Hello, dear colleagues!

Despite the fact that COVID-19 continues its deadly march around the world, threatening its second wave, yesterday there was some risk aversion in the currency market. Perhaps this was caused by improving macroeconomic indicators. Although, as we remember, market participants have recently reacted very sluggishly to fundamental factors.

Some reports were published on the first trading day of the current week. Thus, the consumer confidence index in the Eurozone was better than expected at minus 15 and came out at minus 14.7. It also surpassed the previous value (minus 17.89) of the economic activity index of the Federal Reserve Bank of Chicago, which was in positive territory and amounted to 2.61. However, sales in the secondary housing market in the US were lower than expected by economists.

Today in the Eurozone and the USA, an index of business confidence in the manufacturing sector and the service sector will be published. Also, the United States of America will provide data on new home sales and publish the index of manufacturing activity from the Federal Reserve of Richmond.

If we return to the topic of coronavirus, the largest spike in infections continues to be in South and North America, namely in Brazil and the United States. The difficult situation with COVID-19 is observed in India, where the number of daily infections is also growing steadily.

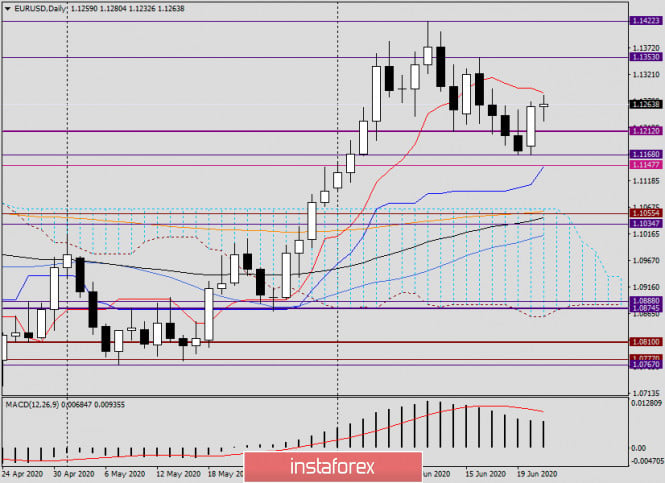

Daily

In yesterday's review of the main currency pair, the daily EUR/USD chart was overlooked. We will start today's analysis of the technical picture for the euro/dollar with the daily chart.

As already noted at the beginning of the article, the US currency was not in demand among investors at yesterday's trading and weakened across a wide range of the market. The euro/dollar currency pair strengthened significantly at the trading on June 22 and ended Monday's session at 1.1259. It is characteristic that the breakdown of the support level of 1.1212 has to be recognized as false. Three consecutive daily candles did not close below this level, and the pair returned above this level yesterday.

Today, at the time of writing, the euro/dollar is trying to continue strengthening, the pair has already updated yesterday's highs at 1.1269 and was rising to 1.1280. However, the euro bulls are not yet able to stay near this level. It seems that the Tenkan line of the Ichimoku indicator, which runs at 1.1285, will play an important role as a resistance. If today's trading ends above Tenkan, this will give additional strength to the euro bulls and they will rush to 1.1353. However, do not forget about the important technical level of 1.1300, which can block further progress of the course up.

Strong support was noted at yesterday's lows of 1.168, which also showed the minimum values on June 19. If this mark is pushed, the next targets of players to lower the rate will be the broken resistance level of 1.148, as well as the Kijun line, which is located just below, at 1.146. In my opinion, these are the immediate reference points of price movement on the daily chart.

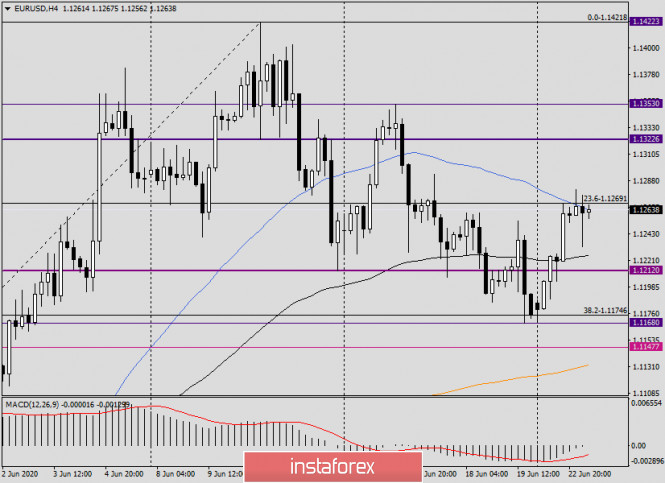

H4

At the 4-hour chart, the pair can not go up to the simple moving average, which provides a strong enough resistance to attempts to grow. If 50 MA is still broken and the pair is fixed higher, you can try buying the euro/dollar pair on the rollback to this moving average. The long tail (shadow) of the previous candle may indicate the market's desire to move up, but whether it will turn out or not will become known after the closing of trading today. You can also look at the opening of long positions after a short-term decline to 1.1247. I fully assume that from here there will be a rebound up and the pair will continue to move in the north direction

For sales, you need to see reversal candlestick patterns on a four-hour or hourly chart in the price zone of 1.1267-1.1277. If there are any, you can sell, but with small goals, in the area of 1.1225-1.1210. By the way, for those who will stand in purchases for the euro/dollar pair, I also do not recommend setting large goals. The price zone of 1.1300-1.1325 is quite suitable for fixing the profit of long positions on the main currency pair.

Good luck!

The material has been provided by InstaForex Company - www.instaforex.com