollar pair again not before fixing the price below the moving average with the first goals of 1.2146 and 1.2130.

The material has been provided by InstaForex Company - www.instaforex.com