Greetings to all newbie crypto-traders and experienced crypto enthusiasts!

In this article, we will discuss the anti-fragility of assets, in particular the crypto industry, as this is currently the most relevant.

So, the term "anti-fragility" came to us from the famous professor, economist and trader Nassim Nicholas Taleb, who proved that profit can be made from chaos.

"Antifragility" is the ability to benefit from stressful situations. Antifragile systems are not just immune to cataclysms, in difficult conditions they "harden" and become better.

From year to year, bitcoin, as a separate cryptocurrency, goes through difficult trials caused by criticism, prohibition, internal and external problems, and now a pandemic, and the global economic crisis. There were a lot of problems at all stages of formation, but Bitcoin still stands still, and its cost amounts to thousands of dollars.

This is a living example of the "antifragile" asset of the future!

Who would have thought that Bitcoin would be traded on the CME commodity exchange five years ago, and institutional investors would keep it in their portfolios for millions of dollars, and this, by the way, is a fact of our future. Bitcoin was able to benefit from the stressful situation and apply it to the benefit of its adaptation in the public and in the market in general.

The adaptation and anti-fragility of the first cryptocurrency led to the fact that Bitcoin turned out to be the most stable asset during the global financial crisis in March 2020. Based on a study by JPMorgan, the world's largest investment bank, the first cryptocurrency, to the surprise of experts, received a strong correlation with stocks and other traditional assets, which could not have been imagined over the past years. At the same time, the recovery process of Bitcoin after the decline of markets in March turned out to be much faster in terms of liquidity and asset value than traditional trading instruments.

"Bitcoin's liquidity fell very much during the peak market drop, but recovered much faster than liquidity in traditional markets. The depth of the Bitcoin market is already above the average for the year, while the liquidity of more traditional asset classes has not yet recovered," a report from JPMorgan said.

Moreover, Bitcoin does not stop at this. Based on an analysis of the financial corporation Fidelity Investments, which manages $ 7.2 trillion of funds, 36% of the surveyed 774 large customers in the US and Europe added digital assets to the portfolio.

"The results confirm a growing trend of interest and the adoption of digital assets as a new investment asset class," said Tom Jessop, president of Fidelity Digital Assets.

That is, institutional investors are already at work, and with such turnovers that it is already difficult to say that we are dealing with a one-day hype, as you might have heard a couple of years ago.

In turn, the chief editor and family member of the founders of the Forbes business publication, Steve Forbes, changed his mind about crypto assets, saying that Bitcoin and other cryptocurrencies can be considered a protective tool against the unstable economic policies of states.

The first cryptocurrency is still far from a defensive asset, but with the achievements that have been achieved, then why not? This is the essence of antifragility, which will turn into success over time, and most importantly, recognition of the public.

Current development and prospects

As early as 50 days, the Bitcoin quote is within the new range of $ 8,500 / $ 10,000, where the recovery from the March decline was 150%, which can be considered an amazing result in terms of speed. A stepped price course indicates that the market is demonstrating a kind of stabilization of interests, thereby controlling speculative excitement, which could theoretically give Bitcoin the basis for further strengthening.

Regarding the accumulation of stop orders [StopLoss], it is worth allocating the coordinates of $ 8,300 / $ 10,500, where if their price is touched, a significant acceleration in the direction of breakdown may occur. At this point, we are focusing attention, since working within the existing range is not so attractive, and most importantly, profitable, as the way out of it.

Based on the general background of market recovery, there is a prospect for further growth of Bitcoin, which means that if prices are consolidated higher than $ 10,500 in the daily period, the market can move to a new level in the region of $ 12,000 / $ 13,868, which will already lead to a maximum 2019 year.

I remind you that you shouldn't enter trading positions early, wait for the stop orders to trigger above the $ 10,500 mark to minimize the chance of a false signal.

The general background of the cryptocurrency market

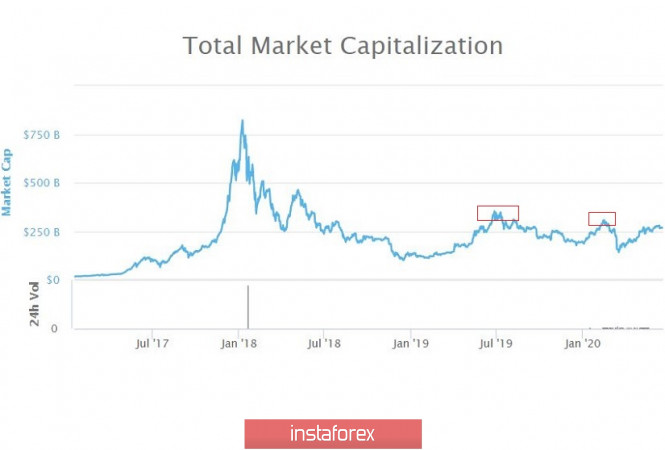

Analyzing the total market capitalization, we can see a significant upward spiral in trading volumes, where the total market is $ 267 billion.

If we consider the volume chart in general terms, then it is clear that the breakdown of the February ceiling of this year is $ 304 billion and its breakdown will lead to further growth in the direction of the maximum of 2019 of $ 362 billion.

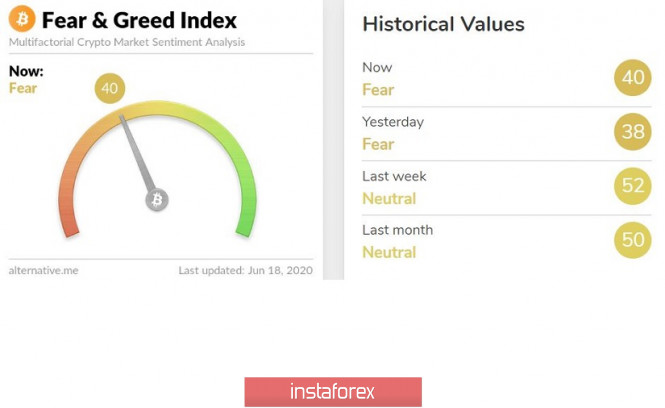

The crypto market emotion index (aka fear and euphoria) is 40 points, but it is worth considering that for the period of a new stage, the index had an average of 45 points, which, in principle, is not bad for an emotional background.

Indicator analysis

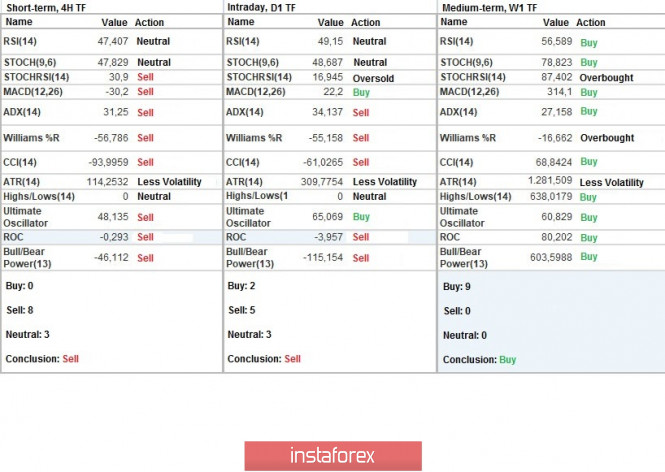

Analyzing a different sector of time frames (TF), it can be seen that relative to the four-hour and daily periods, there is a variable sell signal due to working out the upper boundary of the flat formation of $ 8,500 / $ 10,000. The weekly period, in turn, still reflects the buy signal due to the fast recovery process.