The global markets experienced a surge of enthusiasm on Tuesday, which was based on a report on successful trials of a vaccine against the coronavirus of the American company, Moderna. Moreover, the positivity was supported by sharply higher oil prices, since any messages that can be interpreted as contributing to a way out of the global economy from a deep failure are expected to lead to an increase in consumption and a revival of trade.

At the same time, long-term expectations based on economic calculations do not give any reason for positive growth. The Congressional Budget Committee updated its economic forecasts to the end of 2021, from which it follows that the period of recovery from the recession will be lengthy and difficult.

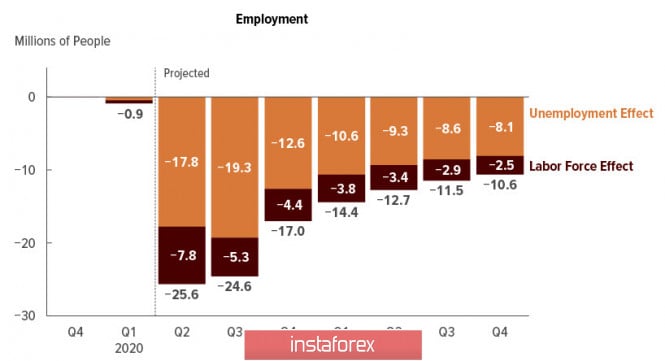

According to the CBO, the unemployment rate in the third quarter will be 15.8%, but even by the end of the 4th quarter of 2021, only a part of the failure this spring can be compensated.

The real production volume for the 4th quarter of 2021 is estimated to be 1.6% lower than in 2019. Interest rates will remain low and economic activity will remain low. CBO does not see any grounds for positive growth at this stage.

The comments of J. Powell and the Minister of Finance Mnuchin in front of the Senate Banking Committee did not have a noticeable effect on the market, both were cautious in their wording and did not essentially say anything new. Volatility can be added today by the publication of the minutes of the Fed meeting, for the time being it is necessary to proceed from the fact that there are few real reasons for the growth of enthusiasm, and you can try to use the growth of risky assets in the last two for sales from higher levels.

USD/CAD

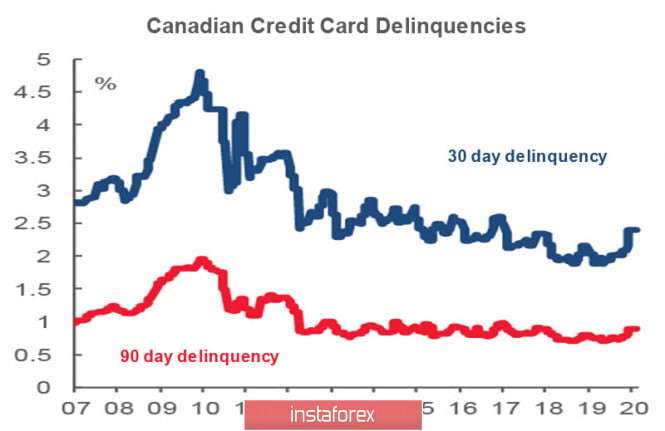

Canadian markets were closed on Monday morning and in the absence of internal impulses, the loonie reacted mainly to external factors. At the same time, the economic situation in Canada remains stable, the failure in employment and real production turned out to be less deep than in the US, consumption has more solid reasons. An analysis of the dynamics of overdue credit cards shows that the share of overdue cards for 90 days (that is, before the pandemic) in the United States was 9 times higher than in Canada, and this gap is growing.

A similar picture for mortgages - debt growth in Canada is lower than in the United States. This means that the failure of consumer activity is less deep, and the Canadian economy is more stable, even taking into account a strong drop in commodity prices.

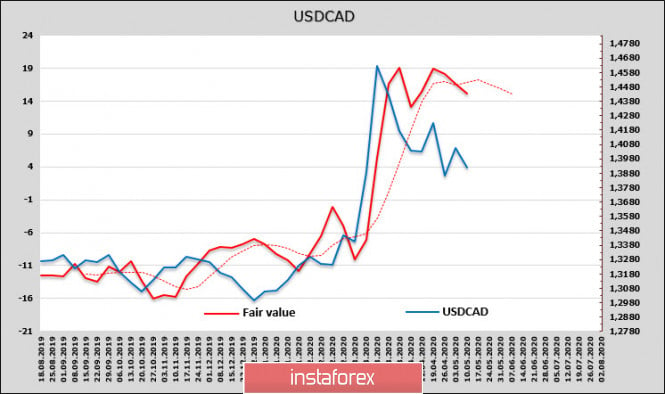

The CFTC report for the Canadian dollar turned out to be neutral with a slight margin of negativity, the net short position grew by $ 9 million, but you need to pay attention to the fact that even under these conditions, the estimated price of USDCAD is slightly higher than the current one and has a downward trend. Perhaps, this is due to the fact that the real economic situation in Canada is better than in the US, and the way out of the crisis may turn out to be faster; therefore, investors keep the demand for Canadian assets at a relatively high level.

The inflation report for April will be published today and on Thursday, the report on private employment from ADP. A sharp increase in USD/CAD should not be expected, even if sales of commodity currencies begin. The support zone 1.3845/65 to hold, and the decline to it can be used for purchases. Exiting from the consolidation zone is still early.

USD/JPY

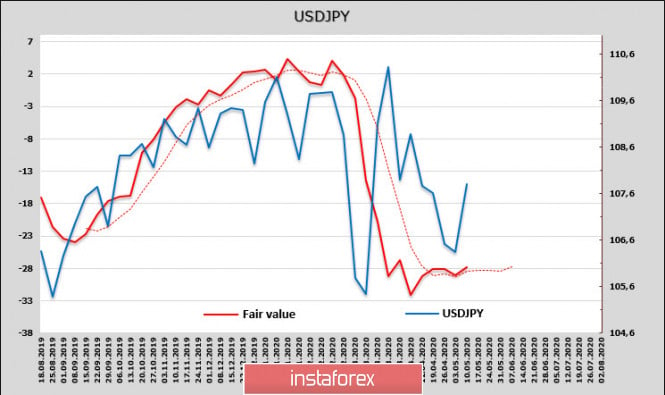

The yen continues to trade in the range, the net long position on the CME increased last week, and the pullback of USD/JPY to the upper boundary of the range can be used for selling.

The goal is the lower boundary of the range 105.80/106.

The material has been provided by InstaForex Company - www.instaforex.com