Markets are still not paying attention to the growth of civil unrest in the United States, nor to the deterioration of US-China relations. The first stage trade agreement signed on January 15 is on the verge of collapse, but the markets have already noticed that Trump's statement on Hong Kong did not entail any action, and therefore rightly judged that the main purpose of such statements is to influence their own electorate. Trump wants to win the election in November, and it is not in his interests to take steps that could strike the stock market. From this, a simple conclusion is that cheap money continues to manage the markets, and their offer will be supported by other central banks. As a result, growth may turn out to be more stable than calculations and fundamental data suggest.

The demand for risk is also supported by rising oil prices. The reduction in capital expenditures, the decline in US production and the efforts of OPEC + with the resumption of economic activity amid a reduction in coronavirus restrictions contribute to the formation of an oil shortage in the second half of the year. This morning, the API reported a decline in oil reserves of 0.483 million barrels, which came as a surprise to the markets. As a result, the July WTI futures added as of 5.30 Universal time more than 2.5%, Brent exceeded $ 40 per barrel, which will further support the demand for commodity assets.

NZD/USD

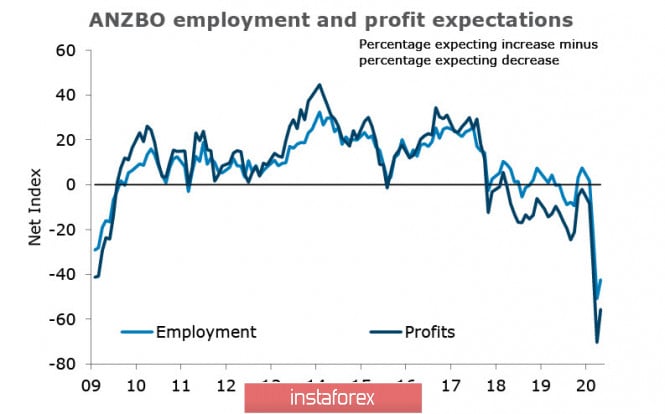

In a financial stability report published last week, RBNZ noted that despite the stability of the New Zealand financial system, the range of internal and external threats is wide and the onset of economic decline is the strongest in 160 years. Despite the fact that economic activity in May began to grow relative to the previously reached lows, the country expects a decline in household incomes, unemployment, bankruptcy and a decline in investment.

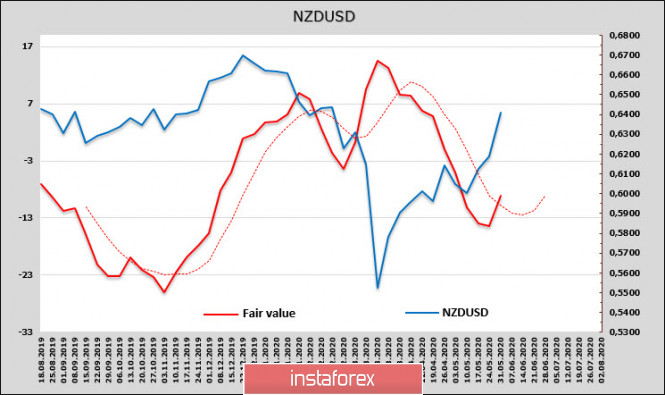

As for speculative expectations regarding the New Zealan dollar, they improved slightly, although not so fast, and did not keep pace with the growth of NZD/USD on the spot. According to the CFTC report, the net short position of NZD has slightly declined, the growth looks reasonable, but not so much as to count on a confident break through of the resistance level of 0.6450 without correction.

The estimated price has turned up, which supports growth, but the current impulse is based more on emotions rather than fundamental data.

Testing the level of 0.6450 seems inevitable, but there is a low probability that it will become successful. Growth does not have fundamental confirmation, and therefore, the peak of NZD/USD will most likely begin to form in the resistance zone, unless of course there are new positive impulses that are considered by the market.

AUD/USD

The Australian dollar is still the leader in growth, completely ignoring either the civil unrest in the United States, the growing tension between the US and China, or the still weak economic prospects for the 2nd quarter.

Yesterday, the RBA left the rate unchanged at 0.25%, and no surprises were found in the report on asset purchases or liquidity transactions. The board has promised that this "adaptive approach will continue until it is needed," while the cash rate will be held until "progress towards full employment is made and the RBA is confident that inflation will be sustainable within the target range."

The RBA supported the growth of the Australian dollar, emphasizing that the economy is in better condition than the central bank feared, but the prospects are extremely uncertain, but because it is completely logical, the RBA will maintain the confidence of households and enterprises. Hence, the expected energetic tone of the accompanying statement.

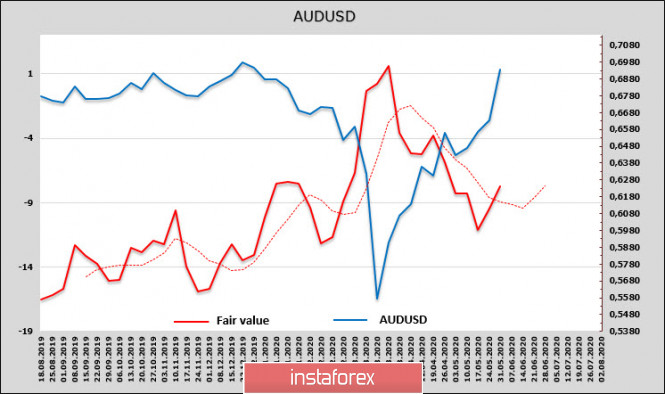

The estimated price has been turned upwards already as 2 weeks, but behind the impulse. The picture is similar to that observed for the New Zealand dollar.

The AUD/USD pair has come close to a year high of 0.7023, and is likely to test its strength. Taking into account market sentiment, the test may be successful, but a strong gap between the spot price and the calculated one increases the chances of a corrective pullback.

The material has been provided by InstaForex Company - www.instaforex.com